Click to enlarge.

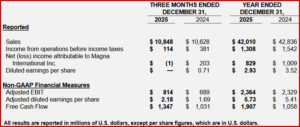

Magna International Inc. (TSX: MG; NYSE: MGA) today reported financial results for the fourth quarter and full year 2025, ending 31 December. Magna 2025 sales were $42,010 million down from 42,836M in 2024. Adjusted EBIT came in at 2,364 Million compared to 2024’s $2,329M. Magna earned $2.93 a diluted share (2024 $3.52).

“We closed 2025 with a strong fourth quarter, successfully navigating another dynamic year in our industry. Our disciplined execution and commitment to operational excellence enabled us to deliver financial results that were in line with, or exceeded, our February 2025 Outlook across all key metrics. We expanded full-year adjusted EBIT margin by 20 basis points and generated robust Free Cash Flow of $1.9 billion,” said Swamy Kotagiri, Magna CEO.

Q4 ending 31 December 2025

Sales of $10.8 billion for the fourth quarter of 2025, an increase of 2% over the fourth quarter of 2024.

The higher sales largely reflects:

- Higher production on certain ongoing programs, and the launch of new programs, including the Ford Expedition and Lincoln Navigator, Xiaomi YU7, and Jetour Zongheng G700;

- Net strengthening of foreign currencies against the U.S. dollar, which increased reported U.S. dollar sales by $355 million;

- Net customer recoveries to largely recoup higher tariff costs incurred during the year; and

- Higher complete vehicle assembly volumes, primarily due to the launch of the Mercedes-Benz G-Class during the fourth quarter of 2024, partially offset by the end of production of the Jaguar I-Pace and Jaguar E-Pace.

These elements were partially offset by:

- Lower engineering revenue, primarily in our Complete Vehicles segment;

- The end of production of certain programs;

- Net commercial items, which had an unfavorable impact on a year-over-year basis, including a customer

- Resolution for a product-related matter during the fourth quarter of 2025; and

- Net customer price concessions subsequent to the fourth quarter of 2024.

Adjusted EBIT increased to $814 million for the fourth quarter of 2025 compared to $689 million for the fourth quarter of 2024, primarily due to:

- Productivity and efficiency improvements, including the benefit of operational excellence initiatives and prior restructuring actions;

- Earnings on higher sales;

- Customer recoveries for tariffs, net of costs incurred;

- Earnings on higher complete vehicle assembly volumes;

- Provisions related to the insolvency of two Chinese OEMs during the fourth quarter of 2024;

- Net strengthening of foreign currencies against the U.S. dollar, which had a $17 million favorable impact on reported U.S. dollar Adjusted EBIT; and

- Lower investments in research, development and our new mobility business

Year Ending 31 December 2025

Magna posted sales of $42.0 billion for the year ending December 31, 2025, compared to $42.8 billion for the year ended December 31, 2024. The lower sales largely reflects:

- Lower light vehicle production in North America and Europe on certain ongoing programs, and the end of

- Production of certain programs, including the Chevrolet Malibu, Ford Edge, and Ford Escape;

- Lower engineering revenue, primarily in our Complete Vehicles segment;

- Net customer price concessions subsequent to 2024;

- Lower complete vehicle assembly volumes, primarily due to the end of production of the Jaguar I-Pace, and Jaguar E-Pace, partially offset by the launch of the Mercedes-Benz G-Class during the fourth quarter of 2024;

- Divestiture of certain operations in India during 2024, net of acquisitions, which decreased sales by $112 million;

- Net commercial items, which had an unfavorable impact on a year-over-year basis, including a customer resolution for a product-related matter during the fourth quarter of 2025.

These factors were partially offset by:

- Launch of new programs during or subsequent to 2024, including the Mercedes-Benz G-Class, GMC Acadia,

- Chevrolet Traverse and Buick Enclave, Skoda Elroq, Audi A5, Cadillac Vistiq, and BMW 1-Series;

- Net strengthening of foreign currencies against the U.S. dollar, which increased reported U.S. dollar sales by $555 million; and

- Net customer recoveries to largely recoup higher tariff costs incurred during the year.

Adjusted EBIT increased to $2.4 billion for the year ending December 31, 2025 compared to $2.3 billion for year ended December 31, 2024 primarily due to:

- Productivity and efficiency improvements, including the benefit of operational excellence initiatives and prior restructuring actions;

- Higher equity income;

- Higher supply chain costs in 2024, due in part to a supplier bankruptcy;

- Lower investments in research, development and our new mobility business; and

- provisions related to the insolvency of two Chinese OEMs during 2024.

Net Commercial Items, which had an unfavorable impact on a year-over-year basis, including:

- A customer resolution for a product-related matter during the fourth quarter of 2025;

- Reduced earnings on lower sales;

- Unfavorable product mix;

- Higher employee profit sharing, stock-based and incentive compensation;

- Higher production input costs net of customer recoveries, primarily for labor;

- Lower income on lower engineering sales, primarily in our Complete Vehicles segment;

- Higher pre-operating costs incurred at new facilities;

- Higher net tariff costs; and

- Net transactional foreign exchange losses in 2025, compared to net transactional foreign exchange gains in 2024.

These factors were partially offset by:

- Net commercial items, which had an unfavorable impact on a year-over-year basis, including:

- A customer resolution for a product-related matter during the fourth quarter of 2025;

- Reduced earnings on lower sales;

- Unfavorable product mix;

- Higher employee profit sharing, stock-based and incentive compensation;

- Higher production input costs net of customer recoveries, primarily for labor;

- Lower income on lower engineering sales, primarily in our Complete Vehicles segment;

- Higher pre-operating costs incurred at new facilities;

- Higher net tariff costs; and

- Net transactional foreign exchange losses in 2025, compared to net transactional foreign exchange gains in 2024.

During the year ended December 31, 2025, income from operations before income taxes was $1.31 billion, and net income attributable to Magna International Inc. was $829 million, decreases of $234 million and $180 million, respectively, each compared to the year ending December 31, 2024.

During the year ending December 31, 2025, diluted earnings per share were $2.93, compared to $3.52 in the year ending December 31, 2024. Adjusted diluted earnings per share were $5.73, compared to $5.41 for the year ending December 31, 2024.

During the year ending December 31, 2025, Magna generated cash from operations of $3.60 billion. Free Cash Flow for the year was $1.91 billion for the full year.

Return Of Capital To Shareholders And Other Matters

- Magna paid dividends of $135 million and $544 million for the three months and year ended December 31, 2025, respectively. In addition, we repurchased 1.7 million shares for $86 million and 3.0 million shares for $137 million, respectively, for the three months and year ended December 31, 2025.

- The Magna Board of Directors declared a fourth quarter dividend of $0.495 per Common Share. This represents a 2% higher dividend, and our 16th consecutive year of fourth quarter dividend increases. The dividend is payable on March 13, 2026 to shareholders of record as of the close of business on February 27, 2026.

“Our 2026 outlook reflects confidence in our ability to build on this momentum. With capital spending expected to remain below historical levels, we anticipate continued strong Free Cash Flow, which we intend to deploy using our long-standing capital allocation framework, including repurchasing the remaining shares available under our current buyback authorization,” said Swamy Kotagiri, Magna CEO.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Magna Posts 2025 EBIT of $2,364 Million

Click to enlarge.

Magna International Inc. (TSX: MG; NYSE: MGA) today reported financial results for the fourth quarter and full year 2025, ending 31 December. Magna 2025 sales were $42,010 million down from 42,836M in 2024. Adjusted EBIT came in at 2,364 Million compared to 2024’s $2,329M. Magna earned $2.93 a diluted share (2024 $3.52).

“We closed 2025 with a strong fourth quarter, successfully navigating another dynamic year in our industry. Our disciplined execution and commitment to operational excellence enabled us to deliver financial results that were in line with, or exceeded, our February 2025 Outlook across all key metrics. We expanded full-year adjusted EBIT margin by 20 basis points and generated robust Free Cash Flow of $1.9 billion,” said Swamy Kotagiri, Magna CEO.

Q4 ending 31 December 2025

Sales of $10.8 billion for the fourth quarter of 2025, an increase of 2% over the fourth quarter of 2024.

The higher sales largely reflects:

These elements were partially offset by:

Adjusted EBIT increased to $814 million for the fourth quarter of 2025 compared to $689 million for the fourth quarter of 2024, primarily due to:

Year Ending 31 December 2025

Magna posted sales of $42.0 billion for the year ending December 31, 2025, compared to $42.8 billion for the year ended December 31, 2024. The lower sales largely reflects:

These factors were partially offset by:

Adjusted EBIT increased to $2.4 billion for the year ending December 31, 2025 compared to $2.3 billion for year ended December 31, 2024 primarily due to:

Net Commercial Items, which had an unfavorable impact on a year-over-year basis, including:

These factors were partially offset by:

During the year ended December 31, 2025, income from operations before income taxes was $1.31 billion, and net income attributable to Magna International Inc. was $829 million, decreases of $234 million and $180 million, respectively, each compared to the year ending December 31, 2024.

During the year ending December 31, 2025, diluted earnings per share were $2.93, compared to $3.52 in the year ending December 31, 2024. Adjusted diluted earnings per share were $5.73, compared to $5.41 for the year ending December 31, 2024.

During the year ending December 31, 2025, Magna generated cash from operations of $3.60 billion. Free Cash Flow for the year was $1.91 billion for the full year.

Return Of Capital To Shareholders And Other Matters

“Our 2026 outlook reflects confidence in our ability to build on this momentum. With capital spending expected to remain below historical levels, we anticipate continued strong Free Cash Flow, which we intend to deploy using our long-standing capital allocation framework, including repurchasing the remaining shares available under our current buyback authorization,” said Swamy Kotagiri, Magna CEO.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.