Maybe the framing should be a roller coaster – AutoCrat?

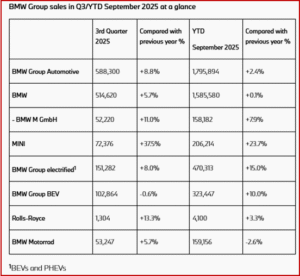

The BMW Group today posted Q3 Sales that increase of +8.8%. From January to September 2025, the BMW Group delivered a total of ~1.8 million BMW, MINI and Rolls-Royce vehicles to customers, This is a sales growth of only +2.4%. During the same period, the company increased sales of fully-electric vehicles by +10.0% to 323,447 units. Between January and September, the BMW Group delivered a total of 470,313 electrified vehicles (BEV and PHEV) to customers (+15.0%). However, the Board of Management of BMW AG today changed the outlook downward for the 2025 financial year. (Read AutoInformed.com on: BMW Group Q1 2025 Earnings Drop 25%)

“The BMW Group reported a slight sales increase for the year to the end of September. The strong sales performance in Europe and the Americas, as well as for the MINI brand, is particularly encouraging. Demand for our wide range of electrified vehicles also remains strong,” said Jochen Goller, member of the Board of Management of BMW AG responsible for Customer, Brands, Sales.

Click to enlarge.

“The BMW Group delivered volume growth year to date September in the European and Americas regions, however, the targeted volume growth in China remained below expectations. On this basis, the BMW Group decided to reduce volume expectations for the Chinese market in the fourth quarter. Additionally, the impact of a significant reduction of commissions from local Chinese banks in connection with the brokering of financial and insurance products to end customers requires financial support to strengthen dealer profitability,” BMW said.

“Furthermore, some of the assumptions on tariff reductions made at the time of its half year reporting have not been fully realized to date. In this context the BMW Group continues, however, to maintain the assumption that the EU implement the agreement with the US on reduction of tariffs from 10% to 0% on the import of vehicles and auto parts into the EU effective 1 August. Accounting for these additional factors weighing on profit, the Auto EBIT margin for 2025 will remain in the guided corridor of 5% to 7%, more specifically in the range of 5% to 6%,” BMW said.

The BMW outlook for the 2025 financial year is adjusted as follows:

- RoCE in Segment Automotive is expected in the corridor from 8% to 10% (previously: 9% to 13%).

- Group Earnings before Tax is expected to decline slightly (previously: on same level as previous year.

“Contrary to assumptions made to date, the BMW Group now assumes that reimbursements of customs duties from the American and German authorities totaling a high three-digit million figure will not be received in 2025 but only paid in 2026. Considering these reimbursements and the impact on profit outlined above, free cashflow in Segment Automotive for the year 2025 is expected to be above €2.5bn (previously above €5bn).

“The dividend payout ratio remains in the corridor of 30% to 40% of net income attributable to BMW AG shareholders. Additionally, the BMW Group remains committed to the share buyback program,” BMW said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

BMW Group Sales – Small Increase YTD. Board Cuts Outlook

Maybe the framing should be a roller coaster – AutoCrat?

The BMW Group today posted Q3 Sales that increase of +8.8%. From January to September 2025, the BMW Group delivered a total of ~1.8 million BMW, MINI and Rolls-Royce vehicles to customers, This is a sales growth of only +2.4%. During the same period, the company increased sales of fully-electric vehicles by +10.0% to 323,447 units. Between January and September, the BMW Group delivered a total of 470,313 electrified vehicles (BEV and PHEV) to customers (+15.0%). However, the Board of Management of BMW AG today changed the outlook downward for the 2025 financial year. (Read AutoInformed.com on: BMW Group Q1 2025 Earnings Drop 25%)

“The BMW Group reported a slight sales increase for the year to the end of September. The strong sales performance in Europe and the Americas, as well as for the MINI brand, is particularly encouraging. Demand for our wide range of electrified vehicles also remains strong,” said Jochen Goller, member of the Board of Management of BMW AG responsible for Customer, Brands, Sales.

Click to enlarge.

“The BMW Group delivered volume growth year to date September in the European and Americas regions, however, the targeted volume growth in China remained below expectations. On this basis, the BMW Group decided to reduce volume expectations for the Chinese market in the fourth quarter. Additionally, the impact of a significant reduction of commissions from local Chinese banks in connection with the brokering of financial and insurance products to end customers requires financial support to strengthen dealer profitability,” BMW said.

“Furthermore, some of the assumptions on tariff reductions made at the time of its half year reporting have not been fully realized to date. In this context the BMW Group continues, however, to maintain the assumption that the EU implement the agreement with the US on reduction of tariffs from 10% to 0% on the import of vehicles and auto parts into the EU effective 1 August. Accounting for these additional factors weighing on profit, the Auto EBIT margin for 2025 will remain in the guided corridor of 5% to 7%, more specifically in the range of 5% to 6%,” BMW said.

The BMW outlook for the 2025 financial year is adjusted as follows:

“Contrary to assumptions made to date, the BMW Group now assumes that reimbursements of customs duties from the American and German authorities totaling a high three-digit million figure will not be received in 2025 but only paid in 2026. Considering these reimbursements and the impact on profit outlined above, free cashflow in Segment Automotive for the year 2025 is expected to be above €2.5bn (previously above €5bn).

“The dividend payout ratio remains in the corridor of 30% to 40% of net income attributable to BMW AG shareholders. Additionally, the BMW Group remains committed to the share buyback program,” BMW said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.