As perceptions of both reliability and actual vehicle dependability improve, new-vehicle shoppers are considering more models before making their purchase decision, according to a new study.

As vehicle quality improves across the industry, new-vehicle shoppers now consider an average of 3.3 vehicles in 2013, compared with 3.1 in 2012 and 2.9 in 2010. (Read AutoInformed on Toyota Leads 2012 Vehicle Dependability Report)

Moreover, fewer shoppers (21%) in 2013 purchased their vehicle without cross shopping other models, compared with 26% in 2012 and 29% in 2010.

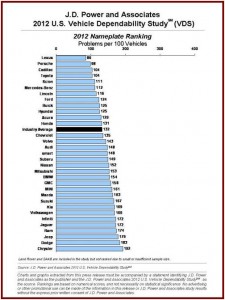

The “Avoider” study from J.D. Power finds that only 17% of new-vehicle shoppers avoid a model due to its reputation for reliability. This is compared to 19% in 2012 and 21% in 2009. Not only has the perception of reliability and dependability improved, but also the actual quality of vehicles has improved, as the average number of problems per 100 vehicles after three years of ownership has decreased to 132 in 2012 from 170 in 2009.

“Improved actual and perceived reliability has leveled the playing field, allowing many manufacturers to be considered among new-vehicle shoppers that may not have been considered in the past,” said Jon Osborn, research director at J.D. Power and Associates.

The styling of the model and its image, are among the primary reasons new-vehicle shoppers avoid particular models. One-third (33%) of shoppers avoid a model because they do not like its exterior look or design, while 19% of shoppers do not consider a model because they do not like its interior look or design. The study finds that the image a model portrays plays an important part in avoidance. Nearly one in five (17%) new-vehicle shoppers avoid a model because they do not like the image it portrays.

Gas mileage remains the most influential purchase reason, similar to 2012, with 15% of new-vehicle owners in 2013 saying it was the primary reason for purchasing their vehicle. Although young owners – under age 25 – cite gas mileage as the most influential purchase reason more often than their older counterparts, owners in all age groups indicate gas mileage is the most influential purchase reason.

New-vehicle shoppers avoid hybrid or electric vehicles because of cost/price (36%) and exterior styling (25%) more than any other reasons. Even when considering a hybrid or electric vehicle, 36% of shoppers cite price/payment as the primary reason for rejecting them as a purchase option.

Although the cost and styling of hybrid and electric vehicles detract some shoppers from considering them, among those who purchased a hybrid or electric vehicle, 95% say that they did so due to gas mileage, while 62% say that it was due to environmental impact.