March 2021 US light-vehicle sales were stronger after sales fell in February with cars diving more than 20%. March’s SAAR of 17.75 million units was the second highest of all time for the month, following March 2000 two decades ago. Light trucks accounted for 77.7% of all new-vehicle sales in March 2021, up from 74% in March 2020. Lower discounting coupled with consumer preferences for higher-trimmed light-truck models should result in record-high transaction prices for March, according to NADA. (Ugh – US Light Vehicle Sales Drop during February 2021,Whither US Vehicle Sales in 2021? Is 14 Million a Stretch?)

Now, the theories – yet to be proven – and debates begin.

March 2021 sales were likely increased by delayed sales caused by harsh February winter weather. Then there’s the increase from stimulus checks following the passage of the Biden administration’s COVID-19 relief bill, which no Republican voted for.

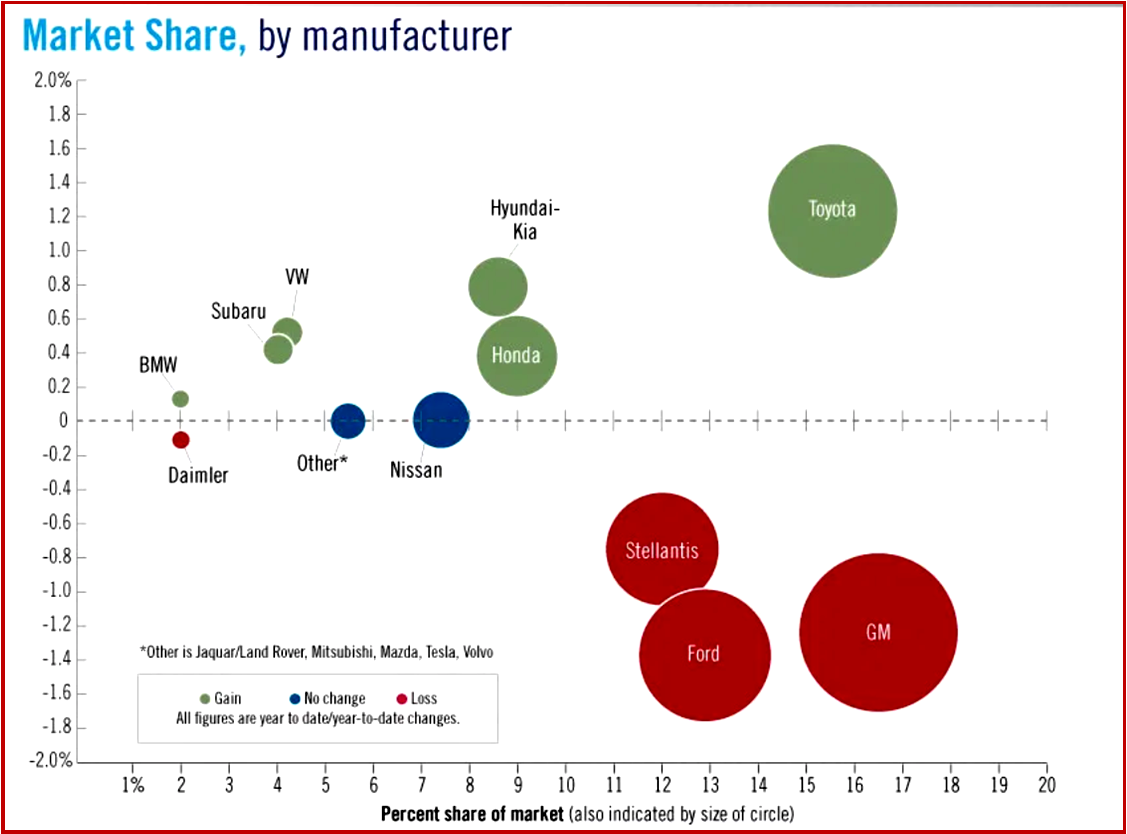

Look at Asian automakers – stronger than the Detroit Three whose truck sales are not large enough to pickup – so to speak – declines in other segments.

Sales in Q1 2021 is a SAAR of 16.8 million units, up from the SAAR of 14.8 million units in Q1 2020 when the failed Republican Administration, aka the QOP or the party of NO help, was denying COVID was a problem. Q1 2021 was indeed un-affected by false statements and deadly bleach diversions but still devastated by the ongoing COVID-19 pandemic. Under Biden things are beginning to normalize – sales in Q1 2021 came in slightly below the more usual SAAR of 16.9 million units, according to NADA.

Almost every automaker has been hurt by the global semiconductor shortage. Automakers are building some vehicles without electronic modules when necessary. The hope here is twofold – vehicles will be completed as soon as more semiconductors become available; Consumer demand under the thus far successful Biden Administration’s war against Covid will continue and sales will appear when it happens. Most makers are projecting strong customer demand during the year. Some even think they can recover lost truck and crossover production in the second half of the year.

J.D. Power – which has an impressive track record on forecasting – summed things up nicely for AutoInformed.

- March Industry SAAR 17.9M

- Best March retail results since 2000

- Q1 Total sales on a DSR basis were off only 0.3% from 2019’s stable levels, but +15% vs Q1 ‘20

- Q1 retail sales were up 9.7% from 2019 (DSR) and easily crushed last year at +26% vs Q1’20

- Retail sales growth despite transaction prices growing 12% from 2019

- Q1 fleet mix is 16.8% a decline of 7.6ppts from 2020 and 7.7ppts from 2019

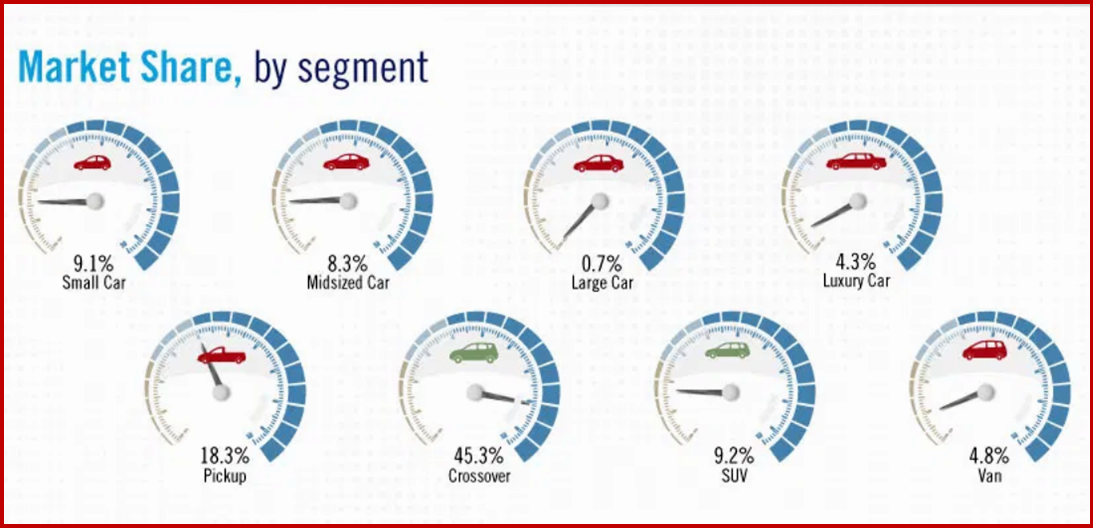

- Strong sales despite very tight light duty pickup: large pickups turned in 41 days in March vs 88 days last March (89 days in March 19)

- Midsize pickups turned in 34 days in March vs 80 and 67 in 2020 and 2019 respectively

“Pickup inventory is already constraining sales and the recent plant closures will make it worse. While the industry has mostly sidestepped the challenges of the microchip shortages to-date, April and Q2 are very likely to show cracks in the recovery,” said J.D. Power.

“Toyota sold the most vehicles in March, beating GM for the sales crown, as they benefited from being less impacted by the semiconductor shortage thus far and made a strong sales push in the last month of their fiscal year. Large Pickups, the least affected segment by the pandemic, has lost 3.5 percentage points of share from a year ago, as the inventory squeeze takes hold. Compact and Midsize SUVs led the market, and the difference between them was just 1,200 units. The Premium and Super Premium segments also performed very well compared to the beginning of the pandemic last year. Sales of Midsize Premium SUVs, for example, more than doubled from a year ago,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

To close out the first quarter, March saw U.S. light vehicles sales soar to a 17.7 million-unit seasonally adjusted annual rate, second highest ever for the month. Even with inventory at a ten-year low, March’s SAAR was at a 41-month high. Raw volume totaled 1,581,067. As inventory remains constrained due to disruptions in the supply chain, days’ supply fell to 39 – the lowest for any month since the cash-for-clunkers program in 2009. The first quarter totaled nearly 3.9 million in sales, a jump of 11% over 2020. Tight inventory and further production slowdowns due to the supply chain could hamper sales going into the second quarter. The manufacturing sector again gained jobs as consumer sentiment continued to rise in late March, reaching its highest level in a year.