Click to enlarge.

Chief Economist of Cox Automotive* Jonathan Smoke said this morning that the US auto market is off to a slow start in 2024. However, the two-handed economist said that “We are seeing more positive momentum in the used-car market and in fixed operations. Tax refunds are just now starting to flow, and that should bring the strongest used-car market performance for the year.”

“We’re only halfway through January with the credit card spending data. But so far it appears that the consumer is holding up with spending growth stable relative to the level of spending growth we had at the end of last year. That was slower than we had seen previously in 2023. But it is enough. To produce growth of roughly 4% in nominal terms in consumer spending, and that’s enough to keep the economy moving forward,” Smoke said.**

Executive Summary

- The Federal Reserves’ efforts slow the economy 2023 worked as job creation slipped, but more than 3 million new jobs were created.

- Forty states now have more jobs than before pandemic.

- Continuing unemployment claims grew last year and at 1.9 million on January 20th, we are now higher than before the pandemic. We see more stress in some areas of the country. States like new. Jersey, Rhode Island, California, Minnesota and Massachusetts.

- The average unleaded gas price, according to AAA, increased 1.3% week over week to $3.15 per gallon as of Sunday or 10% year over year using estimated sales.

- Estimated vehicle transactions recovered from winter disruptions and moved 4% higher against the prior week, but remain below the same levels last year. Used retail sales are currently down 3% year -over-year.

- Manufacturers have started the year with less aggressive financing offers, but consumers can find rates under 3%. Auto loan rates moved higher in 2023, but peaked in the fall and ended the year down from the peaks. But rates moved up again in January and have started February down slightly. The volume weighted average new auto loan interest rate has declined one basis point to 9.67% so far in February. Leaving it up 97 basis points year over year, the average new rate peaked at 9.95% in mid-October.

- The average used auto loan rate has declined 2 basis points to 14.113% so far in February. Leaving it up 38 basis points year-over-year. The average use rate peaked at 14.35% in mid-November.

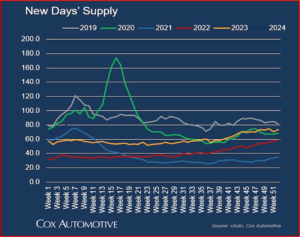

- New vehicle inventory increased almost 3% in the latest week, rising to 2.62 million units. Used inventory was essentially flat in the latest week and inventory remains up 5% against 2023.

- Used retail prices continue declining, but wholesale is more or less treading water. Last year saw several periods of increases in wholesale prices.

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook, or Cox-Automotive-Inc on LinkedIn.

AutoInformed on

*Jonathan Smoke – Cox Automotive Chief Economist

Jonathan Smoke leads Cox Automotive’s economic and industry insights team, which tracks key metrics and trends impacting both the wholesale and retail markets for vehicles informed by the proprietary data from the company’s businesses and platforms. For 28 years, Smoke has focused on translating data and trends into relevant actionable insights for the industries that represent the biggest purchases that consumers make in their lifetimes: real estate and automotive. Smoke joined Cox Automotive in 2017.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Cox Automotive – US Vehicle Market Off To Slow Start, But…

Click to enlarge.

Chief Economist of Cox Automotive* Jonathan Smoke said this morning that the US auto market is off to a slow start in 2024. However, the two-handed economist said that “We are seeing more positive momentum in the used-car market and in fixed operations. Tax refunds are just now starting to flow, and that should bring the strongest used-car market performance for the year.”

“We’re only halfway through January with the credit card spending data. But so far it appears that the consumer is holding up with spending growth stable relative to the level of spending growth we had at the end of last year. That was slower than we had seen previously in 2023. But it is enough. To produce growth of roughly 4% in nominal terms in consumer spending, and that’s enough to keep the economy moving forward,” Smoke said.**

Executive Summary

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook, or Cox-Automotive-Inc on LinkedIn.

AutoInformed on

*Jonathan Smoke – Cox Automotive Chief Economist

Jonathan Smoke leads Cox Automotive’s economic and industry insights team, which tracks key metrics and trends impacting both the wholesale and retail markets for vehicles informed by the proprietary data from the company’s businesses and platforms. For 28 years, Smoke has focused on translating data and trends into relevant actionable insights for the industries that represent the biggest purchases that consumers make in their lifetimes: real estate and automotive. Smoke joined Cox Automotive in 2017.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.