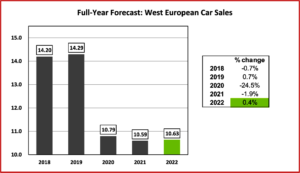

The West European selling rate dropped to 9.0 mn units/year in March, from 10 mn units/year in February, bringing the Q1 2022 average to just 9.6 mn units/year, according to the LMC Automotive* consultancy.

“The start to 2022 has been very disappointing as the automotive industry continues to endure the impact of supply problems. To make matters worse, the horrific war in Ukraine only adds to these issues,” LMC said. (AutoInformed: West European Car Sales Flat Before Russian War On Ukraine; Global Light Vehicle Sales Rate Drops in February; German Automakers Bearing Brunt of Putin’s War on Ukraine)

In Germany, the selling rate fell slightly to 2.4 mn units/year in March, from 2.7 mn units/year previously. The UK personal vehicle (PV) selling rate dropped to 1.2 mn units/year in March, from 1.9 mn units/year in February. In France, the selling rate remained at a disappointing 1.4 mn units/year. In Spain, the selling rate fell to 574k, from 700k units/year previously, after a trucking strike delayed deliveries. Finally, in Italy, the selling rate dropped to 1.1 mn units/year in March, from 1.2mn units/year in February.

“Our forecast has been trimmed since last month as registration statistics continue to languish in the face of supply bottlenecks, these exacerbated due to the war. We still anticipate selling rates to improve over the course of 2022 but now at a slower rate than forecast last month. The war will chip away at underlying demand as well, through higher-for-longer inflation and lower real incomes, though our view is that the initial impact on registrations will be felt through a worsening of supply constraints, as, at least for now, demand is still outstripping supply,” LMC said.

*LMC Automotive is part of the LMC group, originally founded in 1980, which provides market intelligence, analysis and advice to clients around the world involved with agricultural commodities, foods, industrial materials, bio-fuels and their end-markets. A separate company in the group specializes in the coverage of the rubber and tire sectors.

Mitsubishi Motors Corporation has stopped production at its Kaluga plant in Russia until further notice. Due to the logistical difficulties, vehicle exports and parts supply to Russia have been suspended since March. (Well, this is far from over – Autocrat)