Click to enlarge.

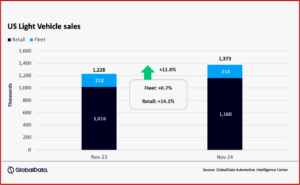

Light Vehicle (LV) sales* in the US grew by 11.8% year-on-year (YoY) in November, to 1.37 million units, according to data released by the respected GlobalData consultancy.** November had one more selling day compared to November 2023. However, it was the strongest sales result since May of 2021 as the Biden Administration job-creating recovery continues.

“Despite some uncertainty over the longer-term outlook for the industry amid potential changes in policy, November sales delivered a strong performance. Volumes were reminiscent of pre-pandemic times, after several years in which the market has been subdued.

“Even though headlines around Electric Vehicles (EVs) have generally been focused on the negatives, brands with a range of electrified offerings, including hybrids, tended to see an enthusiastic response in November. However, some consumers could now be moving to take advantage of EV tax credits, given that the incoming Trump administration has signaled that these credits could be scaled back or removed entirely. Credit availability appears to be improving as interest rates on auto loans slowly creep down, but some of that positivity is being tempered by lower trade-in equity for consumers,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

Highlights

The annualized selling rate for the month was 16.7 million units/year, up from 16.3 million in October, and the strongest since May 2021. The daily selling rate was estimated at 52,800 units/day in November, up from 49,900 in October. October was an upbeat start to Q4. The stimulus continued into November, as higher levels of inventory, increasing incentives, and the return of some models after the ending of stop-sale orders propelled gains. According to initial estimates, retail sales totaled 1.16 million in November, while fleet sales finished at 213,000, accounting for 15.5% of total volumes.

GlobalData Commentary, Observations

- General Motors (GM) once again topped the sales rankings in November. GM achieved its highest volumes (244,000 units) since December 2020 and its largest market share (17.8%) since January 2021.

- Toyota Group experienced a better month than recently, recording only its second month of YoY growth in the past six months with volumes of 207,000 in November. Toyota Group’s struggles have been closely linked with the stop-sale orders on the Toyota Grand Highlander and Lexus TX. Those models are now available once again, so sales rebounded in November. The Grand Highlander recorded sales of 7200 last month, close to its typical monthly volumes.

- Ford Group was the third-largest by sales at 161,000.

Brands

- Toyota pulled away from nearest challengers, reaching 173,000 units. In the battle for second place, Chevrolet(157,000) beat Ford (151,000) for the first time since August 2023.

- Toyota RAV4 was the bestselling model in November at 41,200 leading the Ford F-150 at 38,900. The Tesla Model Y appears to have had an unusually weak month with 26,400 sold, placing it well outside the top five models. In contrast, the Chevrolet Equinox surged in November with 29,400, its highest volume since December 2020.

Vehicle Segment Types

- Compact Non-Premium SUVs had a market share of 21.3%, because of strong contributions from the Toyota RAV4, the Chevrolet Equinox and the Honda CR-V.

- Midsize Non-Premium SUVs had a somewhat more encouraging month than recent performances, with a market share of 15.0%. The Chevrolet Traverse’s market share was its highest since its redesign earlier in 2024.

- Large Pickups recorded a market share of 14.1%, with the segment’s performance having plateaued in recent months.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Light Vehicle Sales Strong in November

Click to enlarge.

Light Vehicle (LV) sales* in the US grew by 11.8% year-on-year (YoY) in November, to 1.37 million units, according to data released by the respected GlobalData consultancy.** November had one more selling day compared to November 2023. However, it was the strongest sales result since May of 2021 as the Biden Administration job-creating recovery continues.

“Despite some uncertainty over the longer-term outlook for the industry amid potential changes in policy, November sales delivered a strong performance. Volumes were reminiscent of pre-pandemic times, after several years in which the market has been subdued.

“Even though headlines around Electric Vehicles (EVs) have generally been focused on the negatives, brands with a range of electrified offerings, including hybrids, tended to see an enthusiastic response in November. However, some consumers could now be moving to take advantage of EV tax credits, given that the incoming Trump administration has signaled that these credits could be scaled back or removed entirely. Credit availability appears to be improving as interest rates on auto loans slowly creep down, but some of that positivity is being tempered by lower trade-in equity for consumers,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

Highlights

The annualized selling rate for the month was 16.7 million units/year, up from 16.3 million in October, and the strongest since May 2021. The daily selling rate was estimated at 52,800 units/day in November, up from 49,900 in October. October was an upbeat start to Q4. The stimulus continued into November, as higher levels of inventory, increasing incentives, and the return of some models after the ending of stop-sale orders propelled gains. According to initial estimates, retail sales totaled 1.16 million in November, while fleet sales finished at 213,000, accounting for 15.5% of total volumes.

GlobalData Commentary, Observations

Brands

Vehicle Segment Types

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.