Click to enlarge.

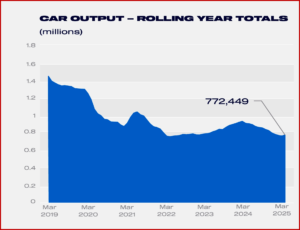

Car manufacturing in March grew for the first time in 12 months, driven by strong export demand that increased by 30.6%, with almost three quarters (73.3%) of output shipped overseas. However, production for the UK market fell by -6.1%. Electrified vehicle production also rose, by 38.5% – more than twice the rate of total production – to 31,661 units, to account for almost half of all UK car output (45.0%), said the Society of Motor Manufacturers and Traders (SMMT)* today. (read AutoInformed.com on: Hybrid-Electric Cars Dominate EU Car Sales, Trump Tariffs – His Next Economic Catastrophe)

“A March uplift to manufacturing is overdue good news, although the performance was boosted by a comparatively weaker month last year, when holiday timings and product changeovers combined to reduce output. With the last quarter showing demand for British-built cars rising overseas, navigating the new era of trade uncertainty is now the major challenge. Government has rightly recognized automotive manufacturing’s critical role in Britain’s export economy and must now show urgency and creativity to deliver a deal that supports our competitiveness, spurs domestic demand for the latest cleanest vehicles, and helps factory lines flourish,” said Mike Hawes, SMMT Chief Executive.

“The recent proposed revisions to the ZEV Mandate have been welcomed by manufacturers, evidence that government recognizes some of the challenges facing the industry, not least the absence of robust consumer demand for EVs which is undermining competitiveness. In addition, given the UK is a significant producer of zero emission commercial vehicles, particularly for the domestic market, extensions to the grants for plug-in vans and trucks are critical if this vital market is going to grow in accordance with mandate ambitions,” said SMMT.

The EU continued to be the largest destination for UK car exports, accounting for 57.2% of all shipments. Ahead of the introduction of new tariffs, the US remained the second largest export market, comprising 15.0% of exports, followed by China (8.5%), Türkiye (2.7%) and Japan (2.6%). Exports to all top five markets rose for the month, with the EU up by 28.9%, the US 36.1%, China 86.0%, Türkiye 272.1% and Japan 91.8%.

CV production also rose, up by 8.2% to 8700 units, in comparison with a weak March 2024 when volumes were constrained by both Easter timing, and a softening of output following 2023’s post-Covid pent-up demand. As in previous months, CV growth was driven by domestic demand, which rose by 77.9% to 5218 units. Conversely, exports fell by -31.8% to comprise just 40.0% of output. The EU remains the sector’s largest market by far, accounting for 94.2% of exports in the month.

As a result, overall UK car production for Q1 2025 was down slightly, by -3.2%, but with exports up 4.4%, while CV output was down a more significant -27.1%, and exports down by -50.3%.

“Given the figures reflect the level of demand ahead of the announcements of new US tariffs, manufacturers face considerable uncertainty heading into Q2 as US demand likely weakens with knock on effects on other markets and the supply chains. Trade discussions must continue at pace to reach a deal that supports jobs, demand and growth on both sides of the Atlantic,” said SMMT.

“Increased protectionism and retaliatory tariffs being levied in key markets mean a rapid response from government is needed, given the immediate challenges facing the industry’s exports. It is also essential the UK does all it can to assure its longer term production competitiveness. Industry looks ahead to the comprehensive industrial strategy, due before the summer, which must have automotive and advanced manufacturing at its heart, and set concrete measures that support the growth of Britain’s most valuable goods export industry,” said SMMT.

*SMMT and the UK automotive industry

The Society of Motor Manufacturers and Traders (SMMT) claims it is one of the largest and most influential trade associations, representing the automotive industry in the UK. The automotive industry is a vital part of the UK economy, integral to growth, the delivery of net zero and the UK as a global trade hub. It contributes £93 billion turnover and £22 billion value added to the UK economy, and invests around £4 billion each year in R&D. With 198,000 people employed directly in manufacturing and some 813,000 across the wider automotive industry. Many of these automotive manufacturing jobs are outside London and the South-East, with wages that are around 13% higher than the UK average. The sector accounts for 13.9% of total UK exports of goods with more than 140 countries importing UK produced vehicles, generating £115 billion of trade in total automotive imports and exports.

The UK makes almost every type of vehicle, from cars, to vans, taxis, trucks, buses and coaches, as well as specialist and off-highway vehicles, supported by more than 2500 component providers and “some of the world’s most skilled engineers.” In addition, the sector has vibrant aftermarket and re-manufacturing industries. The automotive industry also supports jobs in other key sectors , including advertising, chemicals, finance, logistics and steel.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

UK Car Production Down. Trump’s Tariffs Threaten Future

Click to enlarge.

Car manufacturing in March grew for the first time in 12 months, driven by strong export demand that increased by 30.6%, with almost three quarters (73.3%) of output shipped overseas. However, production for the UK market fell by -6.1%. Electrified vehicle production also rose, by 38.5% – more than twice the rate of total production – to 31,661 units, to account for almost half of all UK car output (45.0%), said the Society of Motor Manufacturers and Traders (SMMT)* today. (read AutoInformed.com on: Hybrid-Electric Cars Dominate EU Car Sales, Trump Tariffs – His Next Economic Catastrophe)

“A March uplift to manufacturing is overdue good news, although the performance was boosted by a comparatively weaker month last year, when holiday timings and product changeovers combined to reduce output. With the last quarter showing demand for British-built cars rising overseas, navigating the new era of trade uncertainty is now the major challenge. Government has rightly recognized automotive manufacturing’s critical role in Britain’s export economy and must now show urgency and creativity to deliver a deal that supports our competitiveness, spurs domestic demand for the latest cleanest vehicles, and helps factory lines flourish,” said Mike Hawes, SMMT Chief Executive.

“The recent proposed revisions to the ZEV Mandate have been welcomed by manufacturers, evidence that government recognizes some of the challenges facing the industry, not least the absence of robust consumer demand for EVs which is undermining competitiveness. In addition, given the UK is a significant producer of zero emission commercial vehicles, particularly for the domestic market, extensions to the grants for plug-in vans and trucks are critical if this vital market is going to grow in accordance with mandate ambitions,” said SMMT.

The EU continued to be the largest destination for UK car exports, accounting for 57.2% of all shipments. Ahead of the introduction of new tariffs, the US remained the second largest export market, comprising 15.0% of exports, followed by China (8.5%), Türkiye (2.7%) and Japan (2.6%). Exports to all top five markets rose for the month, with the EU up by 28.9%, the US 36.1%, China 86.0%, Türkiye 272.1% and Japan 91.8%.

CV production also rose, up by 8.2% to 8700 units, in comparison with a weak March 2024 when volumes were constrained by both Easter timing, and a softening of output following 2023’s post-Covid pent-up demand. As in previous months, CV growth was driven by domestic demand, which rose by 77.9% to 5218 units. Conversely, exports fell by -31.8% to comprise just 40.0% of output. The EU remains the sector’s largest market by far, accounting for 94.2% of exports in the month.

As a result, overall UK car production for Q1 2025 was down slightly, by -3.2%, but with exports up 4.4%, while CV output was down a more significant -27.1%, and exports down by -50.3%.

“Given the figures reflect the level of demand ahead of the announcements of new US tariffs, manufacturers face considerable uncertainty heading into Q2 as US demand likely weakens with knock on effects on other markets and the supply chains. Trade discussions must continue at pace to reach a deal that supports jobs, demand and growth on both sides of the Atlantic,” said SMMT.

“Increased protectionism and retaliatory tariffs being levied in key markets mean a rapid response from government is needed, given the immediate challenges facing the industry’s exports. It is also essential the UK does all it can to assure its longer term production competitiveness. Industry looks ahead to the comprehensive industrial strategy, due before the summer, which must have automotive and advanced manufacturing at its heart, and set concrete measures that support the growth of Britain’s most valuable goods export industry,” said SMMT.

*SMMT and the UK automotive industry

The Society of Motor Manufacturers and Traders (SMMT) claims it is one of the largest and most influential trade associations, representing the automotive industry in the UK. The automotive industry is a vital part of the UK economy, integral to growth, the delivery of net zero and the UK as a global trade hub. It contributes £93 billion turnover and £22 billion value added to the UK economy, and invests around £4 billion each year in R&D. With 198,000 people employed directly in manufacturing and some 813,000 across the wider automotive industry. Many of these automotive manufacturing jobs are outside London and the South-East, with wages that are around 13% higher than the UK average. The sector accounts for 13.9% of total UK exports of goods with more than 140 countries importing UK produced vehicles, generating £115 billion of trade in total automotive imports and exports.

The UK makes almost every type of vehicle, from cars, to vans, taxis, trucks, buses and coaches, as well as specialist and off-highway vehicles, supported by more than 2500 component providers and “some of the world’s most skilled engineers.” In addition, the sector has vibrant aftermarket and re-manufacturing industries. The automotive industry also supports jobs in other key sectors , including advertising, chemicals, finance, logistics and steel.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.