The COVID-19 outbreak is causing unprecedented distress across multiple markets.

“Whether you believe there is a public overreaction or that COVID-19 is actually a public health crisis headed for pandemic status, there is no denying the expected negative impact it will have on the economy and auto industry, said Jeff Schuster, President, Global Vehicle Forecasts at LMC. “Volatility will remain with us until there is evidence of containment globally and the lasting effect could spill into 2021. The US outbreak remains at an early stage of development, so additional challenges for the industry, including supply chain issues, could push the market further into negative territory.”

Executive Summary: The rapid international spread of coronavirus COVID-19 outside China is adding another layer of stress to the global automotive market, following the outlook already turning negative as the virus crippled vehicle demand in China in February.

The economic outlook is wavering, with the risk of a global recession somewhat higher than a matter of weeks ago. Global economic growth in 2020 is now expected to be at 2.0%, down from the early 2020 forecast of 2.5%.

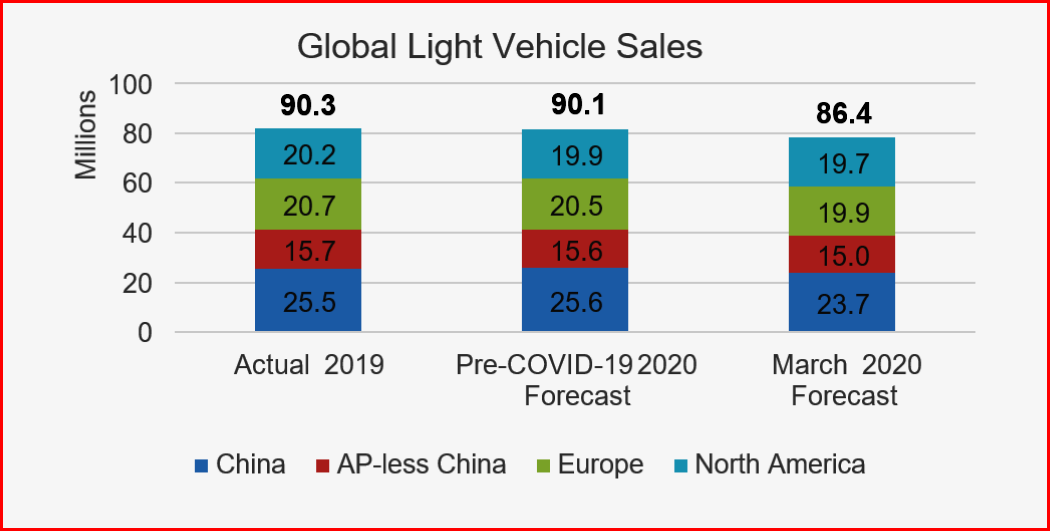

The COVID-19 outbreak is causing unprecedented distress across multiple markets. Given the increasing threat and expected disruptions, global Light Vehicle sales are now expected to contract by 4.4% from 90.3 million units in 2019 to 86.4 million units in 2020, the lowest level since 2013. A moderate pandemic could worsen the outlook by another 2-3 million units globally for 2020.

The risk could be further magnified by supply chain disruptions that have yet to fully emerge. At a minimum, there will be higher logistics costs if air freight is used to mitigate manufacturing downtime.

We are still in the early stages of understanding the full impact but expect it to get worse before it gets better. We continue to monitor the situation in real-time as further downward risk remains high,” said Jonathon Poskitt, Director Global Sales Forecasts at LMC.

Revisions of Key Markets

- China Light Vehicle sales have already been heavily impacted, and it remains the most affected market, making up half of the global volume reduction. Our latest assumption for 2020 is for a decline of 7% from 2019, to 23.7 million units. China does appear to be working past the worst of the outbreak, as the country begins to restart operations and return to normal, a process that is expected to take a few months at a minimum. This process also carries some risk of restarting outbreaks.

- Other important markets in the Asia-Pacific region have seen forecasts reduced, including South Korea, given the scale of outbreak and quarantine measures. Sales in Asia-Pacific, less China, have been cut by nearly 600,000 units, to 15.0 million units, and are projected to contract 4% for 2020.

- Western Europe is expected to experience growing disruption from the outbreak, with Italy placed in lockdown and containment efforts likely to expand elsewhere, potentially spreading to Eastern Europe. Volume in Pan-Europe has been cut by 600,000 units to 20.5 million units, a decline of 4% from 2019.

- Iran had already been facing significant economic challenges, but the outlook has been clouded further by the outbreak. We have reduced vehicle sales by an additional 200,000 units to 686,000 units.

- Risk in the US makes up most of the pullback in expectations across North America. We have cut the US forecast by nearly 300,000 units to 16.5 million units, a decline of 3% from 2019, making three of the last four years negative.

LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

COVID-19 Chaos as LMC Automotive Cuts Global Light Vehicle Sales Forecast by 3.7 Million Units

The COVID-19 outbreak is causing unprecedented distress across multiple markets.

“Whether you believe there is a public overreaction or that COVID-19 is actually a public health crisis headed for pandemic status, there is no denying the expected negative impact it will have on the economy and auto industry, said Jeff Schuster, President, Global Vehicle Forecasts at LMC. “Volatility will remain with us until there is evidence of containment globally and the lasting effect could spill into 2021. The US outbreak remains at an early stage of development, so additional challenges for the industry, including supply chain issues, could push the market further into negative territory.”

Executive Summary: The rapid international spread of coronavirus COVID-19 outside China is adding another layer of stress to the global automotive market, following the outlook already turning negative as the virus crippled vehicle demand in China in February.

The economic outlook is wavering, with the risk of a global recession somewhat higher than a matter of weeks ago. Global economic growth in 2020 is now expected to be at 2.0%, down from the early 2020 forecast of 2.5%.

The COVID-19 outbreak is causing unprecedented distress across multiple markets. Given the increasing threat and expected disruptions, global Light Vehicle sales are now expected to contract by 4.4% from 90.3 million units in 2019 to 86.4 million units in 2020, the lowest level since 2013. A moderate pandemic could worsen the outlook by another 2-3 million units globally for 2020.

The risk could be further magnified by supply chain disruptions that have yet to fully emerge. At a minimum, there will be higher logistics costs if air freight is used to mitigate manufacturing downtime.

We are still in the early stages of understanding the full impact but expect it to get worse before it gets better. We continue to monitor the situation in real-time as further downward risk remains high,” said Jonathon Poskitt, Director Global Sales Forecasts at LMC.

Revisions of Key Markets

LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.