Click for more GlobalData.

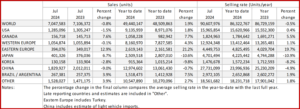

The Global Light Vehicle (LV) selling rate neared 91 million units/year in July, the best result of the year so far, according to numbers just released by the respected GlobalData consultancy.* In a year-on-year (YoY) comparisons market volumes were marginally down on July 2023. Year-to-date (YTD), the market remains in positive territory, up just under 2%.**

“Sales in China maintained a solid pace as NEVs sales continue to gain traction. In the US, YoY sales declined as high vehicle pricing and concerns over the economy weighed on vehicle consumers. The same can be said for Western Europe, which saw its selling rate struggle in July. Meanwhile, the Japanese market surged as supply has begun to catch up from the losses created by the previous vehicle certification issues,” the Global Data Light Vehicle Forecasting Team said.

GlobalData Commentary, Observations

North America

- The US Light Vehicle market saw another YoY decline in July 2024, as sales dropped by 1.5% YoY to1.29 million units. It seems that sales did not recover from June’s CDK cyberattack as strongly as anticipated in the beginning of July. Despite sales dropping on a YoY basis, the selling rate increased in July 2024 to 16.0 million units/year, from 15.3 million June. Transaction prices slowed in July to $44,140, dropping by $694 Month over Month. Incentives grew by US$322 MoM, breaking past the $3000 level for the first time this year at $3017, in a sign that OEMs and dealers may be relenting on high pricing to some degree.

- Canadian Light Vehicle sales reached 157,000, expanding by 7.6% YoY. As sales continue to defy expectations amid an economic downturn, the selling rate expanded to 1.82 million units/year in July, up from the 1.63 million in June.

- Mexican sales grew by 13.9% YoY, reaching 126,000, the strongest monthly result so far into 2024. As consumer spending continues to boost LV sales, the selling rate jumped to 1.60 million/year in July, up from t1.53 million in June.

Europe

- The Western European LV selling rate fell back to 12.9 million units/year in July. Volume at 1.1 million vehicles was flat in YoY terms. YTD sales passed 8 million units, improving on the same period last year by 4.3%. A combination of headwinds continues to thwart growth: high interest rates, high vehicle pricing, and a BEV market slowdown have all hampered growth in the LV market.

- The LV selling rate for Eastern Europe fell to 4.4 million units/year in July. In volume terms, 394,000 vehicles were sold (+12.9% YoY). Year-to-date sales were 21% stronger than the comparative period last year. Russia continues to drive the positive results within the region, while the Turkish market saw a slowdown even though activity remains inflated. The region remains a key risk as the war between Russia and Ukraine intensified.

China

- According to preliminary data, China’s domestic market maintained a solid pace in July. The July selling rate reached 27.7 million units/year, up 2% from June, bringing the YTD average selling rate to 24 million units/year. In YoY terms, however, sales (wholesales) declined by 9% in July and were just lower (-0.7%) YTD. The widening rate of YoY decline should be attributed to abnormally high year-ago levels. It is reported that the share of NEVs in retail sales of Passenger Vehicles exceeded 50%for the first time in July, outselling ICEs.

- As the Chinese government has recently doubled the amount of the temporary trade-in subsidies, the applications for the subsidies are now soaring, indicating that the market is gaining momentum –although the payback will be unavoidable after the incentive program expires at the end of this year. Amid falling sales of foreign brands, some OEMs are changing their game plans. BMW has announced its exit from the bruising price war and increased the prices to focus on earnings, instead of sales volumes. Other foreign luxury brands, such as Mercedes and Audi, are expected to follow suit.

Elsewhere in Asia

- The Japanese market accelerated in July, as production and delivery started to normalize at Daihatsu, Toyota and other OEMs that had the vehicle certification issues. The July selling rate surged to 4.7 million units/year, up 11% from a weak June. In July, sales finally posted a YoY gain (+6.7%) after six consecutive months of decline. As the government has re-approved the certification for most affected models, supply is now catching up – although the recovery in supply and sales could take some time. In the economy, consumer and business confidence could suffer a setback due to the recent plunge in the stock market and the sudden sharp appreciation of the yen.

- The Korean market decelerated further in July after a sluggish H1 2024. The July selling rate was 1.48 million units/year and sales declined by 2.8% in July and nearly 10% YTD. Behind the weak sales so far this year were: 1) the pull-ahead effect of the temporary tax cut last year, 2) Hyundai and Kia’s temporary plant shutdown for retooling earlier this year, 3) high interest rates, 4) weaker model activities in H1 2024, and 5) supply shortages of some popular import brands, such as Mercedes and BMW, due to global logistical issues. However, PV sales are expected to be boosted by a number of new model launches during the rest of this year.

South American

- Brazilian Light Vehicle sales continue to flourish in 2024, as sales grew to 227,000 units in July, up by5.4% YoY. With the market continuing to expand through 2024, the selling rate saw a small bump in July to 2.5 million units/year, up from 2.4 million recorded in June. Despite high interest rates, consumers and businesses are taking advantage of improved credit availability and discounting. Inventory jumped to 256,000 in July as production levels increased, up from 235,000 in June. Days’ supply also increased to 32 days in July, up by 3 days from last month.

- In Argentina, Light Vehicle sales reached 40,300 in July 2024, dropping by 3.9% YoY. Forecasts indicate a possibility of a sales recovery in the second half of 2024 for the country, due to the gap in the exchange rate and more reasonable rates in vehicle financing. The selling rate leaped to 460,000 units/year in July, up from 351,000 in June, making the July value the strongest the rate has been so far in 2024

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

July 2024 Global Light Vehicle Sales at 91 Million Year’s Best

Click for more GlobalData.

The Global Light Vehicle (LV) selling rate neared 91 million units/year in July, the best result of the year so far, according to numbers just released by the respected GlobalData consultancy.* In a year-on-year (YoY) comparisons market volumes were marginally down on July 2023. Year-to-date (YTD), the market remains in positive territory, up just under 2%.**

“Sales in China maintained a solid pace as NEVs sales continue to gain traction. In the US, YoY sales declined as high vehicle pricing and concerns over the economy weighed on vehicle consumers. The same can be said for Western Europe, which saw its selling rate struggle in July. Meanwhile, the Japanese market surged as supply has begun to catch up from the losses created by the previous vehicle certification issues,” the Global Data Light Vehicle Forecasting Team said.

GlobalData Commentary, Observations

North America

Europe

China

Elsewhere in Asia

South American

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.