Supply constraints and demand that have made vehicle prices higher at lower volumes are creating operational inefficiencies and distress in the supply chain, according to new industry-wide analysis from AlixPartners LLP*, the global consulting firm. This imbalance will continue through 2024 as chip availability continues to improve.

The continued trend delivers a “complex backdrop for an industry committing $526 billion through 2026,” AlixPartners’ analysis finds, to fund the shift to battery-electric vehicles (BEVs). The transition, now taking place amid a weakening economic outlook, could cost automakers and suppliers $70 billion if not effectively managed. There are also several implications for dealers and consumers here – not all of them benign.

The latest AlixPartners forecast calls for BEVs to be the majority vehicle type by 2035 in all major regions, surpassing internal-combustion-engine (ICE) vehicles. BEV market growth, however, will be tested by a raw-material cost that is 125% higher than a comparable ICE vehicle; scarcity and price inflation of parts and commodities (including increased use of chips on EVs); and a lack of readiness for the “BEV era” in the supply bases of both automakers and their larger suppliers.

“Automakers and suppliers are benefiting from strong demand despite the economic clouds and are showing resolve in their commitment to shift to electric vehicles, but expectations are high for the industry to hit record economic-profit levels these next two years even while funding for the beginning of the BEV transition is taking place ahead of sufficient volumes for economies-of-scale and cost competitiveness,” said Mark Wakefield, global co-leader of the automotive and industrial practice at AlixPartners and a managing director at the firm. “While many companies are planning their own transition, proactive supply-chain redesign and rigorous cost management needs to be improved to avoid costly surprises down the road.”

“Automakers and suppliers are benefiting from strong demand despite the economic clouds and are showing resolve in their commitment to shift to electric vehicles, but expectations are high for the industry to hit record economic-profit levels these next two years even while funding for the beginning of the BEV transition is taking place ahead of sufficient volumes for economies-of-scale and cost competitiveness,” said Mark Wakefield, global co-leader of the automotive and industrial practice at AlixPartners and a managing director at the firm. “While many companies are planning their own transition, proactive supply-chain redesign and rigorous cost management needs to be improved to avoid costly surprises down the road.”

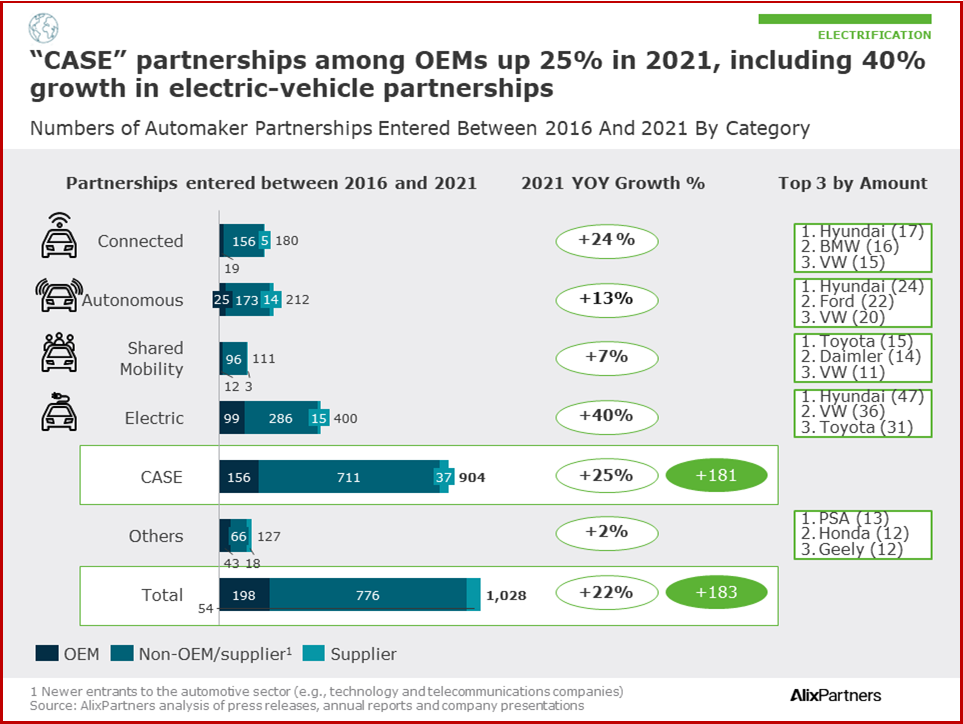

The capital expense of converting an old blacksmithing business to an electric one is leading to partnerships that would have previously been unlikely, if not unthinkable.

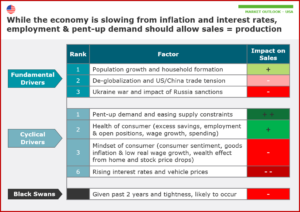

The semiconductor shortage will continue affecting vehicle supply through 2024 while geopolitics and pandemic fallout affect short-term sentiment. Recent new-car pricing power has lifted automaker profits. Pent-up demand will still result in strong sales, but inventory restraints lead to continued operating inefficiencies and resiliency costs.

New-vehicle pricing has been extremely robust, and AlixPartners expects pent-up demand and employment strength to enable automakers to continue to benefit from finding a buyer for each vehicle they can make despite inflation and rising interest rates that are weighing on consumers.

AlixPartners notes – no argument here – that consumers are fickle and reactive, but they still view the car market from a position of scarcity. The question of “Can I get one?” overrides the question of “How much do I have to pay?” and used-vehicle pricing suggests the consumer is a long way from feeling they can shop around for a deal.

AlixPartners notes – no argument here – that consumers are fickle and reactive, but they still view the car market from a position of scarcity. The question of “Can I get one?” overrides the question of “How much do I have to pay?” and used-vehicle pricing suggests the consumer is a long way from feeling they can shop around for a deal.

While this demand-over-supply leverage in the marketplace is driving near-term profitability, it is not sustainable in the long term, says the study. Supply shortages and resulting frequent scheduling changes lead to operational inefficiencies, as measured by sharply rising levels of employees per thousand vehicles produced (31% rise for suppliers compared to Q3 2020; 42% rise for automakers). Inventory is likely to build once demand and supply are even, eroding pricing power. Additional costs to build resiliency into the supply chain adds to pressure that the growing BEV investment demands are placing on the industry. (AutoInformed on: BMW Group Posts Record Revenues, Earnings, Profits for 2021; Suzuki, Subaru, Daihatsu, Toyota and Mazda form JV on Technical Specs for Next-Gen Vehicle Communications Devices)

While supply constraints have been a challenge for consumers, pushing many toward the used-car market, the study finds that automakers have been able to increase profit margins, with a 68% jump in economic profit in 2021 vs. 2018. At the same time, OEMs have driven down net debt by $103 billion, or 11%. Analysts and investors are expecting this tailwind to continue, predicting a near-term doubling of the industry’s economic profit by 2023, to $89.2 billion, notes the study.

The expectations, however, will not be easy to meet, notes AlixPartners. While automakers have seen a profitability windfall recently (increasing EBITDA** 3.2 percentage points in 2021 over 2020), suppliers have been slower to benefit (with EBITDA growing a more moderate 1.7 points in that same period). In 2018, the analysis says, 59% of the industry’s $47.3 billion in economic profit was attributable to suppliers. In just two years, however, it notes that the equation has more than entirely flipped, with OEMs’ $13.1 billion in economic profit growth more than offset by a $13.6 billion (49%) slide in supplier economic profit. And for the first time in memory, it notes, OEM EBITDA margins, of 12.6%, outperformed their 10.3% average of the last decade, as well as outperforming suppliers’ margins, which grew to just 10.8% in 2021, below their 11.4% average of the prior decade.

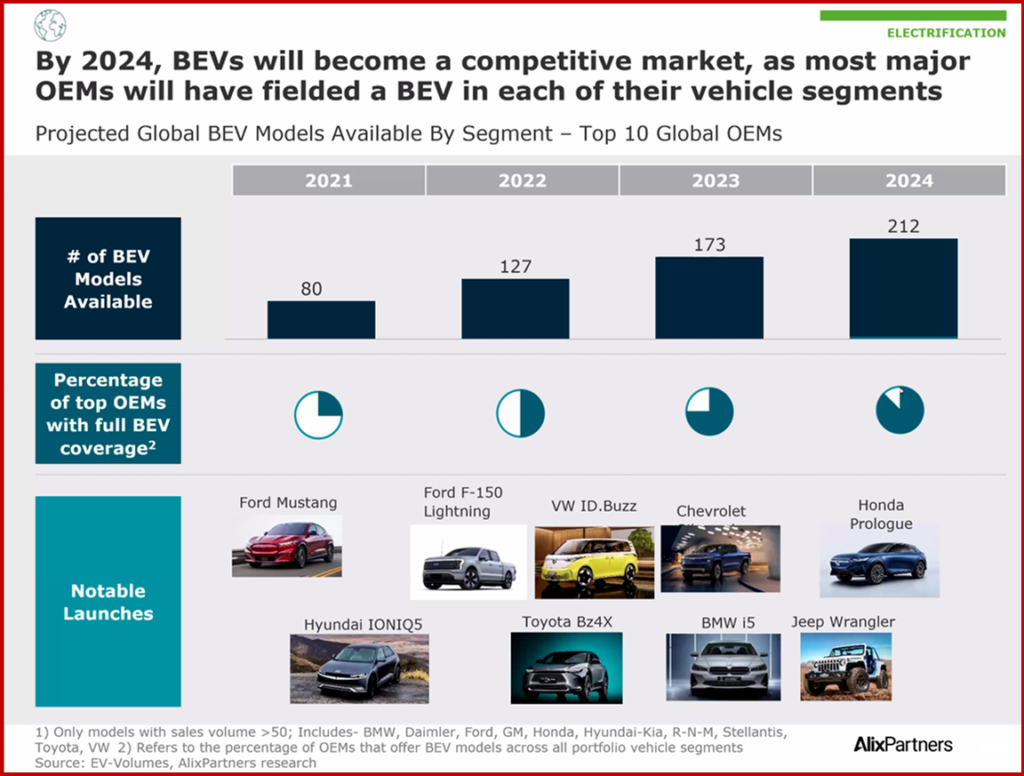

Investment demands will snowball as BEV penetration accelerates and infrastructure needs mature, the analysis finds. Today, buyers remain in early-adopter mode, AlixPartners’ analysis says, but as BEVs entries grow to cover all volume segments for the top OEMs by 2024, new buyers will be more focused on purchase price, ownership costs, and charging convenience. For instance, it says, by the end of the decade, $48 billion in charging infrastructure investment would be needed in the US alone; to date, only $11 billion has been committed.

The study says of the $70 billion cost in transitioning the supply base below the so-called Tier 1 suppliers (the biggest) to BEVs through end of decade, 40-60% can be reduced by proactively managing supply base’s transition from ICE (Internal Combustion Engine) rather than business as usual. Transition challenges include BEV raw-material costs being exponentially higher than ICE costs; stranded assets; a relatively long ramp-up to BEV mass penetration; supply base’s un-readiness for BEV era.

Several suppliers surveyed by AlixPartners have begun to wind-down or sell ICE-related business. The finds in-sourcing by automakers results in only 28% of BEV powertrain production appearing to be accessible to suppliers as automakers are repurposing non-performing factories to BEV powertrain manufacturing. New business models, including separating ICE and BEV operations and forming ICE alliances, may be necessary as ICE-engine programs are near an “inflection point” that marks dramatic change. The study also forecasts that ICE-engine programs are nearing an inflection point, as the number of ICE and hybrid programs have been on the steady decline in Europe over the past four years, and flattish in North America. They are forecast to decrease by at least 33% and 12%, respectively between 2024 and 2028, the study finds.

AlixPartners is a results-driven global consulting firm that specializes in helping businesses successfully address their most complex and critical challenges. Our clients include companies, corporate boards, law firms, investment banks, private equity firms, and others. Founded in 1981, AlixPartners is headquartered in New York, and has offices in more than 20 cities around the world. For more information, please visit www.alixpartners.com.

**Earnings Before Interest, Taxes, Depreciation and Amortization

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Automaker Profits Post-Covid Hiding Supplier Weakness

Supply constraints and demand that have made vehicle prices higher at lower volumes are creating operational inefficiencies and distress in the supply chain, according to new industry-wide analysis from AlixPartners LLP*, the global consulting firm. This imbalance will continue through 2024 as chip availability continues to improve.

The continued trend delivers a “complex backdrop for an industry committing $526 billion through 2026,” AlixPartners’ analysis finds, to fund the shift to battery-electric vehicles (BEVs). The transition, now taking place amid a weakening economic outlook, could cost automakers and suppliers $70 billion if not effectively managed. There are also several implications for dealers and consumers here – not all of them benign.

The latest AlixPartners forecast calls for BEVs to be the majority vehicle type by 2035 in all major regions, surpassing internal-combustion-engine (ICE) vehicles. BEV market growth, however, will be tested by a raw-material cost that is 125% higher than a comparable ICE vehicle; scarcity and price inflation of parts and commodities (including increased use of chips on EVs); and a lack of readiness for the “BEV era” in the supply bases of both automakers and their larger suppliers.

The capital expense of converting an old blacksmithing business to an electric one is leading to partnerships that would have previously been unlikely, if not unthinkable.

The semiconductor shortage will continue affecting vehicle supply through 2024 while geopolitics and pandemic fallout affect short-term sentiment. Recent new-car pricing power has lifted automaker profits. Pent-up demand will still result in strong sales, but inventory restraints lead to continued operating inefficiencies and resiliency costs.

New-vehicle pricing has been extremely robust, and AlixPartners expects pent-up demand and employment strength to enable automakers to continue to benefit from finding a buyer for each vehicle they can make despite inflation and rising interest rates that are weighing on consumers.

While this demand-over-supply leverage in the marketplace is driving near-term profitability, it is not sustainable in the long term, says the study. Supply shortages and resulting frequent scheduling changes lead to operational inefficiencies, as measured by sharply rising levels of employees per thousand vehicles produced (31% rise for suppliers compared to Q3 2020; 42% rise for automakers). Inventory is likely to build once demand and supply are even, eroding pricing power. Additional costs to build resiliency into the supply chain adds to pressure that the growing BEV investment demands are placing on the industry. (AutoInformed on: BMW Group Posts Record Revenues, Earnings, Profits for 2021; Suzuki, Subaru, Daihatsu, Toyota and Mazda form JV on Technical Specs for Next-Gen Vehicle Communications Devices)

While supply constraints have been a challenge for consumers, pushing many toward the used-car market, the study finds that automakers have been able to increase profit margins, with a 68% jump in economic profit in 2021 vs. 2018. At the same time, OEMs have driven down net debt by $103 billion, or 11%. Analysts and investors are expecting this tailwind to continue, predicting a near-term doubling of the industry’s economic profit by 2023, to $89.2 billion, notes the study.

The expectations, however, will not be easy to meet, notes AlixPartners. While automakers have seen a profitability windfall recently (increasing EBITDA** 3.2 percentage points in 2021 over 2020), suppliers have been slower to benefit (with EBITDA growing a more moderate 1.7 points in that same period). In 2018, the analysis says, 59% of the industry’s $47.3 billion in economic profit was attributable to suppliers. In just two years, however, it notes that the equation has more than entirely flipped, with OEMs’ $13.1 billion in economic profit growth more than offset by a $13.6 billion (49%) slide in supplier economic profit. And for the first time in memory, it notes, OEM EBITDA margins, of 12.6%, outperformed their 10.3% average of the last decade, as well as outperforming suppliers’ margins, which grew to just 10.8% in 2021, below their 11.4% average of the prior decade.

Investment demands will snowball as BEV penetration accelerates and infrastructure needs mature, the analysis finds. Today, buyers remain in early-adopter mode, AlixPartners’ analysis says, but as BEVs entries grow to cover all volume segments for the top OEMs by 2024, new buyers will be more focused on purchase price, ownership costs, and charging convenience. For instance, it says, by the end of the decade, $48 billion in charging infrastructure investment would be needed in the US alone; to date, only $11 billion has been committed.

The study says of the $70 billion cost in transitioning the supply base below the so-called Tier 1 suppliers (the biggest) to BEVs through end of decade, 40-60% can be reduced by proactively managing supply base’s transition from ICE (Internal Combustion Engine) rather than business as usual. Transition challenges include BEV raw-material costs being exponentially higher than ICE costs; stranded assets; a relatively long ramp-up to BEV mass penetration; supply base’s un-readiness for BEV era.

Several suppliers surveyed by AlixPartners have begun to wind-down or sell ICE-related business. The finds in-sourcing by automakers results in only 28% of BEV powertrain production appearing to be accessible to suppliers as automakers are repurposing non-performing factories to BEV powertrain manufacturing. New business models, including separating ICE and BEV operations and forming ICE alliances, may be necessary as ICE-engine programs are near an “inflection point” that marks dramatic change. The study also forecasts that ICE-engine programs are nearing an inflection point, as the number of ICE and hybrid programs have been on the steady decline in Europe over the past four years, and flattish in North America. They are forecast to decrease by at least 33% and 12%, respectively between 2024 and 2028, the study finds.

*About AlixPartners LLP

AlixPartners is a results-driven global consulting firm that specializes in helping businesses successfully address their most complex and critical challenges. Our clients include companies, corporate boards, law firms, investment banks, private equity firms, and others. Founded in 1981, AlixPartners is headquartered in New York, and has offices in more than 20 cities around the world. For more information, please visit www.alixpartners.com.

**Earnings Before Interest, Taxes, Depreciation and Amortization

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.