With with the increasing complexity of technology in new models, there is a growing need for dealers to spend time explaining complicated audio, entertainment and navigation systems

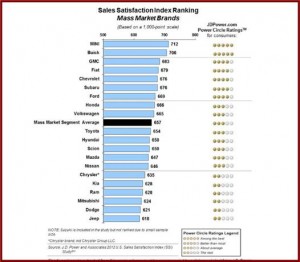

Lexus ranks highest among luxury brands in sales satisfaction during new-vehicle buying for a second consecutive year, with an index score of 737. This is according to consultancy J.D. Power and Associates, which sells its services to virtually the entire U.S. auto industry. Infiniti (728) and Cadillac (725) follow in the luxury segment rankings as the three highest-performing brands. Rankings are based on the experiences of both buyers and rejecters. Premium priced Mini ranks highest among what Power considers mass market brands for the third consecutive year, with a score of 712. Buick (706) and GMC (683) follow in the segment rankings.

Whether it is possible to draw meaningful conclusions from what seem closely ranked sales satisfaction numbers remains an open question among industry marketing executives and observers. Power maintains, not without economic self-interest, that its study is a “comprehensive analysis” of the new-vehicle purchase experience.

The Power study measures customer satisfaction with the selling dealer or satisfaction among buyers. It also measures satisfaction with brands and dealerships that were shopped, but ultimately rejected in favor of the selling brand and dealership or so-called satisfaction among rejecters.

Among buyers, satisfaction has four measures, in order of importance: working out the deal (17%); salesperson (13%); delivery process (11%); and facility (10%).

Among so-called rejecters, satisfaction is rated by five measures, in order of importance: salesperson (20%); fairness of price (12%); facility (6%); inventory (6%); and experience negotiating (5%).

Overall sales satisfaction among both buyers and rejecters averaged 664 on a 1000-point scale in 2012, changing from 648 in 2011.

Satisfaction with the selling dealer averaged 776 in 2012, a five-point change from 2011. Satisfaction went up in three of the four measures that examine it among buyers, with “salesperson” achieving the highest score.

Satisfaction with the dealership where rejecters shopped, but did not buy their vehicle, changed to 553 in 2012, a 28-point difference from 2011, with “significant improvements” alleged in each of the five measures.

Among buyers whose salesperson asked them questions to determine their needs, only 21% perceived some or too much pressure, compared with 32% among those whose salesperson did not ask questions about their needs and who perceived some or too much pressure. These results, claims Power, indicate that customers prefer salespeople who invest the time to listen and ensure they select the right vehicle. Perceived pressure decreases when sales people understand customer needs, according to Power.

Power notes that with the increasing complexity of technology in new models, there is a growing need for dealers to spend time explaining complicated audio, entertainment and navigation systems so buyers can use some of the (alleged?) benefits these technologies offer. A majority (86%) of new-vehicle buyers indicate that the dealer staff spent “just the right amount of time” with them during the delivery. Among the 8% of new-vehicle buyers who say that the dealer staff did not spend enough time at delivery, nearly three-fourths indicated they would have preferred people who spent more time reviewing their vehicle’s features and technologies, such as pairing their phone to Bluetooth or demonstrating the navigation system.

The 2012 U.S. Sales Satisfaction Index or SSI Study is based on responses from 31,386 buyers who purchased or leased their new vehicle in May of 2012. The study was fielded between August and October 2012.