Electric vehicles (EVs) are increasing market share, cars are becoming more connected, and autonomous vehicles are gradually starting to appear on more streets worldwide. However, the transition to new technologies has not been without challenges and kinks, especially with consumer sentiment in the EV sector, according to the Annual Mobility Survey by the respected McKinsey & Company consultancy. Respondents came from China, Europe, and the United States. The 2025 survey released today is ongoing. It will eventually include respondents from nine countries [an unknown number of which Trump wants to takeover – AutoCrat].

“After rising rapidly for years, EV sales growth has slowed in many regions. Meanwhile, new competitors, especially those from China, are entering the EV market and attracting attention by offering innovative and technologically-sophisticated vehicles that are often more affordable than offerings from incumbents,” according to the detailed, multi-sourced McKinsey analysis.*

“Along with regulation, infrastructure buildup, technology evolution and model supply, consumers are a central piece of the EV puzzle, and their behavior helps explain the global adoption curve. Consequently, OEMs and other industry stakeholders should stay close to the current consumer pulse on EVs to understand demand patterns, including region-specific trends. Our Mobility Consumer Pulse Survey, conducted annually in major automotive markets worldwide since 2016, sheds light on some of the most recent market twists, including the impact of Chinese EVs, vehicle features that consumers find most compelling, and the perceived obstacles that make buyers hesitant to transition from an internal combustion engine (ICE) vehicle to an EV,” McKinsey said.

Globally, Consumers Share Similar Concerns and Expectations about EVs

Click to enlarge.

“Issues related to range, price, and charging continue to be top concerns for potential EV buyers. Factors that would convince respondents to switch to an EV include a more built-out public charging network and faster battery recharging speed. Better value stability for EVs is also a concern, especially as EV technology is still evolving.

When asked what factors would tip the balance in favor of an EV purchase, a longer driving range topped the list and was cited by almost half of respondents. Respondents also were asked to identify the average minimum real driving range4 that would convince them to consider shifting to an EV; their average response is about 500 kilometers (310 miles), up from 425 kilometers (264 miles) in the 2022 survey. Many prospective buyers are concerned about range because they think about ‘edge cases,’ such as long vacation trips, rather than their typical daily driving behavior when estimating their needs. Current BEV owners tend to have range requirements about 10% lower than those without EV driving experience.

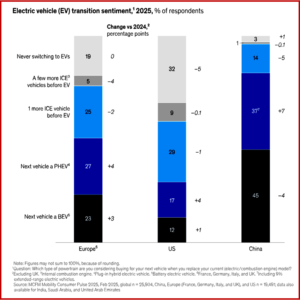

Intent to Buy an EV Varies by Region. Differences Increasing

“Although EV uptake has increased worldwide, it has always varied by region. In 2024, for instance, about 50% of vehicles sold in China were EVs. Of these, 28% were battery electric vehicles (BEVs), 15% plug-in hybrid electric vehicles (PHEVs), and 6% extended-range electric vehicles (EREVs). China is the only market where EREVs are now available at scale. By contrast, EVs accounted for only 21% of vehicles sold in Europe – 14% BEV, 7% PHEV. EV sales were lowest in the United States, at 10% – 8% BEV, 2% PHEV, with uptake varying vastly by state and region.[Europe here refers to the four countries where The McKinsey survey was conducted: France, Germany, Italy, and the United Kingdom. Based on data from EV Volumes, S&P Light Vehicle Sales, and McKinsey Center for Future Mobility.]

Click to enlarge.

“Across regions, EV purchase intent is highest among customers who already have experience with an EV. Surprisingly, this also includes multicar households that currently have an ICE and a BEV, with the majority indicating they will replace their ICE with a BEV as their next car. This finding contradicts the commonly held assumptions that BEVs are only used as the secondary household car, driven for shorter trips, and that consumers may keep an ICE as backup in their garage forever,” McKinsey observed.

“EV uptake is likely to continue to grow across regions. In China, 45% of respondents state that their next car will be a BEV; this compares with 23% in Europe and 12% in the United States. In a departure from current sales trends, customer intent to purchase a PHEV is higher than intent to buy a BEV in the United States and Europe, and it is almost as high as BEV intent in China. These findings highlight the continued relevance of hybrids in the EV transition [Stated intent in a survey cannot be directly translated to actual sales because of stated-intent bias, meaning survey respondents typically overestimate their purchase behavior because they do not have to spend real money in a survey. Most likely, actual EV sales will be below the intent-to-purchase numbers, McKinsey observes]

China Leads

“China has been experiencing EV growth at unbroken high levels, with sales accounting for more than 50% of all vehicles sold in some months. Globally, China’s EV sales are by far the largest. Sales and customer data suggest that the future of China’s market will be electric, with more than 80% of Chinese respondents stating that their next car will likely be electric. This demand suggests that the market has transitioned from “regulatory push” to “consumer pull.” In the short term, hybrids (both PHEVs and EREVs) will likely play an important role in supporting the transition to BEVs.

Moderate Growth in Europe

“In Europe, the EV share of new-car sales declined slightly over the past 18 months, going from 24% in 2022 to 21% in 2024. The recent survey shows an increase of five percentage points in the number of people who plan to buy a PHEV or BEV as their next vehicle, compared with the 2024 survey. Despite this rise, European EV sales are unlikely to be high enough to satisfy the mid-to-long-term regulatory targets in the European Union.

When looking at specific European countries, different trends emerge:

- Demand fell after the government ended purchase subsidies at the end of 2023, but it has recently picked up. (The 2025 survey shows an increase of eight percentage points in EV purchase intent compared with February 2024.) Germany is also the only European country in the survey where BEV purchase intent, at 30%, outweighs PHEV intent, at 18%.

- EV purchase intent is growing moderately in Italy. Consistent with past years, more Italian respondents want a PHEV than a BEV: 41% versus 17%.

- United Kingdom. Of British respondents, 25% state that they plan to get a BEV as their next vehicle, and 22% want a PHEV, both of which exceed the UK purchase intent levels in previous years.

- EV purchase intent is growing moderately, with 21% of French car buyers planning to get a BEV and 29% opting for a PHEV.

Slow transition in the United States

“In the United States, EV sales and consumer interest in EV purchases have remained flat over the past few years, but the results vary significantly by location (by state and by specific location within a state). In states that have adopted the rules of the California Air Resource Board (CARB), for example, 38% of respondents state that their next car will be electric (BEV or PHEV), compared with 25% in non-CARB states. EV purchase intent is highest in California (above 50%) but is well below 20% in about 25 other states, mostly in the South and Midwest.

“The contrast between residents of urban and rural areas is equally stark: EV transition sentiment in urban areas (51%) is more than 2.5 times higher than that in rural areas (18%). Purchase intent for hybrid EVs—both plug-in and full hybrids—is higher than that for BEVs. These trends suggest that the overall EV transition in the United States will continue at a slow pace, and ICE and hybrid-electric-vehicle (HEV) technology will remain relevant over the longer term. OEMs should review their portfolios accordingly,” McKinsey recommended.

However, “lower prices could help tip the balance in favor of EVs. To maintain healthy margins at lower average price levels, OEMs need to evaluate their cost structures and eventually optimize them. New EV start-ups have achieved a cost base per vehicle that is 30 to 50% below that of established OEMs. Overall product costs are particularly low for Chinese OEMs, both new entrants and domestic incumbents. This occurs because they have lower factor costs (such as those for battery components) and more cost-effective vehicle architecture, including streamlined electrical-electronic architecture, among other reasons. China’s competitive landscape is still maturing and may consolidate in the future,” McKinsey observed.

*Thanks and a tip of the AutoInformed fedora to Patrick Hertzke a partner in McKinsey’s Boston office; Patrick Schaufuss a partner in the Munich office, where Anna-Sophie Smith is an asset leader; Philipp Kampshoff a senior partner in the Houston office; Timo Möller a partner in the Cologne office; and Felix Rupalla senior asset leader in the Stuttgart office. These people thank Deston Barger, Isabela Hidalgo-Giraldo, Jan Paulitschek, Kathrin Kiefer, and Zoé-Alexandra Smarandoiu for their contributions. This McKinsey analysis release was edited by Eileen Hannigan, a senior editor in the Boston office.

McKinsey on EVs – China Most Advanced Region by Far

Electric vehicles (EVs) are increasing market share, cars are becoming more connected, and autonomous vehicles are gradually starting to appear on more streets worldwide. However, the transition to new technologies has not been without challenges and kinks, especially with consumer sentiment in the EV sector, according to the Annual Mobility Survey by the respected McKinsey & Company consultancy. Respondents came from China, Europe, and the United States. The 2025 survey released today is ongoing. It will eventually include respondents from nine countries [an unknown number of which Trump wants to takeover – AutoCrat].

“After rising rapidly for years, EV sales growth has slowed in many regions. Meanwhile, new competitors, especially those from China, are entering the EV market and attracting attention by offering innovative and technologically-sophisticated vehicles that are often more affordable than offerings from incumbents,” according to the detailed, multi-sourced McKinsey analysis.*

“Along with regulation, infrastructure buildup, technology evolution and model supply, consumers are a central piece of the EV puzzle, and their behavior helps explain the global adoption curve. Consequently, OEMs and other industry stakeholders should stay close to the current consumer pulse on EVs to understand demand patterns, including region-specific trends. Our Mobility Consumer Pulse Survey, conducted annually in major automotive markets worldwide since 2016, sheds light on some of the most recent market twists, including the impact of Chinese EVs, vehicle features that consumers find most compelling, and the perceived obstacles that make buyers hesitant to transition from an internal combustion engine (ICE) vehicle to an EV,” McKinsey said.

Globally, Consumers Share Similar Concerns and Expectations about EVs

Click to enlarge.

“Issues related to range, price, and charging continue to be top concerns for potential EV buyers. Factors that would convince respondents to switch to an EV include a more built-out public charging network and faster battery recharging speed. Better value stability for EVs is also a concern, especially as EV technology is still evolving.

When asked what factors would tip the balance in favor of an EV purchase, a longer driving range topped the list and was cited by almost half of respondents. Respondents also were asked to identify the average minimum real driving range4 that would convince them to consider shifting to an EV; their average response is about 500 kilometers (310 miles), up from 425 kilometers (264 miles) in the 2022 survey. Many prospective buyers are concerned about range because they think about ‘edge cases,’ such as long vacation trips, rather than their typical daily driving behavior when estimating their needs. Current BEV owners tend to have range requirements about 10% lower than those without EV driving experience.

Intent to Buy an EV Varies by Region. Differences Increasing

“Although EV uptake has increased worldwide, it has always varied by region. In 2024, for instance, about 50% of vehicles sold in China were EVs. Of these, 28% were battery electric vehicles (BEVs), 15% plug-in hybrid electric vehicles (PHEVs), and 6% extended-range electric vehicles (EREVs). China is the only market where EREVs are now available at scale. By contrast, EVs accounted for only 21% of vehicles sold in Europe – 14% BEV, 7% PHEV. EV sales were lowest in the United States, at 10% – 8% BEV, 2% PHEV, with uptake varying vastly by state and region.[Europe here refers to the four countries where The McKinsey survey was conducted: France, Germany, Italy, and the United Kingdom. Based on data from EV Volumes, S&P Light Vehicle Sales, and McKinsey Center for Future Mobility.]

Click to enlarge.

“Across regions, EV purchase intent is highest among customers who already have experience with an EV. Surprisingly, this also includes multicar households that currently have an ICE and a BEV, with the majority indicating they will replace their ICE with a BEV as their next car. This finding contradicts the commonly held assumptions that BEVs are only used as the secondary household car, driven for shorter trips, and that consumers may keep an ICE as backup in their garage forever,” McKinsey observed.

“EV uptake is likely to continue to grow across regions. In China, 45% of respondents state that their next car will be a BEV; this compares with 23% in Europe and 12% in the United States. In a departure from current sales trends, customer intent to purchase a PHEV is higher than intent to buy a BEV in the United States and Europe, and it is almost as high as BEV intent in China. These findings highlight the continued relevance of hybrids in the EV transition [Stated intent in a survey cannot be directly translated to actual sales because of stated-intent bias, meaning survey respondents typically overestimate their purchase behavior because they do not have to spend real money in a survey. Most likely, actual EV sales will be below the intent-to-purchase numbers, McKinsey observes]

China Leads

“China has been experiencing EV growth at unbroken high levels, with sales accounting for more than 50% of all vehicles sold in some months. Globally, China’s EV sales are by far the largest. Sales and customer data suggest that the future of China’s market will be electric, with more than 80% of Chinese respondents stating that their next car will likely be electric. This demand suggests that the market has transitioned from “regulatory push” to “consumer pull.” In the short term, hybrids (both PHEVs and EREVs) will likely play an important role in supporting the transition to BEVs.

Moderate Growth in Europe

“In Europe, the EV share of new-car sales declined slightly over the past 18 months, going from 24% in 2022 to 21% in 2024. The recent survey shows an increase of five percentage points in the number of people who plan to buy a PHEV or BEV as their next vehicle, compared with the 2024 survey. Despite this rise, European EV sales are unlikely to be high enough to satisfy the mid-to-long-term regulatory targets in the European Union.

When looking at specific European countries, different trends emerge:

Slow transition in the United States

“In the United States, EV sales and consumer interest in EV purchases have remained flat over the past few years, but the results vary significantly by location (by state and by specific location within a state). In states that have adopted the rules of the California Air Resource Board (CARB), for example, 38% of respondents state that their next car will be electric (BEV or PHEV), compared with 25% in non-CARB states. EV purchase intent is highest in California (above 50%) but is well below 20% in about 25 other states, mostly in the South and Midwest.

“The contrast between residents of urban and rural areas is equally stark: EV transition sentiment in urban areas (51%) is more than 2.5 times higher than that in rural areas (18%). Purchase intent for hybrid EVs—both plug-in and full hybrids—is higher than that for BEVs. These trends suggest that the overall EV transition in the United States will continue at a slow pace, and ICE and hybrid-electric-vehicle (HEV) technology will remain relevant over the longer term. OEMs should review their portfolios accordingly,” McKinsey recommended.

However, “lower prices could help tip the balance in favor of EVs. To maintain healthy margins at lower average price levels, OEMs need to evaluate their cost structures and eventually optimize them. New EV start-ups have achieved a cost base per vehicle that is 30 to 50% below that of established OEMs. Overall product costs are particularly low for Chinese OEMs, both new entrants and domestic incumbents. This occurs because they have lower factor costs (such as those for battery components) and more cost-effective vehicle architecture, including streamlined electrical-electronic architecture, among other reasons. China’s competitive landscape is still maturing and may consolidate in the future,” McKinsey observed.

*Thanks and a tip of the AutoInformed fedora to Patrick Hertzke a partner in McKinsey’s Boston office; Patrick Schaufuss a partner in the Munich office, where Anna-Sophie Smith is an asset leader; Philipp Kampshoff a senior partner in the Houston office; Timo Möller a partner in the Cologne office; and Felix Rupalla senior asset leader in the Stuttgart office. These people thank Deston Barger, Isabela Hidalgo-Giraldo, Jan Paulitschek, Kathrin Kiefer, and Zoé-Alexandra Smarandoiu for their contributions. This McKinsey analysis release was edited by Eileen Hannigan, a senior editor in the Boston office.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.