Click to enlarge.

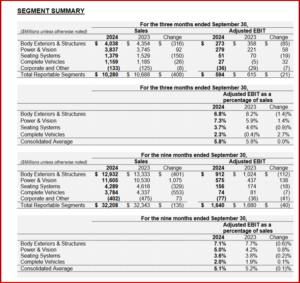

Magna International (NYSE: MGA) today posted sales of $10.3 billion (footnote 1: 1C$ = 0.736 US$) for Q3 2024, a decrease of 4% from the third quarter of 2023. The lower sales come from a 4% decrease in global light vehicle production, including 6% lower production in North America and China, and a 2% decline in Europe. Adjusted EBIT decreased to $594 million in the third quarter of 2024 compared to $615 million in the third quarter of 2023. This was the result of reduced earnings on lower sales, higher production input costs net of customer recoveries, and lower equity income. However, income from operations before income taxes increased to $700 million for the third quarter of 2024 compared to $538 million in the third quarter of 2023 for the giant Canadian-based global mega-supplier to the auto industry.*

“We continue to mitigate industry headwinds including lower production volumes in each of our core regions. Our ongoing initiatives and results to date reinforce our conviction in our free cash flow outlook this year and beyond. As we continuously seek to optimize value creation, we are resuming share repurchases in the fourth quarter –ahead of our prior plan,” said Swamy Kotagiri, Magna’s Chief Executive Officer.

Net income attributable to Magna International Inc. was $484 million for the third quarter of 2024 compared to $394 million in the third quarter of 2023, which includes Other (income) expense, net (footnote 2), after tax and Amortization of acquired intangibles totaling $(115) million and $25 million in the third quarters of 2024 and 2023, respectively. Excluding Other (income) expense, net, after tax and Amortization of acquired intangibles from both periods, net income attributable to Magna International Inc. decreased $50 million in the third quarter of 2024 compared to the third quarter of 2023.

Diluted earnings per share were $1.68 in the third quarter of 2024, up when compared to $1.37 in the comparable period. Adjusted diluted earnings per share were $1.28, down $0.18 from $1.46 for the third quarter of 2023,including $0.10 due to a higher income tax rate.

“In the third quarter of 2024, we generated cash from operations before changes in operating assets and liabilities of $785 million and used $58 million in operating assets and liabilities. Investment activities for the third quarter of 2024 included $476 million in fixed asset additions, $115 million in investments, other assets and intangible assets and $1 million in private equity investments. (footnote 2) Other (income) expense, net is comprised of Fisker Inc. [“Fisker”] related impacts (restructuring and impairment of assembly and production assets, the impairment of Fisker warrants, and the recognition of previously deferred revenue), revaluations of certain public company warrants and equity investments, restructuring activities and gain on business combination, during the three and nine months ended September 30, 2023 & 2024,” MAGNA said in the earnings release.

*AutoInformed on

Footnote 1: 1C$ = 0.736 US$

Footnote 2: Other (income) expense, net is comprised of Fisker Inc. related impacts (restructuring and impairment of assembly and production assets, the impairment of Fisker warrants, and the recognition of previously deferred revenue), revaluations of certain public company warrants and equity investments, restructuring activities and gain on business combination, during the three and nine months ended September 30, 2023 & 2024.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Oh Canada – Magna Q3 Sales Off but Net Earnings Up

Click to enlarge.

Magna International (NYSE: MGA) today posted sales of $10.3 billion (footnote 1: 1C$ = 0.736 US$) for Q3 2024, a decrease of 4% from the third quarter of 2023. The lower sales come from a 4% decrease in global light vehicle production, including 6% lower production in North America and China, and a 2% decline in Europe. Adjusted EBIT decreased to $594 million in the third quarter of 2024 compared to $615 million in the third quarter of 2023. This was the result of reduced earnings on lower sales, higher production input costs net of customer recoveries, and lower equity income. However, income from operations before income taxes increased to $700 million for the third quarter of 2024 compared to $538 million in the third quarter of 2023 for the giant Canadian-based global mega-supplier to the auto industry.*

“We continue to mitigate industry headwinds including lower production volumes in each of our core regions. Our ongoing initiatives and results to date reinforce our conviction in our free cash flow outlook this year and beyond. As we continuously seek to optimize value creation, we are resuming share repurchases in the fourth quarter –ahead of our prior plan,” said Swamy Kotagiri, Magna’s Chief Executive Officer.

Net income attributable to Magna International Inc. was $484 million for the third quarter of 2024 compared to $394 million in the third quarter of 2023, which includes Other (income) expense, net (footnote 2), after tax and Amortization of acquired intangibles totaling $(115) million and $25 million in the third quarters of 2024 and 2023, respectively. Excluding Other (income) expense, net, after tax and Amortization of acquired intangibles from both periods, net income attributable to Magna International Inc. decreased $50 million in the third quarter of 2024 compared to the third quarter of 2023.

Diluted earnings per share were $1.68 in the third quarter of 2024, up when compared to $1.37 in the comparable period. Adjusted diluted earnings per share were $1.28, down $0.18 from $1.46 for the third quarter of 2023,including $0.10 due to a higher income tax rate.

“In the third quarter of 2024, we generated cash from operations before changes in operating assets and liabilities of $785 million and used $58 million in operating assets and liabilities. Investment activities for the third quarter of 2024 included $476 million in fixed asset additions, $115 million in investments, other assets and intangible assets and $1 million in private equity investments. (footnote 2) Other (income) expense, net is comprised of Fisker Inc. [“Fisker”] related impacts (restructuring and impairment of assembly and production assets, the impairment of Fisker warrants, and the recognition of previously deferred revenue), revaluations of certain public company warrants and equity investments, restructuring activities and gain on business combination, during the three and nine months ended September 30, 2023 & 2024,” MAGNA said in the earnings release.

*AutoInformed on

Footnote 1: 1C$ = 0.736 US$

Footnote 2: Other (income) expense, net is comprised of Fisker Inc. related impacts (restructuring and impairment of assembly and production assets, the impairment of Fisker warrants, and the recognition of previously deferred revenue), revaluations of certain public company warrants and equity investments, restructuring activities and gain on business combination, during the three and nine months ended September 30, 2023 & 2024.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.