Click to Enlarge.

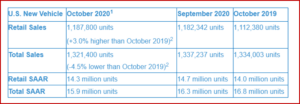

New-vehicle U.S. retail sales for the month of October are projected to be up from October 2019, according to a joint forecast from J.D. Power and LMC Automotive. Retail sales for new vehicles are anticipated to reach 1,187,800 units, a 3.0% increase compared with October 2019 when adjusted for selling days. October 2020 contains one additional selling day over October 2019. Comparing the same sales volume without adjusting for the number of selling days is an increase of 6.8% year-over-year – if the forecast holds true as Covid continues increasing its deadly grip on people and the U.S. economy. Global light-vehicle sales year to date through September increased three percentage points from August and are now down -19% from the same period in 2019.

Complete U.S. new-vehicle sales including all transactions for October are projected to reach 1,321,400 units, a -4.5% decrease from October 2019 when adjusted for selling days. The seasonally adjusted annualized rate, aka SAAR, for total new vehicle sales is expected to be 15.9 million units, down 0.8 million units from 2019, the least year-over-year decline since the pandemic began. This is the annual output of two to four final assembly plants, without considering the component parts plants from internal or external sources.

Power notes that the strong U.S. sales pace is appearing despite tight inventories. Strong demand and lean inventories allow manufacturers to reduce new-vehicle incentives and is allowing retailers to reduce the discounts they typically offer on new vehicles. The combination of elevated retail sales and average transaction prices means that consumers are expected to spend $43.7 billion on new vehicles, a record for the month of October. This represents an increase of $5.6 billion, or 14.6%, from October 2019.

The average number of days a new vehicle sits on a dealer lot before being sold is on pace to fall to 49 days, the first time it has fallen below 50 days in more than eight years. Additionally, for the fourth consecutive month, one in five vehicles are being sold after being on a dealer lot for only five days or less.

The average incentive from manufacturers on new vehicles is on pace to be $3,678 per vehicle, a decrease of $425 from prior year and the second consecutive month below $4,000. Expressed as a percentage of the average vehicle MSRP, incentives for October are 8.7%, down -1.4 percentage points from a year ago and the first time below 9% since June 2016. Incentive spending crested at $4,953 per unit in April 2020. Retailers also continue to post significant growth in margins on new-vehicle sales. Total grosses per unit, inclusive of finance and insurance income, are on pace to reach $2,224, an increase of $829 from a year ago.

“Average transaction prices are expected reach another all-time high, rising 7.3% to $36,755. The shift towards more expensive trucks and SUVs remains a key driver, with those two segments on pace to account for a combined 77% of retail sales compared to 73% prior year. For context, the average transaction price five years ago in October 2015 was $30,921,” said LMC and Power.

Low interest rates and higher trade-in values are supporting higher transaction prices. The average interest rate for loans in October is expected to fall by 94 basis points from a year ago to 4.6%. Over the same time, the average monthly finance payment is up only $16 to $594. Concurrently, the average trade-in value has risen to $5,034 an increase of $519 or 11.5%, from a year ago. Loan terms are relatively stable with the average term up only one month, to 70 months, compared with a year ago.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Vehicle Sales to Rise in October?

Click to Enlarge.

New-vehicle U.S. retail sales for the month of October are projected to be up from October 2019, according to a joint forecast from J.D. Power and LMC Automotive. Retail sales for new vehicles are anticipated to reach 1,187,800 units, a 3.0% increase compared with October 2019 when adjusted for selling days. October 2020 contains one additional selling day over October 2019. Comparing the same sales volume without adjusting for the number of selling days is an increase of 6.8% year-over-year – if the forecast holds true as Covid continues increasing its deadly grip on people and the U.S. economy. Global light-vehicle sales year to date through September increased three percentage points from August and are now down -19% from the same period in 2019.

Complete U.S. new-vehicle sales including all transactions for October are projected to reach 1,321,400 units, a -4.5% decrease from October 2019 when adjusted for selling days. The seasonally adjusted annualized rate, aka SAAR, for total new vehicle sales is expected to be 15.9 million units, down 0.8 million units from 2019, the least year-over-year decline since the pandemic began. This is the annual output of two to four final assembly plants, without considering the component parts plants from internal or external sources.

Power notes that the strong U.S. sales pace is appearing despite tight inventories. Strong demand and lean inventories allow manufacturers to reduce new-vehicle incentives and is allowing retailers to reduce the discounts they typically offer on new vehicles. The combination of elevated retail sales and average transaction prices means that consumers are expected to spend $43.7 billion on new vehicles, a record for the month of October. This represents an increase of $5.6 billion, or 14.6%, from October 2019.

The average number of days a new vehicle sits on a dealer lot before being sold is on pace to fall to 49 days, the first time it has fallen below 50 days in more than eight years. Additionally, for the fourth consecutive month, one in five vehicles are being sold after being on a dealer lot for only five days or less.

The average incentive from manufacturers on new vehicles is on pace to be $3,678 per vehicle, a decrease of $425 from prior year and the second consecutive month below $4,000. Expressed as a percentage of the average vehicle MSRP, incentives for October are 8.7%, down -1.4 percentage points from a year ago and the first time below 9% since June 2016. Incentive spending crested at $4,953 per unit in April 2020. Retailers also continue to post significant growth in margins on new-vehicle sales. Total grosses per unit, inclusive of finance and insurance income, are on pace to reach $2,224, an increase of $829 from a year ago.

“Average transaction prices are expected reach another all-time high, rising 7.3% to $36,755. The shift towards more expensive trucks and SUVs remains a key driver, with those two segments on pace to account for a combined 77% of retail sales compared to 73% prior year. For context, the average transaction price five years ago in October 2015 was $30,921,” said LMC and Power.

Low interest rates and higher trade-in values are supporting higher transaction prices. The average interest rate for loans in October is expected to fall by 94 basis points from a year ago to 4.6%. Over the same time, the average monthly finance payment is up only $16 to $594. Concurrently, the average trade-in value has risen to $5,034 an increase of $519 or 11.5%, from a year ago. Loan terms are relatively stable with the average term up only one month, to 70 months, compared with a year ago.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.