Click for more GlobalData.

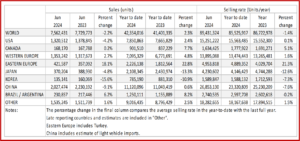

The Global Light Vehicle (LV) selling rate reached 89 million units annually in June, not only an improvement on the previous month, but the best result so far this year, according to an analysis released today by the respected GlobalData consultancy.* At 7.6 million vehicles sold, June marked a 2.2% decline year-on-year (YoY), although year-to-date (YTD) sales were up 2.3%.**

“Sales accelerated in China last month with the price war continuing, while in the US sales staggered as a result of a cyberattack affecting dealerships. Europe saw a rise in selling rates, thanks to improvements in both East and West Europe. Meanwhile, Japan recorded lagging sales in the face of supply issues and a subdued macroeconomic climate,” said the GlobalData Light Vehicle Sales Forecasting Team.

GlobalData Commentary, Observations

North America

The US Light Vehicle market seems to have slightly staggered in June 2024, as sales dropped by 4.2% YoY to 1.32 million units. Sales in the country took a hit mainly due to the CDK cyberattack disrupting business operations for dealerships. The selling rate slowed in June to 15.3 million units/year, down from 16.0 million units/year reported in May. Transaction prices saw a slight bump in June, increasing by US$21 MoM bringing the value to US$44,834. Incentives continue to exceed past the US$2,000 level for an eighth consecutive month at US$2695. (read AutoInformed on CDK Cyberattacks Wound June US Light Vehicle Sales)

Canadian Light Vehicle sales reached 168,000, maintaining the same level of sales as seen in the same period last year. The selling rate continued to slow, dropping to 1.63 million units/year in June, from 1.67 million units/year in May, as mentioned in our previous report. Looking at Mexico, sales grew by 9.3% YoY in June, reaching 124k units. With the Mexican economy showing signs of stability, and with strong consumer spending pushing LV sales growth, the selling rate expanded in June 2024 to 1.53 million units/year, marginally increasing from 1.52 million units/year in May

Europe

The Western European LV selling rate rose to 13.9 million units/year in June as 1.4 million vehicles were sold, 2.7% higher YoY. YTD sales passed 7 million units, improving on the same period last year by 4.8%. “We continue to forecast full-year growth for the region, on the order of circa 2%, although this will not match YTD performance. The ECB’s rate cut in June, and forthcoming additional cuts, should begin to support both economic and automotive market activity over the medium term,” GlobalData said.

The LV selling rate for Eastern Europe rose to 5.0 million units/year in June, with 422000 vehicles sold (+18% YoY). Year-to-date sales were 23% stronger than the comparative period last year. “This positive result continues to be driven by robust recovery in Russia, while the Turkish market saw a dramatic selling rate uptick in June, following an easing in the lofty selling rates seen at the start of the year — the economic environment remains highly uncertain in the face of rampant inflation ,” GlobalData said.

China

Advance data indicates that China’s domestic market accelerated for the second month in a row in June. The June selling rate was 26.9 million units/year, up 5.6% from May. During the first half of 2024, the selling rate averaged 23.3 million units/year. In YoY terms, however, sales (wholesales) declined by 9% in June and were flat (+0.6%) in H1 2024. “The government has launched a trade-in subsidy program and lowered the ratio of the required down-payment for auto loans. Yet, the domestic market remained sluggish, while exports of Passenger Vehicles continued to expand by double digits,” GlobalData said.

“To boost flagging sales, OEMs are continuing to cut prices massively. For example, BMW has cut the price of the i3 EV by half. Mercedes and Audi EV prices are now 30 to 40% lower. Sales of luxury cars, in particular foreign brands, are falling sharply, while Chinese brands continue to advance. An official at China’s Ministry of Industry and Information Technology has acknowledged that demand is weak and abnormally intense price competition is damaging earnings in the auto industry and supply chains – and hinted that the government would do more to shore up measures to expand demand,” GlobalData said.

Elsewhere in Asia

The Japanese market decelerated further in June, impacted mainly by the scandals surrounding the government’s certification process. Sales of Toyota and Mazda declined by double digits YoY, as their temporary production suspension of very popular models led to supply shortages. Daihatsu continued to register a plunge in sales as well, as its supply is not catching up with demand after it resumed full production. The June selling rate reached only 4.2 million units/year, down 6% from a weak May. “Not only supply issues, but also falling real wages and higher prices are behind sluggish sales. Heatwaves across the country may have affected showroom traffic, too,” GlobalData said.

Sales in Korea remained sluggish in June. The June selling rate was 1.59 million units/year, flat from May, and the H1 2024 average selling rate was also 1.59 million units/year. Passenger Vehicle sales were pulled ahead by the expiration of the temporary tax cut in June 2023. “Light Commercial Vehicle sales continued to struggle, owing to aging models, high financing costs and weak demand for BEV trucks. Except Renault Korea, all local OEMs registered double-digit YoY declines, due partially to a high base. Imports also fell YoY despite strong sales of Tesla models and the China-built Hyundai Sonata taxis,” GlobalData said.

South America

Brazilian Light Vehicle sales continue to flourish in 2024, as sales grew to 203k units in June, up by 12.7% YoY. With the market experiencing a strong level of growth, the selling rate saw a slight bump in June to 2.40 million units/year, expanding from the 2.27 million units/year reported in May. A return to more normal conditions in June after flooding in some states in May could have contributed to the uptick in activity. Inventory continued to decline, dropping to 235,400 units in June, down from 246,000 in May.

In Argentina, Light Vehicle sales landed at 28,400 in June 2024, dropping by 25.0% YoY as the country grapples with the changing economic landscape. With the removal of the import restrictions, vehicles built overseas have been slowly gaining share in the market, impacting exports. As sales slowed significantly, the selling rate fell to 339k units/year in June, dropping from 376,000 units/year in May.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Global Light Vehicle June Sales Rate at 89 Million Best in 2024

Click for more GlobalData.

The Global Light Vehicle (LV) selling rate reached 89 million units annually in June, not only an improvement on the previous month, but the best result so far this year, according to an analysis released today by the respected GlobalData consultancy.* At 7.6 million vehicles sold, June marked a 2.2% decline year-on-year (YoY), although year-to-date (YTD) sales were up 2.3%.**

“Sales accelerated in China last month with the price war continuing, while in the US sales staggered as a result of a cyberattack affecting dealerships. Europe saw a rise in selling rates, thanks to improvements in both East and West Europe. Meanwhile, Japan recorded lagging sales in the face of supply issues and a subdued macroeconomic climate,” said the GlobalData Light Vehicle Sales Forecasting Team.

GlobalData Commentary, Observations

North America

The US Light Vehicle market seems to have slightly staggered in June 2024, as sales dropped by 4.2% YoY to 1.32 million units. Sales in the country took a hit mainly due to the CDK cyberattack disrupting business operations for dealerships. The selling rate slowed in June to 15.3 million units/year, down from 16.0 million units/year reported in May. Transaction prices saw a slight bump in June, increasing by US$21 MoM bringing the value to US$44,834. Incentives continue to exceed past the US$2,000 level for an eighth consecutive month at US$2695. (read AutoInformed on CDK Cyberattacks Wound June US Light Vehicle Sales)

Canadian Light Vehicle sales reached 168,000, maintaining the same level of sales as seen in the same period last year. The selling rate continued to slow, dropping to 1.63 million units/year in June, from 1.67 million units/year in May, as mentioned in our previous report. Looking at Mexico, sales grew by 9.3% YoY in June, reaching 124k units. With the Mexican economy showing signs of stability, and with strong consumer spending pushing LV sales growth, the selling rate expanded in June 2024 to 1.53 million units/year, marginally increasing from 1.52 million units/year in May

Europe

The Western European LV selling rate rose to 13.9 million units/year in June as 1.4 million vehicles were sold, 2.7% higher YoY. YTD sales passed 7 million units, improving on the same period last year by 4.8%. “We continue to forecast full-year growth for the region, on the order of circa 2%, although this will not match YTD performance. The ECB’s rate cut in June, and forthcoming additional cuts, should begin to support both economic and automotive market activity over the medium term,” GlobalData said.

The LV selling rate for Eastern Europe rose to 5.0 million units/year in June, with 422000 vehicles sold (+18% YoY). Year-to-date sales were 23% stronger than the comparative period last year. “This positive result continues to be driven by robust recovery in Russia, while the Turkish market saw a dramatic selling rate uptick in June, following an easing in the lofty selling rates seen at the start of the year — the economic environment remains highly uncertain in the face of rampant inflation ,” GlobalData said.

China

Advance data indicates that China’s domestic market accelerated for the second month in a row in June. The June selling rate was 26.9 million units/year, up 5.6% from May. During the first half of 2024, the selling rate averaged 23.3 million units/year. In YoY terms, however, sales (wholesales) declined by 9% in June and were flat (+0.6%) in H1 2024. “The government has launched a trade-in subsidy program and lowered the ratio of the required down-payment for auto loans. Yet, the domestic market remained sluggish, while exports of Passenger Vehicles continued to expand by double digits,” GlobalData said.

“To boost flagging sales, OEMs are continuing to cut prices massively. For example, BMW has cut the price of the i3 EV by half. Mercedes and Audi EV prices are now 30 to 40% lower. Sales of luxury cars, in particular foreign brands, are falling sharply, while Chinese brands continue to advance. An official at China’s Ministry of Industry and Information Technology has acknowledged that demand is weak and abnormally intense price competition is damaging earnings in the auto industry and supply chains – and hinted that the government would do more to shore up measures to expand demand,” GlobalData said.

Elsewhere in Asia

The Japanese market decelerated further in June, impacted mainly by the scandals surrounding the government’s certification process. Sales of Toyota and Mazda declined by double digits YoY, as their temporary production suspension of very popular models led to supply shortages. Daihatsu continued to register a plunge in sales as well, as its supply is not catching up with demand after it resumed full production. The June selling rate reached only 4.2 million units/year, down 6% from a weak May. “Not only supply issues, but also falling real wages and higher prices are behind sluggish sales. Heatwaves across the country may have affected showroom traffic, too,” GlobalData said.

Sales in Korea remained sluggish in June. The June selling rate was 1.59 million units/year, flat from May, and the H1 2024 average selling rate was also 1.59 million units/year. Passenger Vehicle sales were pulled ahead by the expiration of the temporary tax cut in June 2023. “Light Commercial Vehicle sales continued to struggle, owing to aging models, high financing costs and weak demand for BEV trucks. Except Renault Korea, all local OEMs registered double-digit YoY declines, due partially to a high base. Imports also fell YoY despite strong sales of Tesla models and the China-built Hyundai Sonata taxis,” GlobalData said.

South America

Brazilian Light Vehicle sales continue to flourish in 2024, as sales grew to 203k units in June, up by 12.7% YoY. With the market experiencing a strong level of growth, the selling rate saw a slight bump in June to 2.40 million units/year, expanding from the 2.27 million units/year reported in May. A return to more normal conditions in June after flooding in some states in May could have contributed to the uptick in activity. Inventory continued to decline, dropping to 235,400 units in June, down from 246,000 in May.

In Argentina, Light Vehicle sales landed at 28,400 in June 2024, dropping by 25.0% YoY as the country grapples with the changing economic landscape. With the removal of the import restrictions, vehicles built overseas have been slowly gaining share in the market, impacting exports. As sales slowed significantly, the selling rate fell to 339k units/year in June, dropping from 376,000 units/year in May.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.