Click for more.

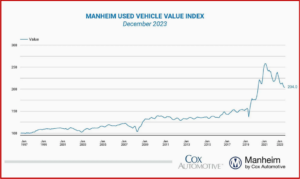

Calendar year 2023 ended with the Manheim* Used Vehicle Value Index down 0.5% in December from November, following a trend that began in the second half of the year. The Manheim Used Vehicle Value Index (MUVVI) dropped to 204.0, down 7% from the previous year, a larger decline than originally forecast. Compared to the index peak in December 2021, used-vehicle values are down ~21%.

“We ended 2023 with about half of the used-vehicle value decline we saw in 2022, but still more than we’d see in a typical year,” said Cox Automotive Chief Economist Jonathan Smoke. “For 2024, the key word for the wholesale market is ‘normalcy.’ Manheim expects constrained growth with a volume increase of less than 1%. As for price patterns, we anticipate a normalization trend, and we expect that 2024 will be the first year in five where we will experience fairly normal depreciation in the wholesale market.”

Manheim Market Report Values Also See Drops

In December, Manheim Market Report (MMR) values saw above-average weekly declines in the final two weeks of the year. Over the last four weeks, the Three-Year-Old Index fell an aggregate of 1.4%, indicating values were falling faster than normal. Those same four weeks delivered an average decline of 0.5% between 2014 and 2019.

Over the month of December, daily MMR Retention – the average difference in price relative to the current MMR – averaged 99.0%, meaning market prices were just below MMR values. The average daily sales conversion rate increased to 53.8%, which indicates demand was improving and relatively strong for the time of year. For comparison, the daily sales conversion rate averaged 52.2% in December 2019.

The major market segments saw seasonally adjusted prices that remained lower year-over-year in December. Compared to December 2022, luxury, pickups, and SUVs lost less than the industry’s decline of 7.0%, down 6.9%, 6.5%, and 6.1%, respectively. Compact cars continued as the worst performer year over year, down 11.7%, followed by mid-size cars, losing 8.1%; and vans, down 7.9%. Compared to last month, luxury lost 0.4%, SUVs were down 0.3%, and mid-size cars declined just 0.1%. Pickups and vans declined by 0.8%, and compact cars lost 0.6%, all worse than the industry’s 0.5% loss.

Used and Wholesale Vehicle Market Forecast for 2024

After historic value increases in 2020 and 2021, followed by stronger depreciation in both 2022 and 2023, used-vehicle values are likely to see slightly higher than average depreciation rates in 2024. Price trends should show muted fluctuations, with lower volatility than observed in 2023 as wholesale volume recovered more over the last year, moving wholesale and retail markets more toward equilibrium. The Manheim Used Vehicle Value Index is forecast to be up 0.5% year over year in December 2024, which would be roughly two points lower than a normal year, according to Manheim.

“As we move into 2024, it’s important to note that used-vehicle values increased faster than the overall rate of inflation,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive.** “So, even though prices have come down over the last two years, they are still about 33% higher than at the end of 2019. More normal declines will likely be seen in the coming years, but the average value of a wholesale unit will continue to be higher than in the past.”

AutoInformed on

*Manheim

Manheim® says it is the nation’s leading provider of end-to-end wholesale vehicle solutions that help dealer and commercial clients increase profits and efficiencies in their used vehicle operations. Through its physical, mobile, and digital sales network, Manheim offers services for decisioning, buying and selling, floor planning, logistics, assurance, and reconditioning. Operating the largest vehicle wholesale marketplace, Manheim provides clients with choices to connect and transact business how and when they want. With nearly 8 million used vehicles offered annually, Manheim team members help the company facilitate transactions representing nearly $80 billion in value. Headquartered in Atlanta, Manheim North America is a Cox Automotive™ brand.

**Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook, or Cox-Automotive-Inc on LinkedIn.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Manheim – Used-Vehicle Values Fall -21% from All-Time High

Click for more.

Calendar year 2023 ended with the Manheim* Used Vehicle Value Index down 0.5% in December from November, following a trend that began in the second half of the year. The Manheim Used Vehicle Value Index (MUVVI) dropped to 204.0, down 7% from the previous year, a larger decline than originally forecast. Compared to the index peak in December 2021, used-vehicle values are down ~21%.

“We ended 2023 with about half of the used-vehicle value decline we saw in 2022, but still more than we’d see in a typical year,” said Cox Automotive Chief Economist Jonathan Smoke. “For 2024, the key word for the wholesale market is ‘normalcy.’ Manheim expects constrained growth with a volume increase of less than 1%. As for price patterns, we anticipate a normalization trend, and we expect that 2024 will be the first year in five where we will experience fairly normal depreciation in the wholesale market.”

Manheim Market Report Values Also See Drops

In December, Manheim Market Report (MMR) values saw above-average weekly declines in the final two weeks of the year. Over the last four weeks, the Three-Year-Old Index fell an aggregate of 1.4%, indicating values were falling faster than normal. Those same four weeks delivered an average decline of 0.5% between 2014 and 2019.

Over the month of December, daily MMR Retention – the average difference in price relative to the current MMR – averaged 99.0%, meaning market prices were just below MMR values. The average daily sales conversion rate increased to 53.8%, which indicates demand was improving and relatively strong for the time of year. For comparison, the daily sales conversion rate averaged 52.2% in December 2019.

The major market segments saw seasonally adjusted prices that remained lower year-over-year in December. Compared to December 2022, luxury, pickups, and SUVs lost less than the industry’s decline of 7.0%, down 6.9%, 6.5%, and 6.1%, respectively. Compact cars continued as the worst performer year over year, down 11.7%, followed by mid-size cars, losing 8.1%; and vans, down 7.9%. Compared to last month, luxury lost 0.4%, SUVs were down 0.3%, and mid-size cars declined just 0.1%. Pickups and vans declined by 0.8%, and compact cars lost 0.6%, all worse than the industry’s 0.5% loss.

Used and Wholesale Vehicle Market Forecast for 2024

After historic value increases in 2020 and 2021, followed by stronger depreciation in both 2022 and 2023, used-vehicle values are likely to see slightly higher than average depreciation rates in 2024. Price trends should show muted fluctuations, with lower volatility than observed in 2023 as wholesale volume recovered more over the last year, moving wholesale and retail markets more toward equilibrium. The Manheim Used Vehicle Value Index is forecast to be up 0.5% year over year in December 2024, which would be roughly two points lower than a normal year, according to Manheim.

“As we move into 2024, it’s important to note that used-vehicle values increased faster than the overall rate of inflation,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive.** “So, even though prices have come down over the last two years, they are still about 33% higher than at the end of 2019. More normal declines will likely be seen in the coming years, but the average value of a wholesale unit will continue to be higher than in the past.”

AutoInformed on

*Manheim

Manheim® says it is the nation’s leading provider of end-to-end wholesale vehicle solutions that help dealer and commercial clients increase profits and efficiencies in their used vehicle operations. Through its physical, mobile, and digital sales network, Manheim offers services for decisioning, buying and selling, floor planning, logistics, assurance, and reconditioning. Operating the largest vehicle wholesale marketplace, Manheim provides clients with choices to connect and transact business how and when they want. With nearly 8 million used vehicles offered annually, Manheim team members help the company facilitate transactions representing nearly $80 billion in value. Headquartered in Atlanta, Manheim North America is a Cox Automotive™ brand.

**Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook, or Cox-Automotive-Inc on LinkedIn.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.