Click for more.

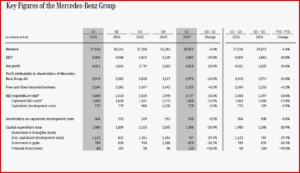

Mercedes-Benz Group AG (MBG.DE) has reported Group Earnings Before Interest and Taxes (EBIT) of €3.9 billion (Q1 2023: €5.5 billion) a surprising drop of -25% but in line with struggles at European-based Volkswagen Group and Stellantis. MBG claimed that lower raw material prices, tight cost control and a strong performance at Mercedes-Benz Vans were partially offset by lower sales at Mercedes-Benz Cars where supplier bottlenecks and model changeovers in the Top-End segment also led to a less favorable model mix. Group revenue came in at €35.9 billion (Q1 2023: €37.5 billion). (Read AutoInformed on: Stellantis Q1 Revenues, Shipments Drop – Transition or Trend?; Badass UAW Bargaining Committee Gets Record Daimler Deal)

“Mercedes-Benz delivered a solid Free Cash Flow in the first quarter thanks to our disciplined go-to-market approach, our desirable products and despite the volatile economic environment and external challenges. While we remain vigilant about the global macroeconomic and geopolitical outlook, we confirm our full-year financial targets for 2024,” said Harald Wilhelm, Chief Financial Officer of Mercedes-Benz Group.

Mercedes Talking Points excerpted

- Earnings Before Interest and Taxes at Mercedes-Benz Cars reached €2.5 billion (Q1 2023: €4.1 billion) and resulted in an adjusted Return on Sales of 9.0% (Q1 2023: 14.8%) mainly due to a temporary decline in volumes and model transitions in the Top-End segment as well as higher lifecycle management costs to keep products fresh. Top-End vehicles were constrained by model changeovers of the G-Class as well as the Mercedes-AMG derivatives of the E-Class and GLC, as well as supply-chain bottlenecks. Mercedes-Benz Cars sales reached 463,000 units (-8%) in the first quarter, with good results in all regions except Asia.

- Overall, pricing remained at a high level in Q1. Sales are expected to increase in the coming quarters with the Top-End vehicle mix expected to improve in the second half of the year. The EV adoption rate has slowed across the industry. In the transition from ICE to BEV vehicles, Mercedes-Benz plug-in hybrids are expected to play an important role. In Q1 Mercedes-Benz initiated BEAT26, an efficiency program to lower material costs in procurement, in collaboration with its suppliers.

- Mercedes-Benz Vans had healthy net pricing supported by strong products leading to very good financial results. The adjusted Return on Sales for Mercedes-Benz Vans rose to 16.3% (Q1 2023: 15.6%) from increased global sales (+7%) driven by positive product structure, especially from commercial Vans (+11%). Regionally, the important markets China (+27%) and the United States (+15%) contributed to the strong Q1 sales. Revenue increased by 6% to €4.9 billion (Q1 2023: €4.6 billion) in the first quarter and the Earnings Before Interest and Taxes increased by 22% to €933 million (Q1 2023: €762 million). BEV sales declined but are expected to rise with the full availability of the newly launched facelifts of the EQV, eVito and the new eSprinter.

- Compared Q1 2023, Mercedes-Benz Mobility almost doubled its new business volume for BEVs to €2.0 billion (Q1 2023: €1.2 billion). Overall, at the end of March 2024, the contract volume amounted to €134.7 billion at the same level as year-end 2023 (FY 2023: €135.0 billion). At €14.8 billion, the new business of Mercedes-Benz Mobility is also at prior-year level (Q1 2023: €14.7 billion). The adjusted EBIT decreased to €279 million mainly due to a lower interest margin and higher cost of credit risk (Q1 2023: €539 million). As a result, the adjusted return on equity (RoE) decreased to 8.5% (Q1 2023: 15.6%).

- The Mercedes-Benz Group confirms its group guidance. Group revenue in 2024 is expected to remain at the prior-year level, with Cars, Vans and Mobility seen unchanged. Group EBIT is expected to be slightly below the 2023 level, resulting out of divisional guidance. Group Free Cash Flow from the Industrial Business is seen slightly below the very strong levels from 2023, due to lower EBIT at Cars and Vans and lower CCR at Vans.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Mercedes-Benz Q1 2024 Profit Drops 25% as Sales Slump

Click for more.

Mercedes-Benz Group AG (MBG.DE) has reported Group Earnings Before Interest and Taxes (EBIT) of €3.9 billion (Q1 2023: €5.5 billion) a surprising drop of -25% but in line with struggles at European-based Volkswagen Group and Stellantis. MBG claimed that lower raw material prices, tight cost control and a strong performance at Mercedes-Benz Vans were partially offset by lower sales at Mercedes-Benz Cars where supplier bottlenecks and model changeovers in the Top-End segment also led to a less favorable model mix. Group revenue came in at €35.9 billion (Q1 2023: €37.5 billion). (Read AutoInformed on: Stellantis Q1 Revenues, Shipments Drop – Transition or Trend?; Badass UAW Bargaining Committee Gets Record Daimler Deal)

“Mercedes-Benz delivered a solid Free Cash Flow in the first quarter thanks to our disciplined go-to-market approach, our desirable products and despite the volatile economic environment and external challenges. While we remain vigilant about the global macroeconomic and geopolitical outlook, we confirm our full-year financial targets for 2024,” said Harald Wilhelm, Chief Financial Officer of Mercedes-Benz Group.

Mercedes Talking Points excerpted

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.