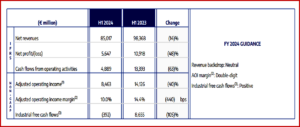

Stellantis (NYSE: STLA) posted today results for the first half of 2024 of €85.0 billion of Net revenues (-14% y-o-y) with €5.6 billion in Net profit, (-48% y-o-y ~$6.1 b). Operating income (see footnotes below*) of €8.5 billion represented a 10% AOI margin as Adjusted diluted EPS (5) decreased 35% y-o-y. Lower financial performance in the first half of 2024 came from lower volumes and mix, with the challenging volume comparisons due to a combination of inventory reduction initiatives, temporary product production gaps due to a generational portfolio transition, and lower market share particularly in North America. (read AutoInformed on: Stellantis Q1 Revenues, Shipments Drop – Transition or Trend?)

“The Company’s performance in the first half of 2024 fell short of our expectations, reflecting both a challenging industry context as well as our own operational issues,” said Carlos Tavares, CEO. “We have significant work to do, especially in North America, to maximize our long-term potential.” Seven or more senior executives have left Stellantis so far this year.

The release claimed that “while corrective actions were needed and are being taken to address these issues, we also have initiated an exciting product blitz, with no fewer than 20 new vehicles launching this year, and with that brings bigger opportunities when we execute well. Stellantis reiterated its financial guidance of double-digit AOI margin(2) in 2024, as well as positive Industrial free cash flow(3), despite macroeconomic uncertainties.

Stellatnis plans ~ 20 new product launches in 2024, including 10 that have started production a in the first half of the year:

- Peugeot 3008 and 5008 – Based on the BEV-native multi-energy STLA Medium platform with a range of up to 680Km, these models feature the brand new Panoramic i-Cockpit. ChatGPT will become standard across the entire Peugeot lineup, following DS brand’s lead earlier this year. In June, nearly 30% of 3008 orders were for the battery electric version. Peugeot also localized production of the 2008 in South America.

- New Lancia Ypsilon – Lancia introduced the first car of its new era in the premium hatchback B-segment, the New Lancia Ypsilon. The brand has a 10-year strategic plan to propel it forward with innovative and timeless Italian elegance.

- Maserati Grecale Folgore – Maserati launched the Grecale Folgore, the Trident’s first-ever SUV powered by a full-electric powertrain with 820 Nm of torque and a top speed of 220 Km/h.

- Ram 1500 – Ram launched the new 1500 on the heels of a positive accolade as the No. 1 industry brand in J.D. Power Initial Quality Study — the only truck-exclusive brand ever to do so. The Ram 1500 features the new Hurricane Twin-turbo family, the most powerful 6-cylinder engine in the segment with up to 540 horsepower and 469 lb-ft of torque.

- Citroën Basalt – The Citroën Basalt, a new SUV coupé, is launching in India and South America. Orders for the new Citroën C3 are strong with 72% of customers opting for the all-new ë-C3, a competitively priced B-segment EV produced in Europe.

- Stellantis Pro One Vans – The renewed Pro One van lineup from Citroën, FIAT Professional, Opel, Peugeot and Vauxhall is on the road with 12 models across all segments. Stellantis Pro One is No. 1 in Enlarged Europe, South America and Middle East & Africa in the first half.

*Inevitable Stellantis footnotes

(1) Adjusted operating income/(loss) excludes from Net profit/(loss) adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit). Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.

(2) Adjusted operating income/(loss) margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

(3) Industrial free cash flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities; (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the substantive timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control.

(4) Combined shipments include shipments by the Company’s consolidated subsidiaries and unconsolidated joint ventures, whereas Consolidated shipments only include shipments by Company’s consolidated subsidiaries. Figures by segments may not add up due to rounding. China shipments from DPCA are no longer included in Combined shipments as of November 2023; prior periods have not been restated.

(5) Adjusted diluted earnings per share (“EPS”) is calculated by adjusting Diluted earnings per share from operations for the post-tax impact per share of the same items excluded from Adjusted operating income as well as tax expense/(benefit) items that are considered rare or infrequent, or whose nature would distort the presentation of the ongoing tax charge of the Company. We believe this non-GAAP measure is useful because it also excludes items that we do not believe are indicative of the Company’s ongoing operating performance and provides investors with a more meaningful comparison of the Company’s ongoing quality of earnings. Adjusted diluted EPS should not be considered as a substitute for Basic earnings per share, Diluted earnings per share from operations or other methods of analyzing our quality of earnings as reported under IFRS.

(6) Industrial net financial position is calculated as Debt plus derivative financial liabilities related to industrial activities less (i) cash and cash equivalents, (ii) financial securities that are considered liquid, (iii) current financial receivables from the Company or its jointly controlled financial services entities and (iv) derivative financial assets and collateral deposits. Therefore, debt, cash and cash equivalents and other financial assets/ liabilities pertaining to Stellantis’ financial services entities are excluded from the computation of the Industrial net financial position. Industrial net financial position includes the Industrial net financial position classified as held for sale.

Rankings, market share and other industry information are derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés(ANTS), Associação Nacional dos Fabricantes de Veículos Automotores (ANFAVEA), Ministry of Infrastructure and Sustainable Mobility (MIMS), S&P Global, Ward’s Automotive) and internal information unless otherwise stated.For purposes of this document, and unless otherwise stated industry and market share information are for passenger cars (PC) plus light commercial vehicles (LCV), except as noted below:

- Enlarged Europe excludes Russia and Belarus; H1 2023 figures have been restated;

- Middle East & Africa exclude Iran, Sudan and Syria;

- South America excludes Cuba;

- India & Asia Pacific reflects aggregate for major markets where Stellantis competes (Japan (PC), India (PC), South Korea (PC + Pickups),Australia, New Zealand and South East Asia);

- China represents PC only and includes licensed sales from DPCA;

- Maserati reflects aggregate for 17 major markets where Maserati competes and is derived from S&P Global data, Maserati competitive segment and internal information. Prior period figures have been updated to reflect current information provided by third-party industry sources.

EU30 = EU 27 (excluding Malta), Iceland, Norway, Switzerland and UK.

Low emission vehicles (LEV) = battery electric (BEV), plug-in hybrid (PHEV), range-extender electric vehicle (REEV) and fuel cell electric (FCEV) vehicles.

All Stellantis reported BEV and LEV sales include Citroën Ami, Opel Rocks-e and Fiat Topolino; in countries where these

Pingback: Beleaguered Stellantis Cuts 2024 Financial Guidance | AutoInformed