Click to enlarge.

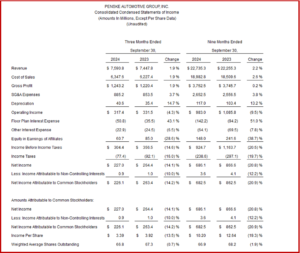

Penske Automotive Group, Inc. (NYSE: PAG), yesterday announced quarterly results for Q3 of 2024. Q3 revenue increased 2% from the third quarter of 2023 to $7.6 billion. Net income attributable to common stockholders was $226.1 million compared to $263.4 million in the prior year period, and related earnings per share was $3.39 compared to $3.92 for the same period in 2023. Foreign currency exchange positively impacted revenue by $69.0 million, net income attributable to common stockholders by $1.7 million, and earnings per share by $0.03. (read AutoInformed on Penske Automotive Group Posts Lukewarm Q2 Results)

“I am pleased with our financial performance during the third quarter, despite the impact from the stop sale of certain vehicles and the residual impact from the CDK Cyber Security incident. New and used retail automotive gross profit per unit remained strong, retail automotive service and parts performed at record levels, the retail commercial truck business performed well, selling, general, and administrative expenses remained well controlled, and the equity income from Penske Transportation Solutions increased 14% sequentially despite continued freight challenges,” said Chair and CEO Roger Penske.

For the nine months ended 30 September 2024, revenue increased 2% to $22.7 billion. Net income attributable to common stockholders was $682.5 million compared to $862.5 million in the prior year period, and related earnings per share was $10.20 compared to $12.64 for the same period in 2023. Foreign currency exchange positively impacted revenue by $166.2 million, net income attributable to common stockholders by $2.7 million, and earnings per share by $0.04.

Q3 2024 Results

During the third quarter, retail automotive service and parts revenue increased 14% to a record $778.0 million. New and used automotive gross profit per unit retailed remained strong, and variable gross profit per unit retailed increased sequentially when compared to the second quarter of 2024 by $8. In addition, when compared to the same sequential period, equity earnings from the Company’s investment in Penske Transportation Solutions increased 14%.

Retail Automotive Dealerships

- For the three months ended 30 September 2024, total new units delivered increased 5% and used units delivered decreased 13%.

- During 2024, the Company transitioned its U.K. based CarShop locations to Sytner Select dealerships. These dealerships sell fewer units which contributed to the 13% decline in used vehicles retailed during the third quarter.

- Excluding these U.K. used only vehicle dealerships, used vehicles retailed would have increased 1%.

- Same-store retail units declined 7% but decreased 3% when excluding the U.K. used only vehicle dealerships.

- Total retail automotive revenue remained flat at $6.3 billion but declined 5% on a same-store basis.

- Service and parts revenue increased 14% to $778.0 million and increased 7% on a same-store basis.

- Total retail automotive gross profit increased 2% to $1.0 billion.

Retail Commercial Truck Dealerships

- As of 30 September 2024, Premier Truck Group operated 46 North American retail commercial truck locations.

- For the three months ended September 30, 2024, retail unit sales increased 14% to 6,331.

- Revenue was $1.1 billion compared to $964.7 million in the same period last year. Earnings before taxes was $56.5 million compared to $61.1 million in the same period in 2023.

- For the nine months ended September 30, 2024, revenue was $2.7 billion compared to $2.8 billion in the same period last year.

- Earnings before taxes was $158.7 million compared to $173.7 million in the same period in 2023.

Penske Transportation Solutions Investment

- Penske Transportation Solutions (PTS) is a leading provider of full-service truck leasing, truck rental, contract maintenance, and logistics services. PTS operates a managed fleet with over 442,000 trucks, tractors, and trailers under lease, rental and/or maintenance contracts. Penske Automotive Group has a 28.9% ownership interest in PTS and accounts for its ownership interest using the equity method of accounting.

- For the three and nine months ended 30 September 2024, the Company recorded $60.3 million and $145.7 million in earnings compared to $84.1 million and $238.3 million for the same periods in 2023. Equity earnings increased by 14% sequentially as full-service leasing and logistics continued to perform well.

Corporate Development, Capital Allocation, Liquidity, and Leverage

- During the nine months ended September 30, 2024, the Company repurchased 0.4 million shares of common stock for ~$58.1 million under its securities repurchase program, and also acquired 0.1 million shares of common stock for $18.4 million from employees in connection with a net share settlement feature of employee equity awards.

- As of 30 September 2024, $157.4 million remained available under the Company’s existing repurchase authority.

- The Board of Directors approved a quarterly dividend of $1.19 per share representing an 11%, or $0.12 per share, increase and represents the fourth increase to the Company’s dividend in 2024 and the 16th consecutive quarterly increase. The dividend is payable on December 3, 2024, to shareholders of record on 15 November 15, 2024.

- Including this dividend distribution and the Company’s securities repurchases, the Company will have returned ~$350 million to shareholders in 2024.

- In July 2024, PAG announced the acquisition of Bill Brown Ford, representing $550 million in estimated annualized revenue. Year-to-date 2024, Penske Automotive Group has completed acquisitions representing nearly $2 billion in estimated annualized revenue.

- In October 2024, PAG signed an agreement to acquire a third Porsche dealership in Melbourne, Australia. This dealership will be acquired from Porsche Retail Group Australia Pty Ltd. and will complement the two Porsche dealerships the Company acquired in Melbourne during the second quarter of 2024. The acquisition is expected to add $130 million in estimated annualized revenue, bringing the estimated annualized revenue for the three Porsche Dealerships in Melbourne to $260 million. The acquisition is subject to customary conditions and is expected to close by the end of this year.

- As of September 30, 2024, the Company had approximately $1.7 billion in liquidity, including $92 million in cash and $1.6 billion of availability under its U.S. and international credit agreements. The Company’s leverage ratio at September 30, 2024 was 1.3x.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Penske Automotive Group Q3 2024 Net Income Drops

Click to enlarge.

Penske Automotive Group, Inc. (NYSE: PAG), yesterday announced quarterly results for Q3 of 2024. Q3 revenue increased 2% from the third quarter of 2023 to $7.6 billion. Net income attributable to common stockholders was $226.1 million compared to $263.4 million in the prior year period, and related earnings per share was $3.39 compared to $3.92 for the same period in 2023. Foreign currency exchange positively impacted revenue by $69.0 million, net income attributable to common stockholders by $1.7 million, and earnings per share by $0.03. (read AutoInformed on Penske Automotive Group Posts Lukewarm Q2 Results)

“I am pleased with our financial performance during the third quarter, despite the impact from the stop sale of certain vehicles and the residual impact from the CDK Cyber Security incident. New and used retail automotive gross profit per unit remained strong, retail automotive service and parts performed at record levels, the retail commercial truck business performed well, selling, general, and administrative expenses remained well controlled, and the equity income from Penske Transportation Solutions increased 14% sequentially despite continued freight challenges,” said Chair and CEO Roger Penske.

For the nine months ended 30 September 2024, revenue increased 2% to $22.7 billion. Net income attributable to common stockholders was $682.5 million compared to $862.5 million in the prior year period, and related earnings per share was $10.20 compared to $12.64 for the same period in 2023. Foreign currency exchange positively impacted revenue by $166.2 million, net income attributable to common stockholders by $2.7 million, and earnings per share by $0.04.

Q3 2024 Results

During the third quarter, retail automotive service and parts revenue increased 14% to a record $778.0 million. New and used automotive gross profit per unit retailed remained strong, and variable gross profit per unit retailed increased sequentially when compared to the second quarter of 2024 by $8. In addition, when compared to the same sequential period, equity earnings from the Company’s investment in Penske Transportation Solutions increased 14%.

Retail Automotive Dealerships

Retail Commercial Truck Dealerships

Penske Transportation Solutions Investment

Corporate Development, Capital Allocation, Liquidity, and Leverage

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.