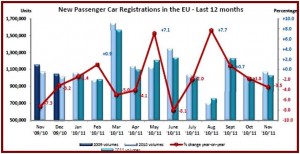

European auto sales decreased once again in November by 3.5%, at 1,030,414 units in the EU 27 , compared to the same month in 2010. Eleven months into 2011, European auto sales totaled 12,157,119 new registrations, or 1.4% less compared to the period January-November 2010. This means that for four straight years automobile sales in moribund, debt-ridden European economies have declined.

Counter intuitively, the Eurozone crisis is producing calls for austerity by ideologues, instead of stimulus plans that would actually increase tax revenues and employment from all industries, including auto manufacturing and sales. The automobile industry in Europe provides employment for more than 2.3 million workers and supports another 10 million jobs in related industries. Annually, automakers invest more than €30 billion in R&D, which makes it the largest private investor in R&D in Europe.

Europe’s increasing instability poses risks for not only European economies and governments, but has far reaching global implications for the global economy. The European Union buys nearly 20% of U.S. exports ($242.6 billion in 2010) and more than 30% of U.S. service exports ($170.2 billion). The European Union accounts for 63% of the stock of foreign direct investment (FDI) into the United States, $1.5 trillion, and 56% of new investment in 2010. Therefore, when European growth slows, U.S. jobs, exports, and FDI decline.

As a result Europe, rebuilt by the U.S taxpayers after WW2, could even affect the outcome of the U.S. presidential election next year, if it tips the world into another economic crisis or recession or worse. No European government will help solve the ongoing U.S. unemployment crisis, or trade or budget deficits that will be the central issues in the election. Uncle Sam really has no siblings in Europe or elsewhere who will help.

American automakers General Motors (8.7% share) and Ford Motor (8%) posted slight auto sales declines, but are essentially flat year-over-year, even though both companies have introduced a series of new models. Fiat – the owner of Chrysler courtesy of American taxpayers – continues to struggle along with Italy, off almost a full percentage point in share to 7.1%. One bright spot – Jeep sales are up 64% from an admittedly small base to more than 20,000 units.

‘Chrysler bails out Fiat’ is looming as a potential headline, a political nightmare for the ‘no jobs’ Obama Administration, which faces a personal unemployment crisis of its own after the elections in 2012.

In November, Germany was the only major market to grow (+2.6%). Sales drops ranged from -4.2% in the UK to -6.4% in Spain, -7.7% in France and -9.2% in Italy. Overall, the EU market was down 3.5%, according to ACEA – the automakers trade group.

Not surprisingly, German based Volkswagen, as Europe’s largest automaker, continued to outperform the moribund market. VW Group has increased market share by 2% ytd to 23%, led by Volkswagen, which sold 1,503,322 vehicles (+8%) in the same period. The VW brand holds a commanding share of better than 12% of the European market. French automakers PSA Group and Renault are second and third with 12.6% share and 9.7% respectively YTD.