Click to enlarge.

According to preliminary estimates, US Light Vehicle (LV) sales grew by 6.8% year-on-year (YoY) in May to 1.44 million units, according to an analysis just released by the respected GlobalData consultancy.* After seeing a lengthy growth streak end in April, the market in the United States returned to YoY expansion in May helped by an additional selling day compared to May 2023. The daily selling rate was estimated at 55,600 units/day in May, compared to 53,100 in April. Both the annualized rate and the daily selling rate were the best for the year-to-date, but neither were as strong as December 2023. Estimated retail sales totaled 1.18 million units in May, while fleet sales finished at ~268,000 units, representing ~18.6% of total sales.

“May is usually an important month for the automotive industry, with warmer temperatures and Memorial Day sales events traditionally bringing consumers out to buy vehicles. This year was no different, with incentives being significantly higher than a year ago, allowing for some buyers to make deals that were not possible when inventory levels were low,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

“With that said, there is still a degree of variance in the performance of different OEMs. Brands that offered a variety of fuel options, including Hybrids and Plug-in Hybrids, appeared to thrive in May, underlining that the industry faces more than just a binary choice between Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs). Leasing is also clearly making a comeback, as it provides both a more affordable option for consumers facing eye-watering financing costs, and a workaround for EVs that would not otherwise qualify for “tax credits,” said Oakley.

Quick Look at the Market

General Motors (GM) had another strong month in May, opening up a lead of 27,000 units over Toyota Group, even though the latter grew by a healthy 15.7% YoY. At a brand level, Toyota led the rankings on 185,000 units, although the gap to Ford was only 10, 000 units. Chevrolet occupied its usual position in third, 160,000 units. Ford F-150 remained the best-selling vehicle in May with 43,800 units, but it is only slowly eroding the lead that the Toyota RAV4 built up in the earlier months of the year, as the RAV4 posted 42,700 sales in May.

Compact Non-Premium SUV’s total market share slipped to 20.5% in May, the lowest since August 2023, but the segment still comfortably led all others. Mid-size Non-Premium SUV was second at 15.5%, while Large Pickup continued its modest recent recovery, as its share was up marginally month-on-month (MoM), to 13.3%.

Growth in US inventory continues, but has slowed as production returns to levels that are able to match demand. Inventory in April rose by 49% YoY, but was just 3.5% higher than in March 2024. Days’ supply climbed to 51 days from 48 days in March. Given the robust sales in May, inventory is projected to increase just slightly from April’s level, while days’ supply is expected to have slipped to 48 days. “Although availability has improved significantly in the past year, OEMs appear to be managing closer to equilibrium thus far in 2024” GlobalData said.

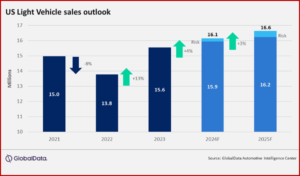

The GlobalData forecast for US LV sales is closer to the 16.2 million level but continues to round down to 16.1 million units, a 4% increase from 2023. “In addition to retail, fleet sales have also been consistent, and we now expect share to be close to the 19% mark for the year – the highest level since 2019. If the market strength continues into the summer selling season, we will likely be looking at a further upward revision to the forecast for the year and into early 2025. The current outlook for LV sales in2025 is holding at 16.6 mn units, an increase of 3% YoY.”

“Consumers continue to replace aging vehicles and as availability improves or levels out in all segments, we could see mild upside potential to the near-term outlook. The combination of moderating prices and an overall stable economic environment may prove to be the right recipe for growth to hold,” said Jeff Schuster, Vice President Research and Analysis, Automotive.” If manageable lease payments improve further, consumers will have another lever to combat the likelihood of higher interest rates for a longer period. The wildcard may be the impact of the election on the economy and policy as the year progresses.”

Global Outlook

“The global LV selling rate improved to 86.1 million units/year in April, up from an average of 83.0 million units/year in Q1 2024. Volumes rose by 3.4% from April 2023 as solid growth continues, but at an expected slower pace,” the Global Data forecast team observed. Their comments:

- Below the topline, the results were mixed, with Europe outperforming all major markets, increasing by 15% YoY. China’s domestic sales increased by just 3% as consumers face mounting challenges that the price cuts did not override.

- North America, Korea, and Japan all contracted in April, due in part to base effects and fewer selling days.

- The 2024 outlook for global auto sales is virtually unchanged from last month at 89.1 mn units, an increase of 3% from 2023. Pricing trends, geopolitical risk and the overall performance of economies around the world continue to be key drivers in the near-term auto market, with some downward pressure in Asia that could impact how the year finishes.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Light Vehicle Sales Strong in May

Click to enlarge.

According to preliminary estimates, US Light Vehicle (LV) sales grew by 6.8% year-on-year (YoY) in May to 1.44 million units, according to an analysis just released by the respected GlobalData consultancy.* After seeing a lengthy growth streak end in April, the market in the United States returned to YoY expansion in May helped by an additional selling day compared to May 2023. The daily selling rate was estimated at 55,600 units/day in May, compared to 53,100 in April. Both the annualized rate and the daily selling rate were the best for the year-to-date, but neither were as strong as December 2023. Estimated retail sales totaled 1.18 million units in May, while fleet sales finished at ~268,000 units, representing ~18.6% of total sales.

“May is usually an important month for the automotive industry, with warmer temperatures and Memorial Day sales events traditionally bringing consumers out to buy vehicles. This year was no different, with incentives being significantly higher than a year ago, allowing for some buyers to make deals that were not possible when inventory levels were low,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

“With that said, there is still a degree of variance in the performance of different OEMs. Brands that offered a variety of fuel options, including Hybrids and Plug-in Hybrids, appeared to thrive in May, underlining that the industry faces more than just a binary choice between Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs). Leasing is also clearly making a comeback, as it provides both a more affordable option for consumers facing eye-watering financing costs, and a workaround for EVs that would not otherwise qualify for “tax credits,” said Oakley.

Quick Look at the Market

General Motors (GM) had another strong month in May, opening up a lead of 27,000 units over Toyota Group, even though the latter grew by a healthy 15.7% YoY. At a brand level, Toyota led the rankings on 185,000 units, although the gap to Ford was only 10, 000 units. Chevrolet occupied its usual position in third, 160,000 units. Ford F-150 remained the best-selling vehicle in May with 43,800 units, but it is only slowly eroding the lead that the Toyota RAV4 built up in the earlier months of the year, as the RAV4 posted 42,700 sales in May.

Compact Non-Premium SUV’s total market share slipped to 20.5% in May, the lowest since August 2023, but the segment still comfortably led all others. Mid-size Non-Premium SUV was second at 15.5%, while Large Pickup continued its modest recent recovery, as its share was up marginally month-on-month (MoM), to 13.3%.

Growth in US inventory continues, but has slowed as production returns to levels that are able to match demand. Inventory in April rose by 49% YoY, but was just 3.5% higher than in March 2024. Days’ supply climbed to 51 days from 48 days in March. Given the robust sales in May, inventory is projected to increase just slightly from April’s level, while days’ supply is expected to have slipped to 48 days. “Although availability has improved significantly in the past year, OEMs appear to be managing closer to equilibrium thus far in 2024” GlobalData said.

The GlobalData forecast for US LV sales is closer to the 16.2 million level but continues to round down to 16.1 million units, a 4% increase from 2023. “In addition to retail, fleet sales have also been consistent, and we now expect share to be close to the 19% mark for the year – the highest level since 2019. If the market strength continues into the summer selling season, we will likely be looking at a further upward revision to the forecast for the year and into early 2025. The current outlook for LV sales in2025 is holding at 16.6 mn units, an increase of 3% YoY.”

“Consumers continue to replace aging vehicles and as availability improves or levels out in all segments, we could see mild upside potential to the near-term outlook. The combination of moderating prices and an overall stable economic environment may prove to be the right recipe for growth to hold,” said Jeff Schuster, Vice President Research and Analysis, Automotive.” If manageable lease payments improve further, consumers will have another lever to combat the likelihood of higher interest rates for a longer period. The wildcard may be the impact of the election on the economy and policy as the year progresses.”

Global Outlook

“The global LV selling rate improved to 86.1 million units/year in April, up from an average of 83.0 million units/year in Q1 2024. Volumes rose by 3.4% from April 2023 as solid growth continues, but at an expected slower pace,” the Global Data forecast team observed. Their comments:

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.