Click to Enlarge.

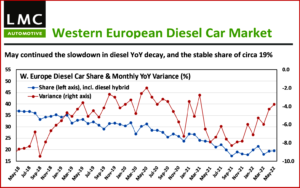

Western European diesel car sales in May were 165,000. This was “in a depressed market that is suffering not only from supply issues, but perhaps starting to feel the beginnings of a consumer slowdown, although that is thought to be a relatively minor part of the problem as the order backlog remains significant,” the respected LMC Automotive* consultancy said today.

Germany, Europe’s largest diesel car market, saw only barely detectable YoY fall in share at -2.1 percentage points with diesel hybrid accounting for 5.8% of all sales and 22% of diesel sales (all diesel share was 26.1%, pure diesel share was 20.3%, according to the KBA.

“The pace of the decline continues to slow with a sub-4pp fall versus May of 2021. We’re not sure of the extent to which the fuel type mix is being influenced by problems with supply of critical parts, but we are aware that more profitable cars are being prioritized and, given that diesel now mainly resides in the large premium segment, that may be a factor in its favor. Equally, BEV share in the region has stopped growing so far in 2022 and this has reduced pressure on the ICE sector, at least temporarily,” said LMC.

“We are aware that more profitable cars are being prioritized and, given that diesel now mainly resides in the large premium segment, that may be a factor in its favor,” said LMC.

*LMC Automotive is part of the LMC group, now part of GlobalData. Originally founded in 1980, it provides market intelligence, analysis and advice to clients around the world involved with agricultural commodities, foods, industrial materials, bio-fuels and their end-markets. A separate company in the group specializes in the coverage of the rubber and tire sectors. Contact LMC at www.lmc-auto.com or LMC Automotive, 4th Floor, Clarendon House, 52 Cornmarket Street, Oxford, Oxfordshire OX1 3HJ, United Kingdom.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Europe’s Diesel Addiction Continues Starting with Germany

Click to Enlarge.

Western European diesel car sales in May were 165,000. This was “in a depressed market that is suffering not only from supply issues, but perhaps starting to feel the beginnings of a consumer slowdown, although that is thought to be a relatively minor part of the problem as the order backlog remains significant,” the respected LMC Automotive* consultancy said today.

Germany, Europe’s largest diesel car market, saw only barely detectable YoY fall in share at -2.1 percentage points with diesel hybrid accounting for 5.8% of all sales and 22% of diesel sales (all diesel share was 26.1%, pure diesel share was 20.3%, according to the KBA.

“The pace of the decline continues to slow with a sub-4pp fall versus May of 2021. We’re not sure of the extent to which the fuel type mix is being influenced by problems with supply of critical parts, but we are aware that more profitable cars are being prioritized and, given that diesel now mainly resides in the large premium segment, that may be a factor in its favor. Equally, BEV share in the region has stopped growing so far in 2022 and this has reduced pressure on the ICE sector, at least temporarily,” said LMC.

“We are aware that more profitable cars are being prioritized and, given that diesel now mainly resides in the large premium segment, that may be a factor in its favor,” said LMC.

*LMC Automotive is part of the LMC group, now part of GlobalData. Originally founded in 1980, it provides market intelligence, analysis and advice to clients around the world involved with agricultural commodities, foods, industrial materials, bio-fuels and their end-markets. A separate company in the group specializes in the coverage of the rubber and tire sectors. Contact LMC at www.lmc-auto.com or LMC Automotive, 4th Floor, Clarendon House, 52 Cornmarket Street, Oxford, Oxfordshire OX1 3HJ, United Kingdom.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.