Click to enlarge eye test.

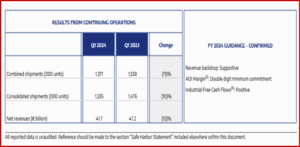

Stellantis N.V. (NYSE: STLA) today reported Q1 2024 financial results that showed net revenues of €41.7 billion off -12% compared to Q1 2023 on consolidated shipments of 1,335,000 vehicles, down 10%. Stellantis claimed these reflected production actions and inventory management to prepare for new product wave in H2 2024 compared with strong shipments in Q1 2023.

“We are getting ready to show you the true color of Stellantis as we bring new products to market where we have multi energy opportunities that will allow us to benefit from a cost side while addressing the consumers in the best way,” said Natalie Knight CFO of Stellantis. “While there are things we would love to have seen different and better in the first quarter and we are very proud of where we’re moving when it comes to market share and inventory. We think we’re doing things in the right way.”

During Q1 2024, it debuted four new models out of a 2024 launch plan of 25 models, including 18 BEV nameplates. Stellantis declared an ordinary dividend of €1.55 per share (16% increase versus prior year) approved at AGM to be paid to shareholders on 3 May 2024. Its €3.0 billion share buyback is on track for 2024 completion, Stellantis said. Notable EV introductions were the Fiat Topolino, Maserati Grecale Folgore, Ram ProMaster EV.*

Stellantis reiterated a minimum commitment of double-digit Adjusted operating income (AOI) margin in 2024, as well as positive Industrial free cash flow, despite macroeconomic uncertainties. Stellantis claimed that it is on track to deliver total capital returns in 2024 more than €7.7 billion, for an 11% yield as a percentage of Stellantis market capitalization on 1 January 2024. It is likely that its value will go down in the short term. The company, in AutoInformed’s view is in a transition that requires the balancing of market share, product cost, revenue and development of new offerings. It is not alone among automakers, and like Ford Motor it has its challenges (Ford Motor Posts Q1 2024 Net Income of $1.3 Billion). It is lagging General Motors (GM Posts $3 Billion in Q1 Earnings. Raises 2024 Guidance).

Significant Technological Items – The Ante Required

- Started production of in-house designed and manufactured electric drive modules at Indiana Transmission (U.S.). Class-leading power density 250kw units will be installed in upcoming STLA Large vehicles (Dodge, Jeep, Alfa Romeo, Chrysler, etc.).

- Began cell and module production with battery partner ACC in Europe. LG Energy Solution and Samsung SDI to follow. Battery components will be assembled into high-energy density, Stellantis-designed and manufactured battery packs ranging from 80 to 120 kWh in size.

- Expanded in-house production of hydrogen fuel cell vehicles on both mid-size and large vans in Hordain (France) and Gliwice (Poland). Fuel cell van extended lineup and increased in-house, industrial-scale production. Pro One is commercial vehicles leader in Europe.

- Refined traditional propulsion systems: Started production of the all-new 2.2L MultiJet 4.0 clean diesel engine (Euro 6e and 7 compatible) at Pratola Serra (Italy) plant.

- Through the eTransmissions Assembly joint venture launched electrified dual-clutch transmission production in Turin (Italy) to help power next-generation, Stellantis-brand hybrids.

- First OEM to integrate ChatGPT functionality as standard, starting with deployment of new travel assistant across entire DS brand range, followed by Peugeot in its i-Cockpit® system, with plans to extend across the Stellantis portfolio.

- Created the world’s first virtual cockpit platform as part of Stellantis Virtual Engineering Workbench enabling engineering teams to deliver infotainment tech to customers quicker through faster development cycles and feedback loops.

- Launched MyTasks, a claimed industry-first tool for fleet managers enabling real-time communication, task assignment and status updates with drivers in the field via the vehicle’s infotainment unit.

- Acquired artificial intelligence framework, machine learning models, intellectual property rights and patents of CloudMade, a developer of big data-driven automotive solutions to support mid-term development of STLA SmartCockpit.

- Stellantis Ventures strategic investments in SteerLight: developer of high-performance, low-cost LiDAR tech, which has the potential to improve advanced driver assistance systems. Tiamat, which develops and commercializes sodium-ion battery tech at a lower cost per kilowatt-hour and free of lithium and cobalt.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis Q1 Revenues, Shipments Drop – Transition or Trend?

Click to enlarge eye test.

Stellantis N.V. (NYSE: STLA) today reported Q1 2024 financial results that showed net revenues of €41.7 billion off -12% compared to Q1 2023 on consolidated shipments of 1,335,000 vehicles, down 10%. Stellantis claimed these reflected production actions and inventory management to prepare for new product wave in H2 2024 compared with strong shipments in Q1 2023.

“We are getting ready to show you the true color of Stellantis as we bring new products to market where we have multi energy opportunities that will allow us to benefit from a cost side while addressing the consumers in the best way,” said Natalie Knight CFO of Stellantis. “While there are things we would love to have seen different and better in the first quarter and we are very proud of where we’re moving when it comes to market share and inventory. We think we’re doing things in the right way.”

During Q1 2024, it debuted four new models out of a 2024 launch plan of 25 models, including 18 BEV nameplates. Stellantis declared an ordinary dividend of €1.55 per share (16% increase versus prior year) approved at AGM to be paid to shareholders on 3 May 2024. Its €3.0 billion share buyback is on track for 2024 completion, Stellantis said. Notable EV introductions were the Fiat Topolino, Maserati Grecale Folgore, Ram ProMaster EV.*

Stellantis reiterated a minimum commitment of double-digit Adjusted operating income (AOI) margin in 2024, as well as positive Industrial free cash flow, despite macroeconomic uncertainties. Stellantis claimed that it is on track to deliver total capital returns in 2024 more than €7.7 billion, for an 11% yield as a percentage of Stellantis market capitalization on 1 January 2024. It is likely that its value will go down in the short term. The company, in AutoInformed’s view is in a transition that requires the balancing of market share, product cost, revenue and development of new offerings. It is not alone among automakers, and like Ford Motor it has its challenges (Ford Motor Posts Q1 2024 Net Income of $1.3 Billion). It is lagging General Motors (GM Posts $3 Billion in Q1 Earnings. Raises 2024 Guidance).

Significant Technological Items – The Ante Required

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.