Click to Enlarge.

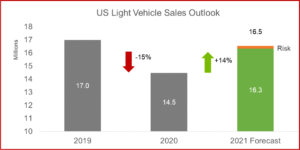

US sales in July volumes were at 1.28 million units, according to LMC Automotive. The is only a 3.5% Year-over-Year increase, resulting from an improved economy and market reopening since last July. The annualized selling rate (SAAR) shows a more pronounced cool-down from previous months. The SAAR fell to 14.5 million units in July from 15.3 million in June – and by more than four million units from the peak back in April. Sales dropped “more substantially in the last week of the month, suggesting that more challenges are ahead,” said LMC. (AutoInformed.com on 2021 Q2 US Sales – Light-Trucks, Crossovers, SUVs Rule)

Toyota, General Motors and Hyundai were the three bestselling OEMs, while Ford had the weakest performance compared to last July. Ford remains mired in semi-conductor shortages and long-standing troubled relationships with suppliers. Hyundai re-introduced the Compact Pickup segment in July when the first units of the Santa Cruz were delivered. This segment of course was once dominated by GM and Ford before Toyota and Nissan moved in. Now come the Koreans to fill an obvious need.

Hyundai Group had a “stellar month, outperforming Stellantis, Honda and Ford with the third highest sales for the month. Midsize Non-Premium SUVs gained the most share from a year ago and led the market in July, accounting for 16.8% of total sales. A stronghold of the Detroit 3, Large Pickup has struggled with low inventories. Sales fell by 2% from June and by 12% from a year ago,” said LMC.

All this is occurring amid the resurgence of covid through the deadly, aggressively transmissible Delta variant. This and the possibility that more monstrous mutations could appear, makes forecasts doubtful from the moment they are released.

Nonetheless, automakers “cannot keep up with the overall level of demand, they remain committed to the retail market. Initial estimates indicate that dealers sold 1.13 million vehicles, which means that fleet accounted for just 11.5% of total sales. Transaction prices likely broke the $40,000 threshold for the first time ever, after they were just short of the record by $58 in June. Increased trade-in equity and ultra-low interest rates helped consumers keep monthly payments manageable,” according to LMC. So here another demon lurks – affordability.

The global outlook is the same. The continued semi-conductor chip shortage and numerous market restrictions due to the COVID-19 Delta variant, has LMC’s global Light Vehicle sales outlook for 2021 at 86.1 million units, an increase of 11% from 2020, but down one million form the last forecast. “Further risk of a slower recovery remains in H2,” says LMC.

Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive said: “As has been the case since March, depleted inventory remains the major roadblock to stronger demand, while the rising cases from the Delta variant does pose some additional short-term risk in the coming weeks. We continue to believe that much of the demand not being met in 2021 will be pushed into 2022, but there is also risk that some consumers may forgo a new vehicle purchase unless they absolutely need to, since transaction prices remain high, and incentives are very low. However, as the opening up continues, the need for transportation will increase and, as inventory is replenished, the recovery in demand will restart.”

One hopes…

A 15.6 million unit selling rate is forecast in August, an increase from July but still modest.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Vehicle Sales Drop in July for Third Month Running

Click to Enlarge.

US sales in July volumes were at 1.28 million units, according to LMC Automotive. The is only a 3.5% Year-over-Year increase, resulting from an improved economy and market reopening since last July. The annualized selling rate (SAAR) shows a more pronounced cool-down from previous months. The SAAR fell to 14.5 million units in July from 15.3 million in June – and by more than four million units from the peak back in April. Sales dropped “more substantially in the last week of the month, suggesting that more challenges are ahead,” said LMC. (AutoInformed.com on 2021 Q2 US Sales – Light-Trucks, Crossovers, SUVs Rule)

Toyota, General Motors and Hyundai were the three bestselling OEMs, while Ford had the weakest performance compared to last July. Ford remains mired in semi-conductor shortages and long-standing troubled relationships with suppliers. Hyundai re-introduced the Compact Pickup segment in July when the first units of the Santa Cruz were delivered. This segment of course was once dominated by GM and Ford before Toyota and Nissan moved in. Now come the Koreans to fill an obvious need.

Hyundai Group had a “stellar month, outperforming Stellantis, Honda and Ford with the third highest sales for the month. Midsize Non-Premium SUVs gained the most share from a year ago and led the market in July, accounting for 16.8% of total sales. A stronghold of the Detroit 3, Large Pickup has struggled with low inventories. Sales fell by 2% from June and by 12% from a year ago,” said LMC.

All this is occurring amid the resurgence of covid through the deadly, aggressively transmissible Delta variant. This and the possibility that more monstrous mutations could appear, makes forecasts doubtful from the moment they are released.

Nonetheless, automakers “cannot keep up with the overall level of demand, they remain committed to the retail market. Initial estimates indicate that dealers sold 1.13 million vehicles, which means that fleet accounted for just 11.5% of total sales. Transaction prices likely broke the $40,000 threshold for the first time ever, after they were just short of the record by $58 in June. Increased trade-in equity and ultra-low interest rates helped consumers keep monthly payments manageable,” according to LMC. So here another demon lurks – affordability.

The global outlook is the same. The continued semi-conductor chip shortage and numerous market restrictions due to the COVID-19 Delta variant, has LMC’s global Light Vehicle sales outlook for 2021 at 86.1 million units, an increase of 11% from 2020, but down one million form the last forecast. “Further risk of a slower recovery remains in H2,” says LMC.

Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive said: “As has been the case since March, depleted inventory remains the major roadblock to stronger demand, while the rising cases from the Delta variant does pose some additional short-term risk in the coming weeks. We continue to believe that much of the demand not being met in 2021 will be pushed into 2022, but there is also risk that some consumers may forgo a new vehicle purchase unless they absolutely need to, since transaction prices remain high, and incentives are very low. However, as the opening up continues, the need for transportation will increase and, as inventory is replenished, the recovery in demand will restart.”

One hopes…

A 15.6 million unit selling rate is forecast in August, an increase from July but still modest.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.