Click for more information.

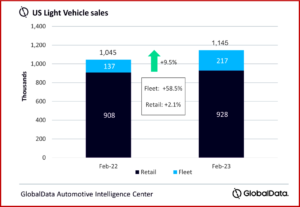

US Light Vehicle sales totaled 1.14 million units in February, according to an analysis just released by LMC Automotive.* This converts to a Year-over-Year rise of 9.5%, with the same number of selling days as February 2022. The month’s results were “flattered by the depressed state of the market a year ago.” Compared to February 2021’s total, sales were down by 3.8%.

“The declines would be larger if we used the pre-pandemic period as a baseline. Still, given the headwinds of sky-high average transaction prices, lingering inventory shortages for some OEMs, and economic uncertainty, February’s results surpassed expectations and can be considered an encouraging outcome,” LMC said.

The February selling rate was estimated to be 15.0 million units/year, aka SAAR, down from 16.0 million units/year in January. However, as LMC observed last month, January’s rate appears to have been distorted by changing seasonality and the unique conditions in the market whereby a lack of supply is still constraining sales in some cases.

Continued strength in fleet volume recovery has nudged up the outlook for US Light Vehicle sales to 15.0 million units, an increase 9% from 2022 and 50,000 units higher than last month. The economy is also stronger than expected at the start of the year, as consumers remain resilient in their spending and the labor market continue to be steady. This could push the timing of a mild recession to later in 2023, according to LMC

Highs and Lows

- General Motors was the bestselling maker for the seventh consecutive month, “although its market share was notably trimmed compared to recent history,” LMC said.

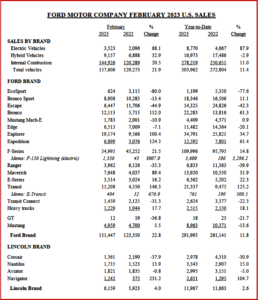

- After several months in which GM had been the OEM to grow the most in YoY terms, that title was taken by Ford Group in February, as its sales expanded by 24.0% YoY, compared to 14.0% for GM. VW Group also saw a larger YoY gain than GM in percentage terms, at 20.7%. “While to a large extent this reflects the fact that GM was already starting to recover from its worst inventory shortages a year ago, when Ford was struggling to a greater degree, GM’s market share did slip to 16.2% in February, compared to 17.6% in January,” LMC said.

- Despite posting a YoY loss and continuing to struggle with inventory shortages, Toyota Group reclaimed second place, having fallen behind Ford Motor in January.

- The gap between GM and Toyota Group was around 27,000 units, whereas GM was around 43k units ahead of Ford Motor (Group) in January.

- Ford was the number one brand in February, outselling Toyota by approximately 10k units, but Toyota was comfortably ahead of Chevrolet – with a margin of 17,000 units – having slipped behind Chevrolet into third place in January.

- The Ford F-150 was once again the bestselling Light Vehicle in February, around 6000 units ahead of the Toyota RAV4.

Click to enlarge.

“February was one of the more upbeat months for the US auto market in recent times, although this should be taken in the context of the lower volumes we have seen since the onset of the chip shortage and other supply- side issues. One encouraging sign from February’s results was that the recovery appeared to become more broad-based, with brands that had been extremely subdued showing some evidence of returning to more normal levels, as inventory climbs. On the other hand, it should be noted that fleet sales continue to support the market even as retail sales are weak by historical standards, with February’s results showing barely any growth over last year’s lows. Still, after more than two years in which fleet sales were well below historical averages, there should remain plenty of demand from this channel, and this supports our view that the market will grow overall YoY in 2023,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

Global Forecast

January Light Vehicle sales were broadly in line with the level in Q4 2022, but slightly weaker than expectations. Global volume was down 8.1% to 6.0 million units and the selling rate dropped to 82.7 million from 83.6 in January 2022. Global supply chain disruption remained a factor in the weak start to the year. However, LMC observed there were also distortions from tax incentive changes and a spike in COVID-19 cases in China.

The forecast for 2023 is holding at 85.9 million units, an increase of 6% from 2022. “Disruption is easing some but there remains risk with economic growth and affordability. Compared with February 2021’s total, sales were down by 3.8%. The declines would be larger if we used the pre-pandemic period as a baseline. Still, given the headwinds of sky-high average transaction prices, lingering inventory shortages for some OEMs, and economic uncertainty, February’s results surpassed expectations and can be considered an encouraging outcome,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com. https://www.globaldata.com/

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Light Vehicle Sales Up in February Amid Uncertainty

Click for more information.

US Light Vehicle sales totaled 1.14 million units in February, according to an analysis just released by LMC Automotive.* This converts to a Year-over-Year rise of 9.5%, with the same number of selling days as February 2022. The month’s results were “flattered by the depressed state of the market a year ago.” Compared to February 2021’s total, sales were down by 3.8%.

“The declines would be larger if we used the pre-pandemic period as a baseline. Still, given the headwinds of sky-high average transaction prices, lingering inventory shortages for some OEMs, and economic uncertainty, February’s results surpassed expectations and can be considered an encouraging outcome,” LMC said.

The February selling rate was estimated to be 15.0 million units/year, aka SAAR, down from 16.0 million units/year in January. However, as LMC observed last month, January’s rate appears to have been distorted by changing seasonality and the unique conditions in the market whereby a lack of supply is still constraining sales in some cases.

Continued strength in fleet volume recovery has nudged up the outlook for US Light Vehicle sales to 15.0 million units, an increase 9% from 2022 and 50,000 units higher than last month. The economy is also stronger than expected at the start of the year, as consumers remain resilient in their spending and the labor market continue to be steady. This could push the timing of a mild recession to later in 2023, according to LMC

Highs and Lows

Click to enlarge.

“February was one of the more upbeat months for the US auto market in recent times, although this should be taken in the context of the lower volumes we have seen since the onset of the chip shortage and other supply- side issues. One encouraging sign from February’s results was that the recovery appeared to become more broad-based, with brands that had been extremely subdued showing some evidence of returning to more normal levels, as inventory climbs. On the other hand, it should be noted that fleet sales continue to support the market even as retail sales are weak by historical standards, with February’s results showing barely any growth over last year’s lows. Still, after more than two years in which fleet sales were well below historical averages, there should remain plenty of demand from this channel, and this supports our view that the market will grow overall YoY in 2023,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

Global Forecast

January Light Vehicle sales were broadly in line with the level in Q4 2022, but slightly weaker than expectations. Global volume was down 8.1% to 6.0 million units and the selling rate dropped to 82.7 million from 83.6 in January 2022. Global supply chain disruption remained a factor in the weak start to the year. However, LMC observed there were also distortions from tax incentive changes and a spike in COVID-19 cases in China.

The forecast for 2023 is holding at 85.9 million units, an increase of 6% from 2022. “Disruption is easing some but there remains risk with economic growth and affordability. Compared with February 2021’s total, sales were down by 3.8%. The declines would be larger if we used the pre-pandemic period as a baseline. Still, given the headwinds of sky-high average transaction prices, lingering inventory shortages for some OEMs, and economic uncertainty, February’s results surpassed expectations and can be considered an encouraging outcome,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global clients include car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com. https://www.globaldata.com/

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.