Click chart for more information.

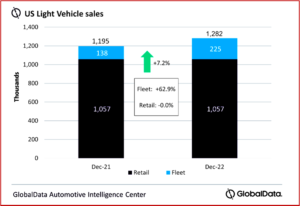

US Light Vehicle sales totaled an estimated 1.28 million units in December, according to an analysis just released by LMC Automotive.* This is a Year-over-Year increase of 7.2%, with the same number of selling days as December 2021. The year end was not one to celebrate, though. During each year between 2014 and 2020, December sales were at 1.5 million units or above. “A combination of ongoing problems with the availability of vehicles and unfavorable economic conditions are keeping the market relatively subdued,” LMC said.

However, December posted the highest volumes of 2022, ahead of March by ~26,000 units. The daily selling rate was estimated by LMC as 47,500 units/selling day, compared to 44,900 units/selling day in November. LMC thinks that shows how the annualized selling rate was affected by historical seasonality rather than the pace of sales necessarily slowing down. According to preliminary estimates, retail sales totaled around 1,057,000 units, unchanged from December 2021, while fleet accounted for approximately 225,000 units, representing 17.6% of the total market.

December sales continued to be hurt by increasing interest rates, while inflation remained high, but it has eased from its peak earlier in 2022. Conventional thinking has this keeping some consumers out of the new vehicle market. However, LMC noted fleet sales “appeared to continue their recent uptick in December, bolstering total sales, while the retail side of the market is thought to have been stagnant as compared to year-ago sales.”

General Motors once again increase its lead over Toyota Group. GM sold around ~41,000 units more than Toyota Group in December, compared to a 27,000 lead in November. “Whereas inventory shortages are largely in the rear-view mirror for GM, this is far from the case for Toyota. (Autoinformed.com: General Motors Posts US Sales Leadership for 2022; Toyota Motor North America 2022 Sales Drop Notably)

Moreover, for the first time since April, Toyota was not the market’s leading brand. Instead, that title went to Ford in December, which outsold Toyota by almost 6k units. The Ford F- 150 was the bestselling model in December, leading the Chevrolet Silverado by a 12,000-unit margin. (Autoinformed.com: Ford Claims F-Series Retains Title of Best-Selling Truck in 2022)

“December sales were mediocre, falling well short of the pre-chip crisis standard. Still, the month did at least record the highest volumes of 2022, and the overall performance was in line with our expectations. The pre-Christmas period was disrupted to some extent by severe winter weather across large swathes of the country, while the deals that may have tempted potential buyers into dealerships in previous years were fewer and further between in December 2022. The optimistic view is that the daily selling rate ticked up, despite these headwinds, and higher sales volumes were likely a factor behind rather modest gains in inventory during the month,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

General Motors as noted delivered the clearest Year-over-Year growth of the major automakers, with sales jumping 33.8% (from a low base). GM was followed in percentage growth terms by Hyundai Group with a 32.2% YoY increase. Toyota Group reported a 3.5% YoY gain, below the market average with Toyota Group 3.2 percentage points behind GM in market share. GM was number one at 17.3%.

Compact Non-Premium SUV was again the bestselling segment in December, with a 17.4% market share, up by 1.8 pp, YoY. This is the global sales sweet spot as well since it is the fastest growing segment. As in November, Mid-size Non-Premium SUV was the next most popular segment, 16.8%, down by 1.1 pp, YoY. “Perhaps the most significant change between November and December was a substantially improved performance for Large Pickups, which held a 15.9% share in December, up by 1.6 pp from the prior month and up from 14.5% in December 2021. As in November, Pickups once again outsold Cars in December, but the gap was extended from 7,100 units to 47,000 units,” LMC noted.

Jeff Schuster, President, LMC Automotive, A GlobalData Company, said: “We start 2023 with many of the issues continuing from 2022, though disruption is at a lesser scale. Some improvements in the economic outlook could spill into the Auto sector, but any material improvement is not expected in the first half of the year, as record high pricing continues and incentives are not strong enough to overcome the level. There does remain some room for upward revision if net pricing begins to fall sooner than expected.”

The bottom line: the economy and auto industry continue to struggle with the hopes that the Federal Reserve can choreograph a soft landing – a dubious proposition in AutoInformed’s historically nurtured view – 2022 ended with US sales coming in at 13.7 million units, a decline of 8% from 2021. (More jobs data out today – preliminary: Total non-farm payroll employment increased by 223,000 in December, and the unemployment rate edged down to 3.5 %, the U.S. Bureau of Labor Statistics said. Notable job gains occurred in leisure and hospitality, health care, construction, and social assistance.)

Soothsaying 2023, there are some improvements in the economic outlook. While a recession is still the base case scenario from all consultancies, GDP growth is expected to be positive for the year, at 0.9% growth in LMC’s forecast. However, given the pricing pressure and a remaining level of disruption, Light Vehicle sales are still expected to remain well below pre-pandemic levels at 14.9 million units, an increase of 9% from 2022.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

2022 US Light Vehicles Sales Worst Since 2011

Click chart for more information.

US Light Vehicle sales totaled an estimated 1.28 million units in December, according to an analysis just released by LMC Automotive.* This is a Year-over-Year increase of 7.2%, with the same number of selling days as December 2021. The year end was not one to celebrate, though. During each year between 2014 and 2020, December sales were at 1.5 million units or above. “A combination of ongoing problems with the availability of vehicles and unfavorable economic conditions are keeping the market relatively subdued,” LMC said.

However, December posted the highest volumes of 2022, ahead of March by ~26,000 units. The daily selling rate was estimated by LMC as 47,500 units/selling day, compared to 44,900 units/selling day in November. LMC thinks that shows how the annualized selling rate was affected by historical seasonality rather than the pace of sales necessarily slowing down. According to preliminary estimates, retail sales totaled around 1,057,000 units, unchanged from December 2021, while fleet accounted for approximately 225,000 units, representing 17.6% of the total market.

December sales continued to be hurt by increasing interest rates, while inflation remained high, but it has eased from its peak earlier in 2022. Conventional thinking has this keeping some consumers out of the new vehicle market. However, LMC noted fleet sales “appeared to continue their recent uptick in December, bolstering total sales, while the retail side of the market is thought to have been stagnant as compared to year-ago sales.”

General Motors once again increase its lead over Toyota Group. GM sold around ~41,000 units more than Toyota Group in December, compared to a 27,000 lead in November. “Whereas inventory shortages are largely in the rear-view mirror for GM, this is far from the case for Toyota. (Autoinformed.com: General Motors Posts US Sales Leadership for 2022; Toyota Motor North America 2022 Sales Drop Notably)

Moreover, for the first time since April, Toyota was not the market’s leading brand. Instead, that title went to Ford in December, which outsold Toyota by almost 6k units. The Ford F- 150 was the bestselling model in December, leading the Chevrolet Silverado by a 12,000-unit margin. (Autoinformed.com: Ford Claims F-Series Retains Title of Best-Selling Truck in 2022)

“December sales were mediocre, falling well short of the pre-chip crisis standard. Still, the month did at least record the highest volumes of 2022, and the overall performance was in line with our expectations. The pre-Christmas period was disrupted to some extent by severe winter weather across large swathes of the country, while the deals that may have tempted potential buyers into dealerships in previous years were fewer and further between in December 2022. The optimistic view is that the daily selling rate ticked up, despite these headwinds, and higher sales volumes were likely a factor behind rather modest gains in inventory during the month,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

General Motors as noted delivered the clearest Year-over-Year growth of the major automakers, with sales jumping 33.8% (from a low base). GM was followed in percentage growth terms by Hyundai Group with a 32.2% YoY increase. Toyota Group reported a 3.5% YoY gain, below the market average with Toyota Group 3.2 percentage points behind GM in market share. GM was number one at 17.3%.

Compact Non-Premium SUV was again the bestselling segment in December, with a 17.4% market share, up by 1.8 pp, YoY. This is the global sales sweet spot as well since it is the fastest growing segment. As in November, Mid-size Non-Premium SUV was the next most popular segment, 16.8%, down by 1.1 pp, YoY. “Perhaps the most significant change between November and December was a substantially improved performance for Large Pickups, which held a 15.9% share in December, up by 1.6 pp from the prior month and up from 14.5% in December 2021. As in November, Pickups once again outsold Cars in December, but the gap was extended from 7,100 units to 47,000 units,” LMC noted.

Jeff Schuster, President, LMC Automotive, A GlobalData Company, said: “We start 2023 with many of the issues continuing from 2022, though disruption is at a lesser scale. Some improvements in the economic outlook could spill into the Auto sector, but any material improvement is not expected in the first half of the year, as record high pricing continues and incentives are not strong enough to overcome the level. There does remain some room for upward revision if net pricing begins to fall sooner than expected.”

The bottom line: the economy and auto industry continue to struggle with the hopes that the Federal Reserve can choreograph a soft landing – a dubious proposition in AutoInformed’s historically nurtured view – 2022 ended with US sales coming in at 13.7 million units, a decline of 8% from 2021. (More jobs data out today – preliminary: Total non-farm payroll employment increased by 223,000 in December, and the unemployment rate edged down to 3.5 %, the U.S. Bureau of Labor Statistics said. Notable job gains occurred in leisure and hospitality, health care, construction, and social assistance.)

Soothsaying 2023, there are some improvements in the economic outlook. While a recession is still the base case scenario from all consultancies, GDP growth is expected to be positive for the year, at 0.9% growth in LMC’s forecast. However, given the pricing pressure and a remaining level of disruption, Light Vehicle sales are still expected to remain well below pre-pandemic levels at 14.9 million units, an increase of 9% from 2022.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.