Click to Enlarge.

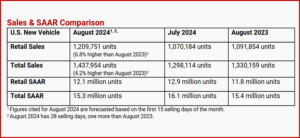

Absolute new-vehicle sales for August 2024, including retail and non-retail transactions, are set to reach 1,437,954, a 4.2% increase from August 2023 on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.* August 2024 has 28 selling days, one more than August 2023. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 8.1% from 2023.

“New-vehicle sales in August are up from a year ago, as expected. A key element of the improvement is that this year, the Labor Day holiday weekend falls within the August** sales reporting period instead of September where it normally falls,” said Thomas King, president of the data and analytics division at J.D. Power. “While the sales results for August will be positive, the seasonally adjusted annualized rate (SAAR), which corrects for Labor Day timing, is relatively modest at just 15.3 million units.”

New-vehicle retail sales for August 2024 are forecast to increase from a year ago. Retail sales of new vehicles projected at 1,209,800, a 6.8% increase from August 2023 when adjusting for selling days. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 10.8% from 2023.

Data Points

- The average new-vehicle retail transaction price in August is expected to reach $44,039, down $1895 from August 2023. (The high for any month, $47,329, was set in December 2022.)

- Average incentive spending per unit in August is expected to reach $3035, up $1132 from August 2023. Spending as a percentage of the average MSRP is expected to increase to 6.2%, up 2.3 percentage points from August 2023.

- Average incentive spending per unit on trucks/SUVs in August is expected to be $3234, up $1254 from a year ago. Average spending on cars is expected to be $2242, up $639 from a year ago.

- Retail buyers are on pace to spend $50.7 billion on new vehicles, up $3.0 billion from August 2023.

- Trucks/SUVs are on pace to account for 80.0% of new-vehicle retail sales in August.

- Fleet sales are expected to total 228,202 units in August, down 7.7% from August 2023. Fleet volume is expected to account for 15.9% of total light-vehicle sales, down 2.0 percentage points from a year ago.

- Average interest rates for new-vehicle loans are expected to be 6.87%, down 36 basis points from a year ago.

GlobalData and J.D. Power Observations

- The modest August SAAR reflects the trade-off between key factors: discounts from dealers and manufacturers are rising while average transaction prices are falling. As a result, the sales pace should improve. However, inventory – while rising for the industry as a whole – remains lean for some high-volume brands, which is limiting their sales pace. In addition, used-vehicle values continue to fall, which means buyers returning to showrooms have less equity in their trade-ins.

- The auto industry is still dealing with the effects of reduced leasing activity from three years ago. Fewer leases signed then mean fewer lessees are returning to dealers to purchase or lease a new vehicle today. The number of expiring leases decreased 8.4% from July and decreased 16% from August 2023. With fewer lease customers returning to the market, there are fewer opportunities for new sales.

- Retail inventory is projected to be around 1.7 million units, a 4.2% recovery from July and a 43.5% increase from August 2023.

- The average new-vehicle retail transaction price is declining from a year ago due to higher manufacturer incentives, larger retailer discounts and rising availability of lower-priced vehicles. Transaction prices are trending towards $44,039, down $1895 or 4.1%, compared to August 2023. The combination of higher retail sales and lower transaction prices means that buyers are on track to spend ~ $50.7 billion on new vehicles this month, 6.3% higher than August 2023.

- Total retailer profit per unit, which includes vehicles gross plus finance and insurance income, is expected to be $2249, down 33% from August 2023. Rising inventory is the primary factor behind the profit decline and fewer vehicles are selling above the manufacturer’s suggested retail price (MSRP). Thus far, only 13.0% of new vehicles have been sold above MSRP, which is down from 31.2% in August 2023.

- Total aggregate retailer profit from new-vehicle sales for this month is projected to be $2.6 billion, down 26% from August 2023.

EV Outlook

“The J.D. Power EV Index, which tracks the path to parity of EVs with gas-powered vehicles, reached a historic high score in July of 56 on a 100-point scale. July marked the fifth consecutive month that the EV Index rose but it’s the six factors that make up the index that tell the real story of the EV ecosystem’s dynamics.,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power.

“One factor – interest – reached a high for the year with 28% of new-vehicle shoppers saying they are ‘very likely’ to consider a battery electric vehicle for their next purchase, but the industry seems to be struggling to attract more buyers than a year ago, even with the tremendous improvements in another factor, availability. Availability has increased 22 points year over year, with 66% of shoppers now having a viable alternative to a gas-powered equivalent.

“Incentives have helped align prices in popular compact and mid-size mass market segments, making them more affordable. Mass market and premium BEVs are at and above parity with gas-powered alternatives—from a total cost of ownership standpoint—and this is driven by aggressive manufacturer incentives; federal and state incentives; and lower operating costs. BEV monthly retail sales have held steady at 9.2% of the market for two consecutive months. While infrastructure remains insufficient, customer satisfaction with charging in the second quarter improved for a second consecutive quarter. Especially noteworthy is the satisfaction experienced by Ford and Rivian owners now having access to the Tesla charging network. An increase in the transition to EVs will take time, with several interdependent variables affecting adoption, but the foundation is growing as consumers try to match vehicle options with their lifestyle.”

Global Sales Outlook

“The global light-vehicle selling rate rose again in July 2024, increasing 200,000 units from June to 89.9 million units. While the sales pace remains at a healthy level, July decreased from 92.2 million units in July 2023 as the early inventory recovery supported pent-up demand a year ago,” said Jeff Schuster, vice president of research, automotive at GlobalData.

“Volume declined for the second consecutive month, with July falling 1.6% from July 2023. Year-to-date sales volume through July reached 49.3 million units, marking a 1.7% increase from year-to-date July 2023. Sales performance in July was mixed, with some key markets showing weakness compared with the previous year. The domestic market in China experienced the largest decline, falling 10.3%. Posting declines were India (-3.3%), South Korea (-2.8%), the United States (-1.5%) and Western Europe (-0.6%). The volume markets showing growth were Eastern Europe (+8.4%) and Japan (+6.7%). As the base effect from last year’s strong recovery affects growth rates, some market volumes are leveling off, leading to constrained growth that could affect the remainder of the year.

“August is expected to maintain a selling rate at or slightly above July’s 90-million-unit level, but volume is projected to decline at least 1% from August 2023. China and Western Europe are anticipated to decline from the previous year, with Western Europe particularly affected by a more than 20% pullback in Germany. Markets expected to show positive gains in August include Japan, North America and Eastern Europe, but these increases are not expected to be sufficient to offset the declines.

“The global demand recovery is showing signs of slowing, with lower volume tempering the outlook for the rest of the year. The 2024 sales forecast remains at 88.7 million units, representing a 2.2% increase from 2023. While the overall environment and volume level remain healthy, any significant near-term increase in demand has been put on hold. There is a downside volume risk of approximately 500,000-750,000 units in 2024 with five months remaining in the year.”

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Slight Labor Day Jump Forecast for August US Auto Sales

Click to Enlarge.

Absolute new-vehicle sales for August 2024, including retail and non-retail transactions, are set to reach 1,437,954, a 4.2% increase from August 2023 on a selling day adjusted basis, according to a joint forecast from J.D. Power and GlobalData.* August 2024 has 28 selling days, one more than August 2023. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 8.1% from 2023.

“New-vehicle sales in August are up from a year ago, as expected. A key element of the improvement is that this year, the Labor Day holiday weekend falls within the August** sales reporting period instead of September where it normally falls,” said Thomas King, president of the data and analytics division at J.D. Power. “While the sales results for August will be positive, the seasonally adjusted annualized rate (SAAR), which corrects for Labor Day timing, is relatively modest at just 15.3 million units.”

New-vehicle retail sales for August 2024 are forecast to increase from a year ago. Retail sales of new vehicles projected at 1,209,800, a 6.8% increase from August 2023 when adjusting for selling days. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 10.8% from 2023.

Data Points

GlobalData and J.D. Power Observations

EV Outlook

“The J.D. Power EV Index, which tracks the path to parity of EVs with gas-powered vehicles, reached a historic high score in July of 56 on a 100-point scale. July marked the fifth consecutive month that the EV Index rose but it’s the six factors that make up the index that tell the real story of the EV ecosystem’s dynamics.,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power.

“One factor – interest – reached a high for the year with 28% of new-vehicle shoppers saying they are ‘very likely’ to consider a battery electric vehicle for their next purchase, but the industry seems to be struggling to attract more buyers than a year ago, even with the tremendous improvements in another factor, availability. Availability has increased 22 points year over year, with 66% of shoppers now having a viable alternative to a gas-powered equivalent.

“Incentives have helped align prices in popular compact and mid-size mass market segments, making them more affordable. Mass market and premium BEVs are at and above parity with gas-powered alternatives—from a total cost of ownership standpoint—and this is driven by aggressive manufacturer incentives; federal and state incentives; and lower operating costs. BEV monthly retail sales have held steady at 9.2% of the market for two consecutive months. While infrastructure remains insufficient, customer satisfaction with charging in the second quarter improved for a second consecutive quarter. Especially noteworthy is the satisfaction experienced by Ford and Rivian owners now having access to the Tesla charging network. An increase in the transition to EVs will take time, with several interdependent variables affecting adoption, but the foundation is growing as consumers try to match vehicle options with their lifestyle.”

Global Sales Outlook

“The global light-vehicle selling rate rose again in July 2024, increasing 200,000 units from June to 89.9 million units. While the sales pace remains at a healthy level, July decreased from 92.2 million units in July 2023 as the early inventory recovery supported pent-up demand a year ago,” said Jeff Schuster, vice president of research, automotive at GlobalData.

“Volume declined for the second consecutive month, with July falling 1.6% from July 2023. Year-to-date sales volume through July reached 49.3 million units, marking a 1.7% increase from year-to-date July 2023. Sales performance in July was mixed, with some key markets showing weakness compared with the previous year. The domestic market in China experienced the largest decline, falling 10.3%. Posting declines were India (-3.3%), South Korea (-2.8%), the United States (-1.5%) and Western Europe (-0.6%). The volume markets showing growth were Eastern Europe (+8.4%) and Japan (+6.7%). As the base effect from last year’s strong recovery affects growth rates, some market volumes are leveling off, leading to constrained growth that could affect the remainder of the year.

“August is expected to maintain a selling rate at or slightly above July’s 90-million-unit level, but volume is projected to decline at least 1% from August 2023. China and Western Europe are anticipated to decline from the previous year, with Western Europe particularly affected by a more than 20% pullback in Germany. Markets expected to show positive gains in August include Japan, North America and Eastern Europe, but these increases are not expected to be sufficient to offset the declines.

“The global demand recovery is showing signs of slowing, with lower volume tempering the outlook for the rest of the year. The 2024 sales forecast remains at 88.7 million units, representing a 2.2% increase from 2023. While the overall environment and volume level remain healthy, any significant near-term increase in demand has been put on hold. There is a downside volume risk of approximately 500,000-750,000 units in 2024 with five months remaining in the year.”

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.