Jeep has been posting electrifying profits – before upcoming EVs.

Stellantis (NYSE: STLA) today posted strong growth while setting new records in net revenues, operating income and net profit for the first half of 2023 while continuing its transformation to electrified and software-defined vehicles for its 14 brands. Stellantis currently has 25 BEVs available today and another 23 launching through 2024.*

“It takes a united effort and open mindset across all our employees to embark on our no-compromise transformation journey while protecting the Company from external challenges. I want to express my gratitude to each, and every employee and I am proud to say that the teams are delivering across multiple dimensions. We are well-positioned for the remainder of 2023 and beyond,” said Carlos Tavares, CEO.

Click for more.

“There are healthy profits and then there are obscene profits. These record profits are obscene, and they come off the backs of underpaid workers and broken communities. Our workers got raises of just 6% over the last four years even as CEO Tavares saw his compensation soar 72%. As Stellantis made its mega-profits, it kept our assembly plant in Belvidere, Illinois sitting idle. Workers who’ve given their lives to the company have no idea what the future holds,” said UAW president Shawn Fain.

“Stellantis said today that they’re pouring a staggering $1.7 billion (1.5 billion euros) into a stock buyback scheme that artificially inflates the value of shares, further enriching company executives and the top 1%. That is $1.7 billion being robbed from the workers who made those profits possible and the latest in a long line of examples of how corporate greed is plundering our communities. It’s time for Stellantis to pony up and make things right for working families,” said Fain.

Stellantis H1 2023 Summary

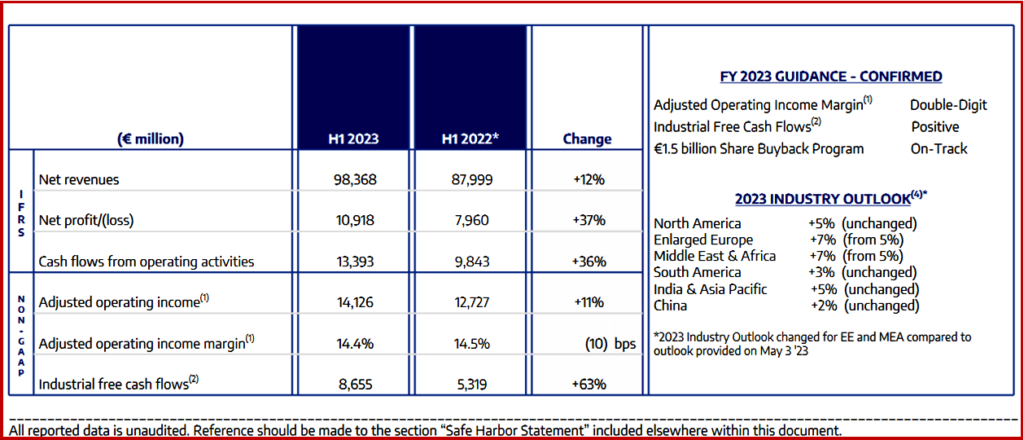

- Net revenues of €98.4 billion, up 12% compared to H1 2022 primarily due to higher shipments.

- Adjusted operating income(1) of €14.1 billion, up 11% compared to H1 2022(#), with strong 14.4% margin.

- Net profit of €10.9 billion, up 37% compared to H1 2022.

- Industrial free cash flows(2) of €8.7 billion, up €3.3 billion compared to H1 2022.

- Record results enable continued strategic investments to drive a sustainable road to Carbon Net Zero transformation.

- Global BEV and LEV sales went up 24% y-o-y to 169,000 units and up 28% y-o-y to 315,000, respectively.

- Stellantis ranked third in EU30 overall BEV sales; second in the U.S. market for LEV sales(3)

- Stellantis repurchased €0.7 billion in shares in the first half of 2023, and expects to complete the announced €1.5 billion share buyback program before the end of 2023. As of June 30, 2023, Stellantis executed €0.7 billion of the €1.5 billion share buyback program, repurchasing approximately 45 million shares. More than €6 billion has been returned to shareholders and employees related to fiscal year 2022 in dividends and bonuses.

- Stellantis announced a new, streamlined structure for financing and leasing services in Europe, simplifying its multi-brand capacity with the new Stellantis Financial Services and Leasys organizations. The Company also boosted its activity in the U.S. with receivables at approximately €4 billion (~$4 billion) as of June 30, 2023, and a €9 billion (~$10 billion) target by end of 2024.

(#) Share of the profit of equity method investees is included in Stellantis Operating income and Adjusted operating income(1) effective January 1, 2023. Comparatives for H1 2022 have been adjusted accordingly.

AutoInformed on

*Stellantis

Stellantis is one of the world’s leading automakers and a mobility provider. Its brands include Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2Move and Leasys. Stellantis N.V. posted record full year 2022 results with €16.8 billion Net profit and €23.3 billion Adjusted Operating Income (AOI). Stellantis was formed by a merger of FCA and PSA in January of 2021.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis Posts Record Revenue and Profits for 2023 Half 1

Jeep has been posting electrifying profits – before upcoming EVs.

Stellantis (NYSE: STLA) today posted strong growth while setting new records in net revenues, operating income and net profit for the first half of 2023 while continuing its transformation to electrified and software-defined vehicles for its 14 brands. Stellantis currently has 25 BEVs available today and another 23 launching through 2024.*

“It takes a united effort and open mindset across all our employees to embark on our no-compromise transformation journey while protecting the Company from external challenges. I want to express my gratitude to each, and every employee and I am proud to say that the teams are delivering across multiple dimensions. We are well-positioned for the remainder of 2023 and beyond,” said Carlos Tavares, CEO.

Click for more.

“There are healthy profits and then there are obscene profits. These record profits are obscene, and they come off the backs of underpaid workers and broken communities. Our workers got raises of just 6% over the last four years even as CEO Tavares saw his compensation soar 72%. As Stellantis made its mega-profits, it kept our assembly plant in Belvidere, Illinois sitting idle. Workers who’ve given their lives to the company have no idea what the future holds,” said UAW president Shawn Fain.

“Stellantis said today that they’re pouring a staggering $1.7 billion (1.5 billion euros) into a stock buyback scheme that artificially inflates the value of shares, further enriching company executives and the top 1%. That is $1.7 billion being robbed from the workers who made those profits possible and the latest in a long line of examples of how corporate greed is plundering our communities. It’s time for Stellantis to pony up and make things right for working families,” said Fain.

Stellantis H1 2023 Summary

(#) Share of the profit of equity method investees is included in Stellantis Operating income and Adjusted operating income(1) effective January 1, 2023. Comparatives for H1 2022 have been adjusted accordingly.

AutoInformed on

*Stellantis

Stellantis is one of the world’s leading automakers and a mobility provider. Its brands include Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2Move and Leasys. Stellantis N.V. posted record full year 2022 results with €16.8 billion Net profit and €23.3 billion Adjusted Operating Income (AOI). Stellantis was formed by a merger of FCA and PSA in January of 2021.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.