Previous cheaters, notably the Germans, can’t sell illegal vehicles.

The European car market continued to decline in October 2018, as 1.12 million vehicles were registered during the month, down 7.1% on the same time last year. In early October 43% of the model versions available on the market had not been homologated, with the percentage only falling to 37% one month later.

The industry continued to suffer the consequences of September’s results, when the introduction of WLTP* and the lack of availability of non-homologated model versions caused the market to drop. However, year to date figures remain unimpaired and indicate overall registrations are at the highest point of the past 10 years. (*Worldwide Harmonized Light Vehicle Test Procedure – WLTP – is used to measure fuel consumption and CO2 emissions from light vehicles, as well as their pollutant emissions during real world driving conditions.

Felipe Munoz, JATO’s global analyst, said: “We expected another drop in October, as the homologation process is taking its time. However, it is concerning to see that some of the industry’s key players are still quite behind in the process.”

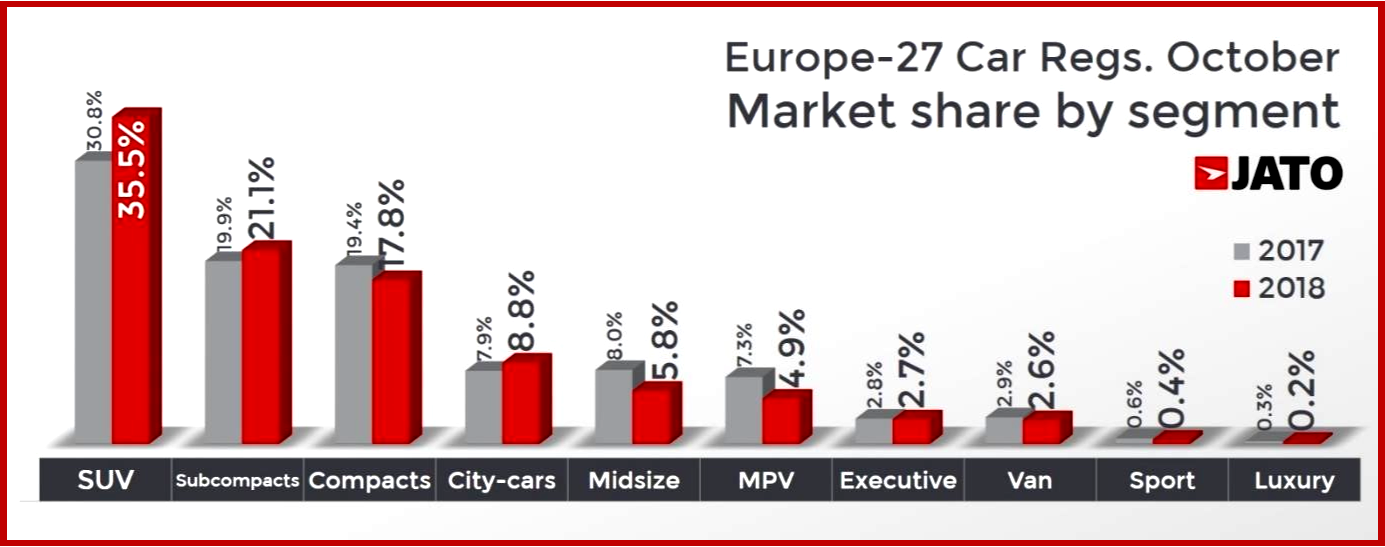

As in September, the SUV segment once again bucked the negative impact of both WLTP and the diesel crisis. Despite having to navigate more challenging market conditions, SUVs continued to gain traction, with their registrations growing by 7.2% to 397,200 units and their market share jumping from 30.8% in October 2017 to 35.5% last month.

Most of the growth was driven by small SUVs, where volume increased by 16.6%, after being boosted by new arrivals. In fact, “European B-SUVs may reach the 2 million registrations mark by the end of the year,” predicts Munoz.

In contrast, MPV volume fell by 37% to just 55,000 registrations, while midsize cars fell by 33% to 64,500 registrations and sports cars fell by 33% to 4,900 units.

Diesel vehicles started to lose ground again after some months of stability. Registrations fell by 24% during October, counting for 34.1% of the total market. This can be attributed to the fact that many of the diesel models popular among consumers are non-homologated versions.

Alternative-fueled vehicles continued to gain traction with their market share increasing by 2 percentage points to 7.5%, while demand for pure electric cars grew immensely, with volume up by 70%.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

European Market Sinks. One-Third of Model Versions Not legal

Previous cheaters, notably the Germans, can’t sell illegal vehicles.

The European car market continued to decline in October 2018, as 1.12 million vehicles were registered during the month, down 7.1% on the same time last year. In early October 43% of the model versions available on the market had not been homologated, with the percentage only falling to 37% one month later.

The industry continued to suffer the consequences of September’s results, when the introduction of WLTP* and the lack of availability of non-homologated model versions caused the market to drop. However, year to date figures remain unimpaired and indicate overall registrations are at the highest point of the past 10 years. (*Worldwide Harmonized Light Vehicle Test Procedure – WLTP – is used to measure fuel consumption and CO2 emissions from light vehicles, as well as their pollutant emissions during real world driving conditions.

Felipe Munoz, JATO’s global analyst, said: “We expected another drop in October, as the homologation process is taking its time. However, it is concerning to see that some of the industry’s key players are still quite behind in the process.”

As in September, the SUV segment once again bucked the negative impact of both WLTP and the diesel crisis. Despite having to navigate more challenging market conditions, SUVs continued to gain traction, with their registrations growing by 7.2% to 397,200 units and their market share jumping from 30.8% in October 2017 to 35.5% last month.

Most of the growth was driven by small SUVs, where volume increased by 16.6%, after being boosted by new arrivals. In fact, “European B-SUVs may reach the 2 million registrations mark by the end of the year,” predicts Munoz.

In contrast, MPV volume fell by 37% to just 55,000 registrations, while midsize cars fell by 33% to 64,500 registrations and sports cars fell by 33% to 4,900 units.

Diesel vehicles started to lose ground again after some months of stability. Registrations fell by 24% during October, counting for 34.1% of the total market. This can be attributed to the fact that many of the diesel models popular among consumers are non-homologated versions.

Alternative-fueled vehicles continued to gain traction with their market share increasing by 2 percentage points to 7.5%, while demand for pure electric cars grew immensely, with volume up by 70%.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.