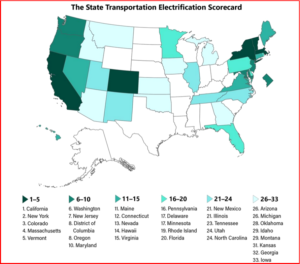

While some states are clearly leading and strengthening policies to enable widespread use of electric cars, trucks, and buses, all states will have to significantly step up their efforts to enable a full transition, says a new report from the American Council for an Energy-Efficient Economy (ACEEE). The 2023 State Transportation Electrification Scorecard evaluates states’ policies to encourage electric vehicle (EV) adoption. Only nine states scored more than half the points available. (AutoInformed: Watt? Electric Cars Cause Another Great Generational Divide)

“We are seeing incremental progress, not transformational progress. States will have to move far more aggressively to do their part to enable the electric vehicle transition that the climate crisis demands,” said Peter Huether, senior research associate at ACEEE and the lead writer of the report. “Auto manufacturers are expanding their EV options and consumers are increasingly choosing them, but supportive state policies are needed to ensure that the electric grid is ready and that all households and businesses, including those in under-served communities, can use EVs and have adequate access to charging.”

California ranked first in the Scorecard, scoring 88 out of 100 points. California is devoted to full electrification of light-duty vehicle sales, is planning significant updates to its electricity grid to prepare for a sharp rise in EVs, and incorporates equity considerations into its EV policy, setting aside significant funding for EV purchases in low-income communities and communities of color.

New York, which came in second with 62 points, has heavily incentivized the purchase of EVs and EV charging infrastructure, including from its investor-owned utilities, and has taken considerable steps to integrate EVs onto the grid. Rounding out the top 10 are Colorado (#3), Massachusetts (#4), Vermont (#5), Washington State (#6), New Jersey (#7), the District of Columbia (tied for #8), Oregon (tied for #8), and Maryland (#10). The top nine states scored more than 50 points, and all others scored less than half the points available.

Since ACEEE’s last assessment in 2021, California finalized two significant EV regulations: the Advanced Clean Cars II rule, which requires all new cars sold by 2035 to be EVs, and the Advanced Clean Truck regulation, which requires heavy-duty truck sales to begin to transition to electric models. Six states have adopted California’s Advanced Clean Cars II rule, and seven adopted its truck rule. Six additional states are considering adopting one or both of the rules. Nationwide, utilities have committed to investing $760 million in vehicle charging infrastructure since the last scorecard. The number of states requiring transit agencies to electrify their buses has doubled from four to eight.

In many areas, the picture is grim. Most states do not have targets to reduce emissions from the transportation sector, and since the last scorecard, only Colorado added such a goal. Only four states have set binding targets to electrify school buses, and only two of those prioritize equity in those targets. Seventeen states offer purchase incentives for heavy-duty electric vehicles, down from 27 in 2021 because some states allowed funding for the incentives to expire.

The Scorecard only presents scores for the top 33 states, because the remaining states achieved very few points, and there is little differentiation in policy progress among those states.

Release from Wolfsburg, 14 July 2023 – The Volkswagen Group increased its deliveries of all-electric vehicles (BEVs) by 48% year-on-year to 321,600 vehicles in the first half of the year. The BEV share of total deliveries rose to 7.4%, up from 5.6% in the first six months of the previous year.

The Group achieved the highest growth in Europe, where deliveries rose by 68% to 217,100 BEVs. Here, the Volkswagen Group is the market leader and gained market share. Significantly more customers of a Group brand took delivery of their all-electric vehicles in the USA, too. The increase here was 76% to 29,800 vehicles.

In China, deliveries were around two% below the previous year’s level at 62,400 BEVs in a particularly competitive market environment. Recently, however, the trend here has also been positive. Following a lower first quarter, 18% more BEVs were handed over to customers in the world’s largest automotive market in the second quarter than in the prior-year period.

Worldwide, the increase in the second quarter was 53% to 180,600 vehicles (118,000), and the BEV share of total deliveries rose to 7.7% (6.0) in this period.

Around 68% of the Group’s BEV deliveries were in its home region of Europe, followed by China with 19% and the USA with 9%. 4% went to other markets.

T

he Volkswagen Passenger Cars brand delivered 164,800 vehicles by the end of June, slightly more than half of all BEVs in the Group. It was followed by Audi with 75,600 vehicles (group share 24%), ŠKODA with 31,300 vehicles (group share 10%), SEAT/CUPRA with 18,900 vehicles (group share 6%), Porsche with 18,000 vehicles (group share 6%) and Volkswagen Commercial Vehicles with 12,300 vehicles (group share 4%).

The most successful BEV models in the first half of 2023 were:

• Volkswagen ID.4/ID.5 101,200

• Volkswagen ID.3 49,800

• Audi Q4 e-tron (incl. Sportback) 48,000

• ŠKODA Enyaq iV (incl. Coupé) 31,300

• Audi Q8 e-tron (incl. Sportback) 19,500