The COVID-19 pandemic, LMC Automotive says will result in a decline in global Light Vehicle sales in 2020 nearly double that of the fall during the Great Recession (between years 2007 and 2009). All markets globally are now struggling from the COVID-19 impact. Worse, there remains significant risk as the situation is extremely dynamic. Further downward revisions in many markets are probable.

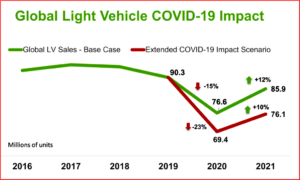

LMC currently is forecasting 2020 global Light Vehicle sales to fall below 77 million units, a decline of nearly 14 million units or -15% from the 2019 level. For comparison, global Light Vehicle sales fell 6 million units from 2007-2009 to 64 million units, a two-year decline of 8.7%, or 4.5% CAGR (compounded annualized growth rate).

GDP growth prospects have turned negative in most countries, resulting in zero global GDP growth for 2020, down significantly from the LMC January forecast of 2.5% growth for the year.

Central to economic shock has been the vast lock-down of normal consumer and business activity in most major markets around the world.

- Many OEMs have shut down assembly across Europe, North America and parts of Asia as population controls have been applied in order to slow the spread of the virus.

- Unemployment is expected to rise considerably across the world, hitting larger purchases such as vehicles beyond the near-term, even as business starts to return to normal activity.

LMC is also modeling a scenario in which COVID-19 impact continues well into H2 2020 or relapses in late Q3 and Q4. “If that were to take place, we would expect global Light Vehicle sales to decline more than 20%, with volume falling to 69 million units. Such a scenario would put 2021 and the longer-term recovery pattern at further risk,” says LMC.

Pingback: West European Car Sales Remain Weak at 9.8M Annual Rate | AutoInformed