Click for more.

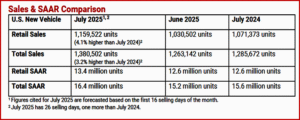

Total U.S. new-vehicle sales for July 2025, including retail and non-retail transactions, are forecast to reach 1,380,500, a 3.2% increase from July 2024 according to a joint forecast from J.D. Power and GlobalData. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 7.4% from 2024. Nonetheless, consumer spending set record for month with $49.8 billion spent on new vehicles if the forecast holds, which is likely given the track record of the source.

“July retail sales are projected to finish 4.1% higher than a year ago but interpreting that gain requires care due to events both last year and this year that disrupted normal monthly sales patterns,” said Thomas King, president of the data and analytics division at J.D. Power.

“There are two timing-related factors to consider. First, year ago results were affected by a dealer software outage in June 2024, which caused 85,000 sales that should have occurred in June to actually occur in July and August 2024, making year-over-year comparisons appear weaker than actual performance. Second, the tariff-related pull-ahead of 173,000 sales into March and April of this year, is now being paid back, deflating July 2025 results,” said King.

“In addition, July results are also being impacted by lower-than-normal incentive escalation by manufacturers. Instead of discounts rising as they normally would at this time of year, incentive spending has edged down to 6.1% of MSRP in July from 6.3% in January, reflecting the cost pressure that manufacturers are under due to tariffs.”

“Finally, the announcement that federal credits of up to $7500 on electric vehicles will expire on Sept. 30 is causing many EV intenders to accelerate their purchases that otherwise would have occurred either later this year or early next year. In sum, the retail sales growth in July is, at first glance, strong but even more so after consideration of the factors described above,” said King.

The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is forecast at 16.4 million units, up 0.8 million units from July 2024.

The Consequences – Bad and Good

- Higher prices translate to higher monthly loan payments. Average monthly finance payments in July are on track to reach $742, an increase of $12 from July 2024, and the highest on record for the month of July. The average interest rate for new-vehicle loans is 6.54%, a decrease of 30 basis points from a year ago. Finance loans with terms greater than or equal to 84 months are expected to reach 11.6% of finance sales this month, up 2.7 percentage points from July 2024.

- Fleet sales are projected to decline 0.8% from a year ago, as manufacturers continue to prioritize retail buyers over the historically less-profitable fleet channel.

- “The average used-vehicle price is trending towards $29,514, up $896 from a year ago. This reflects the combination of reduced supply of recent model-year used vehicles, due to lower new-vehicle production during the pandemic, fewer lease maturities and manufacturers moderating discounts.

- The rise in used prices is good news for new vehicle buyers trading in their used vehicle, but is merely offsetting the higher loan balances that exist on vehicles being traded in. Average trade-in equity in July is $7,984, down $4 from a year ago. The number of new-vehicle buyers with negative equity on their trade-in is expected to reach 25.5%, an increase of 1.9 percentage points from July 2024.

Electrification?

Tyson Jominy, senior vice president of data and analytics at J.D. Power:

“The electric vehicle (EV) market is experiencing a sharp uptick in demand as consumers rush to take advantage of the $7,500 federal incentive before it expires Sept. 30. July marks the first month of this surge, with EVs projected to hit 10.9% retail share, up 1.9 percentage points from June. It’s also the first time this year that the segment has reached double digits.

“Despite the momentum, inventory constraints may soon emerge. June ended with 213,000 EVs in dealer stock, representing a 65-day supply. However, with automakers anticipating a slower fourth quarter, reducing imports due to tariffs, and ramping up marketing and incentives, top EV models could soon become scarce.

“Interestingly, this EV sales burst has not cannibalized hybrid demand. Traditional hybrid share is forecasted to be 13.9% this month—flat from June—but up 2.9 percentage points from July 2024. Meanwhile, plug-in hybrids are benefiting from similar dynamics as EVs, with share forecasted to end at 2.2%, up 0.2 percentage points from a year ago.”

Global Sales Forecast

David Oakley, manager, Americas vehicle sales forecasts at GlobalData:

“June global light-vehicle sales in June increased 1.1% year over year to 7.7 million units, with most regions showing year-over-year growth. The selling rate finished at 91.9 million units, up from 90.0 million units in May.

“China, Japan, Korea, and South America delivered the most significant contributions to year-over-year sales increases in June, but the gains were kept in check by declines in the United States and Europe. In China, pent-up demand helped to fuel growth in sales, as there is a sense that economic uncertainty is easing. Meanwhile, aggressive pricing strategies by Chinese manufacturers are helping stimulate demand within China, even as the trade war creates the potential for lower sales of Chinese brands in some overseas markets.

“July sales are expected to increase 2.1% from July 2024. China and Japan are once again likely to provide the largest year-over-year sales increases. Consumer spending is rising in China, and the automotive sector is seeing further incentives and free upgrades to provide more value to buyers without increasing pricing. There could also be some modest year-over-year gains in Europe this month, but the increase would be partly attributable to weak 2024 sales. The global selling rate is projected to reach 91.3 million units in July, up from a rate of 90.0 million units in July 2024.

“The trade war shows no signs of reaching a conclusion, with the Trump administration threatening further tariffs on various countries in recent weeks. Still, resilience in China and some emerging markets should allow for total 2025 global sales to grow 1.4% year over year, to 90.0 million units.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

July Record – $49.8B Spent New Vehicles in U.S.

Click for more.

Total U.S. new-vehicle sales for July 2025, including retail and non-retail transactions, are forecast to reach 1,380,500, a 3.2% increase from July 2024 according to a joint forecast from J.D. Power and GlobalData. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 7.4% from 2024. Nonetheless, consumer spending set record for month with $49.8 billion spent on new vehicles if the forecast holds, which is likely given the track record of the source.

“July retail sales are projected to finish 4.1% higher than a year ago but interpreting that gain requires care due to events both last year and this year that disrupted normal monthly sales patterns,” said Thomas King, president of the data and analytics division at J.D. Power.

“There are two timing-related factors to consider. First, year ago results were affected by a dealer software outage in June 2024, which caused 85,000 sales that should have occurred in June to actually occur in July and August 2024, making year-over-year comparisons appear weaker than actual performance. Second, the tariff-related pull-ahead of 173,000 sales into March and April of this year, is now being paid back, deflating July 2025 results,” said King.

“In addition, July results are also being impacted by lower-than-normal incentive escalation by manufacturers. Instead of discounts rising as they normally would at this time of year, incentive spending has edged down to 6.1% of MSRP in July from 6.3% in January, reflecting the cost pressure that manufacturers are under due to tariffs.”

“Finally, the announcement that federal credits of up to $7500 on electric vehicles will expire on Sept. 30 is causing many EV intenders to accelerate their purchases that otherwise would have occurred either later this year or early next year. In sum, the retail sales growth in July is, at first glance, strong but even more so after consideration of the factors described above,” said King.

The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is forecast at 16.4 million units, up 0.8 million units from July 2024.

The Consequences – Bad and Good

Electrification?

Tyson Jominy, senior vice president of data and analytics at J.D. Power:

“The electric vehicle (EV) market is experiencing a sharp uptick in demand as consumers rush to take advantage of the $7,500 federal incentive before it expires Sept. 30. July marks the first month of this surge, with EVs projected to hit 10.9% retail share, up 1.9 percentage points from June. It’s also the first time this year that the segment has reached double digits.

“Despite the momentum, inventory constraints may soon emerge. June ended with 213,000 EVs in dealer stock, representing a 65-day supply. However, with automakers anticipating a slower fourth quarter, reducing imports due to tariffs, and ramping up marketing and incentives, top EV models could soon become scarce.

“Interestingly, this EV sales burst has not cannibalized hybrid demand. Traditional hybrid share is forecasted to be 13.9% this month—flat from June—but up 2.9 percentage points from July 2024. Meanwhile, plug-in hybrids are benefiting from similar dynamics as EVs, with share forecasted to end at 2.2%, up 0.2 percentage points from a year ago.”

Global Sales Forecast

David Oakley, manager, Americas vehicle sales forecasts at GlobalData:

“June global light-vehicle sales in June increased 1.1% year over year to 7.7 million units, with most regions showing year-over-year growth. The selling rate finished at 91.9 million units, up from 90.0 million units in May.

“China, Japan, Korea, and South America delivered the most significant contributions to year-over-year sales increases in June, but the gains were kept in check by declines in the United States and Europe. In China, pent-up demand helped to fuel growth in sales, as there is a sense that economic uncertainty is easing. Meanwhile, aggressive pricing strategies by Chinese manufacturers are helping stimulate demand within China, even as the trade war creates the potential for lower sales of Chinese brands in some overseas markets.

“July sales are expected to increase 2.1% from July 2024. China and Japan are once again likely to provide the largest year-over-year sales increases. Consumer spending is rising in China, and the automotive sector is seeing further incentives and free upgrades to provide more value to buyers without increasing pricing. There could also be some modest year-over-year gains in Europe this month, but the increase would be partly attributable to weak 2024 sales. The global selling rate is projected to reach 91.3 million units in July, up from a rate of 90.0 million units in July 2024.

“The trade war shows no signs of reaching a conclusion, with the Trump administration threatening further tariffs on various countries in recent weeks. Still, resilience in China and some emerging markets should allow for total 2025 global sales to grow 1.4% year over year, to 90.0 million units.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.