The global economy is fragile and disrupted by uncertainty. Click to Enlarge.

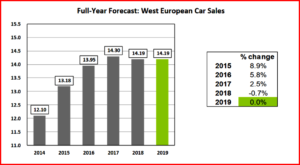

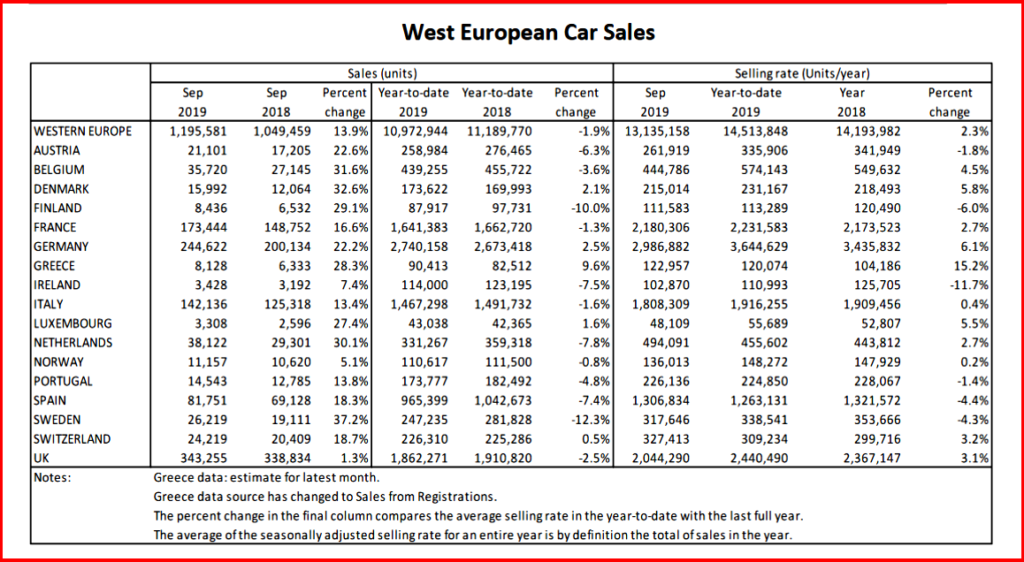

Western European car registrations rose by 13.9% YoY in September, but the selling rate faded to 13.1mn units/year, from16.9 mn units/year in August, the weakest selling rate of the year so far, according to consultancy LMC.

As AutoInformed readers know the introduction of WLTP in September 2018 distorted the market in August and September last year, with a high base effect in August and a low base effect for September as it became clear that diesels were dirty and not meeting emission standards.

“This has led to a perceived growth in sales across Europe for September while, in many cases, the selling rate has dropped since August and sales growth is weak or negative in the year to date,” says LMC.

Click to enlarge.

August’s strong sales were largely the result of an increased use of self-registrations by dealers and OEMs, ahead of further changes to WLTP regulations which came into effect on 1st September 2019, and therefore there was some settlement in selling rates in September this year. (WLTP How Does It Work? Will it Work?)

In the epicenter of Dieselgate, Germany’s September selling rate was its weakest for the year so far, at 3.0 mn units/year. However, taken alongside August’s inflated 4.3 mn units/year, the selling rate has averaged almost 3.7 mn units/year over the last two months, still okay. (Death of the Diesel: Daimler Guilty of Selling Dirty Diesels in Germany – Pays $957,000,000 Fine Rather than Litigate)

In the UK, sales advanced just 1.3% YoY in September; a month which usually sees the second highest volumes of the year, due to the release of new registration plates.

“If August and September volumes are taken together, the UK’s performance was similar to last year’s, but this compares poorly to markets such as Germany and France, which saw robust YoY growth.,” said LMC. Political and economic uncertainty around the BREXIT catastrophe is clearly hurting the UK car market AutoInformed opines.

“We expected to see a more significant increase in September, similar to those seen in France, Germany, Italy and Spain, given the negative effect WLTP had on all European markets last year. Instead, consumer confidence is being undermined by political and economic uncertainty. We need to restore stability to the market which means avoiding a ‘no deal’ Brexit and, moreover, agreeing a future relationship with the EU that avoids tariffs and barriers that could increase prices and reduce buyer choice,” said Mike Hawes, SMMT Chief Executive.

The French selling rate dropped from 2.6 mn units/year in August to 2.2 mn units/year in September, back down to rates on par with July, although sales jumped16.6% YoY.

Italy’s selling rate dropped from 2.2 mn units/year in August to 1.8mn units/year in September; the market expanded by 13.4% YoY.

“WLTP repercussions continue to distort the data,” says LMC. Executive summary: weak selling rates and strong YoY growth throughout Western Europe.

In Spain, the market saw an 18.3% YoY increase in sales; however, sales were still down on September 2017’s volumes, which are a better indictor than last September’s artificially low total. The selling rate fell slightly to 1.3 mn units/year in September, and for the YTD, Spanish registrations are down 7.4% YoY.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Western European Passenger Car Sales Weak

The global economy is fragile and disrupted by uncertainty. Click to Enlarge.

Western European car registrations rose by 13.9% YoY in September, but the selling rate faded to 13.1mn units/year, from16.9 mn units/year in August, the weakest selling rate of the year so far, according to consultancy LMC.

As AutoInformed readers know the introduction of WLTP in September 2018 distorted the market in August and September last year, with a high base effect in August and a low base effect for September as it became clear that diesels were dirty and not meeting emission standards.

“This has led to a perceived growth in sales across Europe for September while, in many cases, the selling rate has dropped since August and sales growth is weak or negative in the year to date,” says LMC.

Click to enlarge.

August’s strong sales were largely the result of an increased use of self-registrations by dealers and OEMs, ahead of further changes to WLTP regulations which came into effect on 1st September 2019, and therefore there was some settlement in selling rates in September this year. (WLTP How Does It Work? Will it Work?)

In the epicenter of Dieselgate, Germany’s September selling rate was its weakest for the year so far, at 3.0 mn units/year. However, taken alongside August’s inflated 4.3 mn units/year, the selling rate has averaged almost 3.7 mn units/year over the last two months, still okay. (Death of the Diesel: Daimler Guilty of Selling Dirty Diesels in Germany – Pays $957,000,000 Fine Rather than Litigate)

In the UK, sales advanced just 1.3% YoY in September; a month which usually sees the second highest volumes of the year, due to the release of new registration plates.

“If August and September volumes are taken together, the UK’s performance was similar to last year’s, but this compares poorly to markets such as Germany and France, which saw robust YoY growth.,” said LMC. Political and economic uncertainty around the BREXIT catastrophe is clearly hurting the UK car market AutoInformed opines.

“We expected to see a more significant increase in September, similar to those seen in France, Germany, Italy and Spain, given the negative effect WLTP had on all European markets last year. Instead, consumer confidence is being undermined by political and economic uncertainty. We need to restore stability to the market which means avoiding a ‘no deal’ Brexit and, moreover, agreeing a future relationship with the EU that avoids tariffs and barriers that could increase prices and reduce buyer choice,” said Mike Hawes, SMMT Chief Executive.

The French selling rate dropped from 2.6 mn units/year in August to 2.2 mn units/year in September, back down to rates on par with July, although sales jumped16.6% YoY.

Italy’s selling rate dropped from 2.2 mn units/year in August to 1.8mn units/year in September; the market expanded by 13.4% YoY.

“WLTP repercussions continue to distort the data,” says LMC. Executive summary: weak selling rates and strong YoY growth throughout Western Europe.

In Spain, the market saw an 18.3% YoY increase in sales; however, sales were still down on September 2017’s volumes, which are a better indictor than last September’s artificially low total. The selling rate fell slightly to 1.3 mn units/year in September, and for the YTD, Spanish registrations are down 7.4% YoY.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.