Click for more GlobalData.

“In the ever-evolving landscape of the automotive industry, the lower utilization conundrum appears to be here to stay. The recovery in global Light Vehicle (LV) demand in 2023 has been stronger than expected, as supply constraints eased in most markets. The outlook for 2023 has been increased by 4%, from 85.8 million units in January to 89.2 million units in November.

“However, this recovery and, more specifically, consumers still face headwinds from high vehicle prices (with the exception of China’s price war). High prices have kept the recovery in check and some consumers on the sidelines, as pressure on vehicle production eases,” said Jeff Schuster Vice President Research and Analysis, Automotive, at the GlobalData* consultancy in an analyst briefing made public today.

“With the current high-price environment as a backdrop, the progression of the Electric Vehicle (EV) transition and the potential for other external shocks, we can’t help but raise the caution flag about the prospects for the medium-term forecast and a recovery in demand to pre-pandemic levels. We had recently already trimmed the global LV forecast by an average of 7.5 million units a year throughout the forecast horizon, citing pricing pressure as the main driver. However, additional cuts to the outlook post-recovery could be on the horizon if pricing isn’t addressed,” Schuster said.

In his view sustained higher prices shrink the new vehicle market, causing it to behave more like a premium market, squeezing out some buyers that simply don’t have an option but to keep their vehicle, buy a used vehicle or not own one. “Given the likelihood of manufacturers embracing margin and not chasing volume, there is a plausible scenario that lowers demand further, adding more uncertainty to the billions invested in shifting and building vehicle capacity to support the push to electrification,” said Schuster.

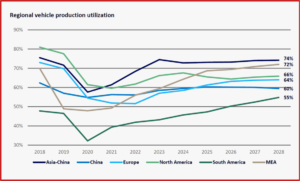

“Utilization is not expected to crest 70% in our forecast horizon, with global utilization at 65% in 2028 in our base forecast. Under a scenario with weaker demand, utilization falls to 60%, as investment in new electric plants drives up capacity that demand cannot support,” said Schuster. GlobalData’s dedicated research platform, the Automotive Intelligence Center originally developed this report.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Automotive Capacity Too High for Demand?

Click for more GlobalData.

“In the ever-evolving landscape of the automotive industry, the lower utilization conundrum appears to be here to stay. The recovery in global Light Vehicle (LV) demand in 2023 has been stronger than expected, as supply constraints eased in most markets. The outlook for 2023 has been increased by 4%, from 85.8 million units in January to 89.2 million units in November.

“However, this recovery and, more specifically, consumers still face headwinds from high vehicle prices (with the exception of China’s price war). High prices have kept the recovery in check and some consumers on the sidelines, as pressure on vehicle production eases,” said Jeff Schuster Vice President Research and Analysis, Automotive, at the GlobalData* consultancy in an analyst briefing made public today.

“With the current high-price environment as a backdrop, the progression of the Electric Vehicle (EV) transition and the potential for other external shocks, we can’t help but raise the caution flag about the prospects for the medium-term forecast and a recovery in demand to pre-pandemic levels. We had recently already trimmed the global LV forecast by an average of 7.5 million units a year throughout the forecast horizon, citing pricing pressure as the main driver. However, additional cuts to the outlook post-recovery could be on the horizon if pricing isn’t addressed,” Schuster said.

In his view sustained higher prices shrink the new vehicle market, causing it to behave more like a premium market, squeezing out some buyers that simply don’t have an option but to keep their vehicle, buy a used vehicle or not own one. “Given the likelihood of manufacturers embracing margin and not chasing volume, there is a plausible scenario that lowers demand further, adding more uncertainty to the billions invested in shifting and building vehicle capacity to support the push to electrification,” said Schuster.

“Utilization is not expected to crest 70% in our forecast horizon, with global utilization at 65% in 2028 in our base forecast. Under a scenario with weaker demand, utilization falls to 60%, as investment in new electric plants drives up capacity that demand cannot support,” said Schuster. GlobalData’s dedicated research platform, the Automotive Intelligence Center originally developed this report.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.