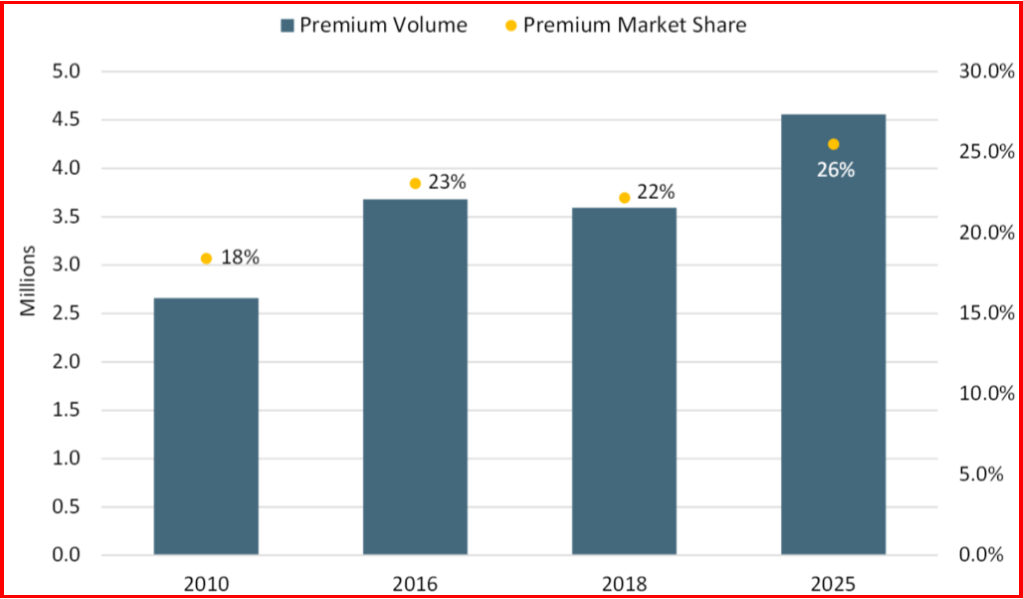

The Premium Car market share in Europe has, generally, been on a steady increase during the last couple of decades,” observes Sammy Chan, Analyst at consultancy LMC. During 2000-2010, Premium market share of European Passenger Cars grew from 15% to 18%. By the end of 2018, it was 22%.

The Premium Car market share in Europe has, generally, been on a steady increase during the last couple of decades,” observes Sammy Chan, Analyst at consultancy LMC. During 2000-2010, Premium market share of European Passenger Cars grew from 15% to 18%. By the end of 2018, it was 22%.

“A closer look, however, reveals that Premium share actually suffered two consecutive years of decline recently,” Chan notes. The £1 Billion questions are: will this drop continue, and should Premium segment players be worried?

In the run-up to the high sales of 2016, when Premium brand market share totaled 23% on volumes of 3.7 million, manufacturers had been releasing an array of new models – the focus of which was – guess what – the SUV segment. During 2017 though Conventional, Sporty and MAVs seemed to have reached saturation point, causing overall model addition to halt. (see chart)

In the run-up to the high sales of 2016, when Premium brand market share totaled 23% on volumes of 3.7 million, manufacturers had been releasing an array of new models – the focus of which was – guess what – the SUV segment. During 2017 though Conventional, Sporty and MAVs seemed to have reached saturation point, causing overall model addition to halt. (see chart)

Inactivity in Conventional model intros, and the proliferation in SUV count, meant there were more SUV model lines available than any other body type for the first time in 2018*.

The SUV model count expansion shows no sign of slowing. Currently LMC expect as many as 30 new SUVs on the Premium market during 2020-2025. Given the current strength of the SUV segment, this should continue Premium market growth.

After a marginal market share fall in 2017 (-0.3 percentage points), the decline picked up pace in 2018 (-0.6 percentage points year-on-year). So, what happened last year?

The changeover to WLTP from NEDC not only distorted selling rates generally but really hits the significant Premium brand Audi, due to lack of model availability caused by previous cheating that needed more work to clean the dirty diesels up. Some potential Audi buyers would have gone to other Premium brands to meet their requirements, but those brands were also in short supply. (WLTP How Does It Work? Will it Work?)

There was also a geographical element to the Premium market decline last year. Despite the UK Premium share proving resilient, as the overall UK market fell back, the relatively large UK Premium volume fell sharply – explaining 37% of the region’s 160,000 Premium volume contraction.

However, neither model supply issues nor the contraction of the UK Premium market** is expected to persist, or resurface, over the next few years LMC thinks. With further model activity and stable, if slightly underwhelming, economic expansion, LMC forecasts European Premium market share to resume growth over the forecast period, albeit more slowly than we have seen through this decade. Looking ahead, LMC expects the overall European Premium share to hover around 25% by the middle of next decade.

* Noteworthy that there remains a substantial gap between SUV and Conventional model count in the Non-Premium segment in favor of Conventional.

** The Brexit path the UK ultimately takes, however, with the large downside forecast risk associated with a no-deal Brexit, could prove to be a major problem for further Premium growth.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Luxury Vehicles No Longer Have Panache?

“A closer look, however, reveals that Premium share actually suffered two consecutive years of decline recently,” Chan notes. The £1 Billion questions are: will this drop continue, and should Premium segment players be worried?

Inactivity in Conventional model intros, and the proliferation in SUV count, meant there were more SUV model lines available than any other body type for the first time in 2018*.

The SUV model count expansion shows no sign of slowing. Currently LMC expect as many as 30 new SUVs on the Premium market during 2020-2025. Given the current strength of the SUV segment, this should continue Premium market growth.

After a marginal market share fall in 2017 (-0.3 percentage points), the decline picked up pace in 2018 (-0.6 percentage points year-on-year). So, what happened last year?

The changeover to WLTP from NEDC not only distorted selling rates generally but really hits the significant Premium brand Audi, due to lack of model availability caused by previous cheating that needed more work to clean the dirty diesels up. Some potential Audi buyers would have gone to other Premium brands to meet their requirements, but those brands were also in short supply. (WLTP How Does It Work? Will it Work?)

There was also a geographical element to the Premium market decline last year. Despite the UK Premium share proving resilient, as the overall UK market fell back, the relatively large UK Premium volume fell sharply – explaining 37% of the region’s 160,000 Premium volume contraction.

However, neither model supply issues nor the contraction of the UK Premium market** is expected to persist, or resurface, over the next few years LMC thinks. With further model activity and stable, if slightly underwhelming, economic expansion, LMC forecasts European Premium market share to resume growth over the forecast period, albeit more slowly than we have seen through this decade. Looking ahead, LMC expects the overall European Premium share to hover around 25% by the middle of next decade.

* Noteworthy that there remains a substantial gap between SUV and Conventional model count in the Non-Premium segment in favor of Conventional.

** The Brexit path the UK ultimately takes, however, with the large downside forecast risk associated with a no-deal Brexit, could prove to be a major problem for further Premium growth.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.