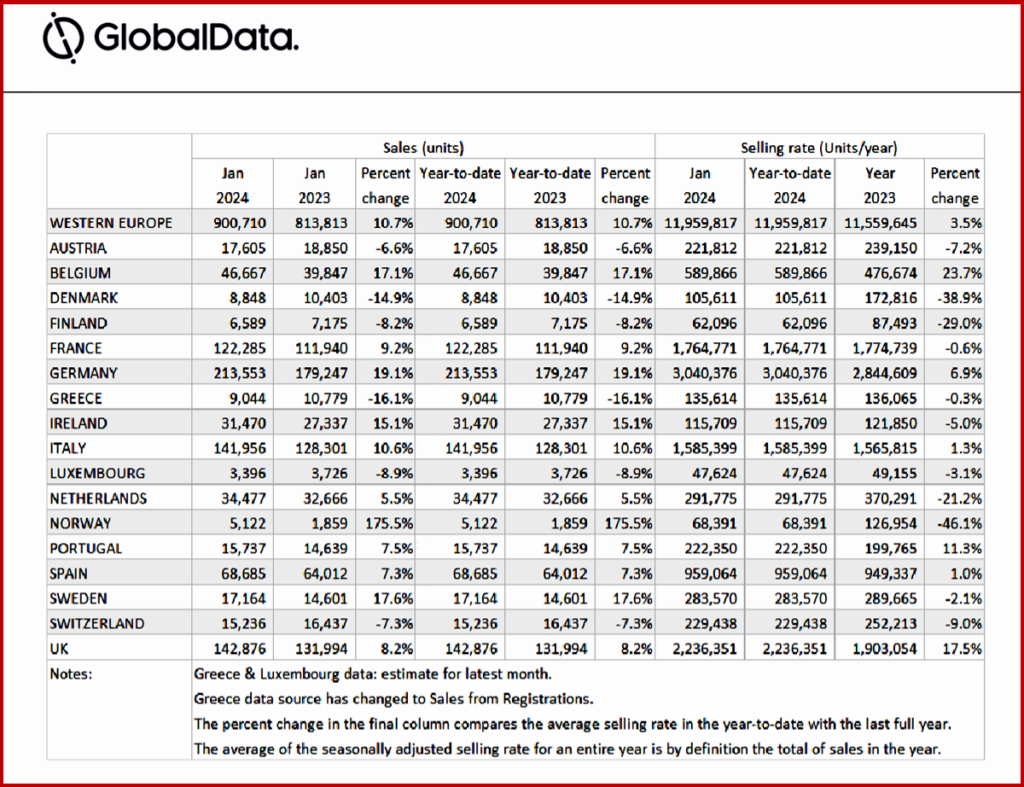

The Western Europe passenger car selling rate fell slightly to 12 million units a year in January, according to numbers just released by the respected GlobalData* consultancy, at 901,000 vehicle registrations. Year-over-year (YoY) January grew 10.7% with strong growth in Germany and other major West European countries. However, relative to pre-pandemic January 2019, the passenger vehicle (PV) market is down almost 19%.

“With supply having been a key limiting factor over recent years, 2024 will see the focus return to the health of underlying demand. In this regard, consumers face headwinds such as high interest rates, inflation, and elevated vehicle pricing. However, the latter should ease as a function of greater vehicle supply and further volume recovery is baked into the 2024 outlook. Risks remains, noting the recent Red Sea attacks hitting freight costs, which only increases pressure on the manufacturing cost base,” the GlobalData European Light Vehicle Sales Forecasting Team said.

Click for more GlobalData.

GlobalData Observations

- The Western Europe passenger car in 2024 is forecast to reach 12.1 million units, the best year since the pandemic.

- The Germany PV market recorded 214,000 vehicle registrations in January, 19.1% higher YoY. With a selling rate of 3 million units/year, the strong positive YoY growth is due to January being a low base given the fact that Germany brought down some incentives from the start of 2023. The market is still, however, lagging 20% behind January 2019 and domestic demand remains weak.

- The UK PV market registered 143,000 vehicles in January 2024, 8.2% higher YoY, with a selling rate of 2.2 million units/year. The PV market continues to register positive YoY growth, thanks to the fleet side.

- The French PV market started 2024 with 122,000 vehicle registrations in January, 9.2% higher than January. With a selling rate of 1.8 million units/year, the market performed close to expectations as supply constraints become less of an issue.

- The Italian PV market registered 142,000 vehicles in January 2024, 10.6% higher YoY, with the selling rate steady at 1.6 million units/year. Demand in upcoming months may benefit from the new car incentive plan unveiled by the Italian government.

- The Spanish PV market in January 2024 registered 69,000 vehicles, 7.3% higher YoY, with a selling rate of 960,000 units/year — the market performance continues to improve, helped by growth in the rental channel.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

European Passenger Car Sales Soft in January 2024

The Western Europe passenger car selling rate fell slightly to 12 million units a year in January, according to numbers just released by the respected GlobalData* consultancy, at 901,000 vehicle registrations. Year-over-year (YoY) January grew 10.7% with strong growth in Germany and other major West European countries. However, relative to pre-pandemic January 2019, the passenger vehicle (PV) market is down almost 19%.

“With supply having been a key limiting factor over recent years, 2024 will see the focus return to the health of underlying demand. In this regard, consumers face headwinds such as high interest rates, inflation, and elevated vehicle pricing. However, the latter should ease as a function of greater vehicle supply and further volume recovery is baked into the 2024 outlook. Risks remains, noting the recent Red Sea attacks hitting freight costs, which only increases pressure on the manufacturing cost base,” the GlobalData European Light Vehicle Sales Forecasting Team said.

Click for more GlobalData.

GlobalData Observations

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.