Click to enlarge.

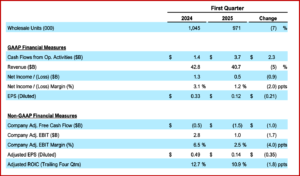

Ford Motor Company (NYSE: F)* late yesterday announced weak first- quarter 2025 financial results and “suspended” financial guidance, including full year adjusted EBIT and adjusted free cash flow because of Trump tariff-related” uncertainties.” Ford first-quarter revenue of was $40.7 billion; net income $471 million with an adjusted EBIT of $1 billion. Operating cash flow was $3.7 billion. Improvements in cost and quality favorably contributed to performance in the quarter, Ford claimed. When excluding the nearly 200 million impact of tariffs, this was Ford’s third consecutive quarter of year-over -year cost improvement. Ford estimates a tariff-related net adverse adjusted EBIT impact of about $1.5 billion for full year 2025, subject to ongoing tariff-related policy developments. For comparison, General Motors earned $2.78 billion, $3.35 per share, for the three months ended March 31. During Q1 of 2024 GM earned $2.98 billion, or $2.56 per share.

“We are strengthening our underlying business with significantly better quality and our third straight quarter of year-over-year cost improvement, excluding the impact of tariffs,” said Ford President and CEO Jim Farley. “Ford Pro, our largest competitive advantage, is off to a strong start to the year, gaining market share in the most profitable U.S. and European customer segments.”

Click to enlarge.

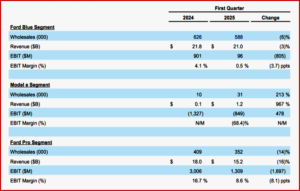

In the first quarter, Ford Blue reported $96 million in EBIT, down from a year ago due to expected volume decline and adverse exchange. Segment revenue declined 3% to $21 billion.

Nameplates such as F-Series and Bronco, continue to lead their respective segments. Ford says it is continuing to work on its warranty costs particularly around new product launches which have materially affected its costs in a negative way for multiple years now.

Ford Model e reported a first-quarter EBIT loss of $849 million. “The segment remains focused on improving gross margins and exercising a disciplined approach to investments in battery facilities and next-generation products. U.S. retail sales grew 15% compared to a year ago as the Ford Power Promise campaign gave more customers access to home chargers and standard installation,” Ford said.

Ford Credit reported first-quarter earnings before taxes (EBT) of $580 million, up significantly compared to a year ago. In the quarter, Ford Credit paid a $200 million distribution to Ford Motor Company.

In April, Ford renewed its $18 billion corporate credit facilities for another year.

Ford Pro generated $1.3 billion in EBIT with a margin of 8.6% on $15.2 billion in revenue. The EBIT change from a year ago primarily reflects a 14% decline in wholesales due to planned downtime and unfavorable fleet pricing. Ford Pro ended the first quarter with 675,000 paid subscriptions, up 4% sequentially.

Full-Year 2025 Outlook

“Ford’s underlying business is strong – tracking within the previous adjusted EBIT guidance range of $7 billion to $8.5 billion, excluding new tariff-related impacts. Based on what the company knows now, and its expectation of how certain details and changes will be resolved related to tariffs, the company estimates a net adverse adjusted EBIT impact of about $1.5 billion for full-year 2025. Given material near-term risks, especially the potential for industry-wide supply chain disruption impacting production, the potential for future or increased tariffs in the U.S., changes in the implementation of tariffs including tariff offsets, retaliatory tariffs and other restrictions by other governments and the potential related market impacts, and finally policy uncertainties associated with tax and emissions policy, the company is suspending guidance. These are substantial industry risks, which could have significant impacts on financial results, and that make updating full year guidance challenging right now given the potential range of outcomes. The company will provide an update during the Q2 earnings call. Ford’s annual meeting will take place online at 8:30 a.m. ET on Thursday, May 8,” Ford said.

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor 2025 Q1 Net Income $47M Down from $1.3B!

Click to enlarge.

Ford Motor Company (NYSE: F)* late yesterday announced weak first- quarter 2025 financial results and “suspended” financial guidance, including full year adjusted EBIT and adjusted free cash flow because of Trump tariff-related” uncertainties.” Ford first-quarter revenue of was $40.7 billion; net income $471 million with an adjusted EBIT of $1 billion. Operating cash flow was $3.7 billion. Improvements in cost and quality favorably contributed to performance in the quarter, Ford claimed. When excluding the nearly 200 million impact of tariffs, this was Ford’s third consecutive quarter of year-over -year cost improvement. Ford estimates a tariff-related net adverse adjusted EBIT impact of about $1.5 billion for full year 2025, subject to ongoing tariff-related policy developments. For comparison, General Motors earned $2.78 billion, $3.35 per share, for the three months ended March 31. During Q1 of 2024 GM earned $2.98 billion, or $2.56 per share.

“We are strengthening our underlying business with significantly better quality and our third straight quarter of year-over-year cost improvement, excluding the impact of tariffs,” said Ford President and CEO Jim Farley. “Ford Pro, our largest competitive advantage, is off to a strong start to the year, gaining market share in the most profitable U.S. and European customer segments.”

Click to enlarge.

In the first quarter, Ford Blue reported $96 million in EBIT, down from a year ago due to expected volume decline and adverse exchange. Segment revenue declined 3% to $21 billion.

Nameplates such as F-Series and Bronco, continue to lead their respective segments. Ford says it is continuing to work on its warranty costs particularly around new product launches which have materially affected its costs in a negative way for multiple years now.

Ford Model e reported a first-quarter EBIT loss of $849 million. “The segment remains focused on improving gross margins and exercising a disciplined approach to investments in battery facilities and next-generation products. U.S. retail sales grew 15% compared to a year ago as the Ford Power Promise campaign gave more customers access to home chargers and standard installation,” Ford said.

Ford Credit reported first-quarter earnings before taxes (EBT) of $580 million, up significantly compared to a year ago. In the quarter, Ford Credit paid a $200 million distribution to Ford Motor Company.

In April, Ford renewed its $18 billion corporate credit facilities for another year.

Ford Pro generated $1.3 billion in EBIT with a margin of 8.6% on $15.2 billion in revenue. The EBIT change from a year ago primarily reflects a 14% decline in wholesales due to planned downtime and unfavorable fleet pricing. Ford Pro ended the first quarter with 675,000 paid subscriptions, up 4% sequentially.

Full-Year 2025 Outlook

“Ford’s underlying business is strong – tracking within the previous adjusted EBIT guidance range of $7 billion to $8.5 billion, excluding new tariff-related impacts. Based on what the company knows now, and its expectation of how certain details and changes will be resolved related to tariffs, the company estimates a net adverse adjusted EBIT impact of about $1.5 billion for full-year 2025. Given material near-term risks, especially the potential for industry-wide supply chain disruption impacting production, the potential for future or increased tariffs in the U.S., changes in the implementation of tariffs including tariff offsets, retaliatory tariffs and other restrictions by other governments and the potential related market impacts, and finally policy uncertainties associated with tax and emissions policy, the company is suspending guidance. These are substantial industry risks, which could have significant impacts on financial results, and that make updating full year guidance challenging right now given the potential range of outcomes. The company will provide an update during the Q2 earnings call. Ford’s annual meeting will take place online at 8:30 a.m. ET on Thursday, May 8,” Ford said.

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.