Click to enlarge.

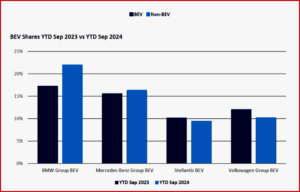

A mere five days after Carlos Tavares* was ousted from the CEO job at Stellantis over his embrace of electric vehicles as the core of the global automaker’s strategy, Stellantis said it would rejoin the European Automobile Manufacturers’ Association** (aka ACEA at AutoInformed), the lobbying group of 15 major European automakers. Under Tavares, Stellantis resigned from ACEA, which has been advocating slow-walking fines for automakers that fail to meet intermediate carbon reduction targets set for 2025. Battery electric vehicles sales in the EU have been tanking this year.

“ACEA welcomes the application from Stellantis to rejoin the association. Given Europe’s unprecedented competitiveness crisis and collective need to master the challenges of the green transformation, it is more important than ever to stand united. ACEA members may be competitors on the market, but they all share the same goal: a competitive and sustainable transition to zero-emission mobility, in a Europe that can stand its ground globally. This we will continue working on with full drive and commitment,” stated Luca de Meo, ACEA President and CEO of Renault Group.

Back in November ACEA said that “New data from S&P Global reveals a worsening outlook for the EU battery-electric vehicle (BEV) market amid shifting economic conditions. Between the first and second halves of 2024 market expectations significantly evolved, prompting a reassessment of EU trends.

“S&P Global data reveals a substantial downward revision in BEV market share forecasts for 2025, from 27% in the first half of the year to 21% today. This recalibration signals a major compliance setback for the EU’s 2025 CO2 emission targets, linked directly to the reduced BEV market penetration, stoking concern across EU capitals….

“The European Automobile Manufacturers’ Association (ACEA) has consistently urged EU policymakers to address the steep compliance costs associated with the 2025 targets, caused to a large extent by factors outside manufacturers’ control, such as a lack of widespread charging infrastructure and EV market stimulus. A robust, comprehensive and immediate review of the current approach is essential, given that the current trajectory diverges sharply from earlier projections. In light of recent economic and geopolitical challenges, ACEA calls for urgent cost relief in 2025 and an expedited review of the CO2 standards for both light- and heavy-duty vehicles to safeguard EU industry competitiveness,” said Sigrid de Vries, ACEA Director General.

The Amsterdam Hedge

In a related development today Monday 9 December, the first meeting of the Stellantis Dealers Associations was held in Amsterdam, with 110 participants from 20 European countries. The stated main objective “was to define together the 2025 priorities both for Sales and After Sales activities, in a particularly challenging market that is undergoing a revolutionary transition to electric power.” AutoInformed notes the irony and nuance of this position compared to Tavare’s aspirations.

Jean-Philippe Imparato, Stellantis Chief Operating Officer for Enlarged Europe, attended with his top Brand and Marketing & Sales executives, and firmly reiterated the centrality of the dealer network for the Stellantis project: “The Stellantis distribution network is fundamental to our business: we are all Stellantis, and only by maintaining open collaboration and a climate of mutual trust can we overcome and win the challenges that await us in this period of great change.”

Imparato asserted 2025 goals stressing the need for simplification and streamlining of processes, with a view to continuous support for the network from a commercial, financial, and ITC perspective. The sales goals are to increase both market share and the share of electric vehicles, to comply with stringent European regulations.

*AutoInformed on

**ACEA

The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group

The EU automobile industry

- 2 million Europeans work in the automotive sector.

- 3% of all manufacturing jobs in the EU.

- €383.7 billion in tax revenue for European governments.

- €106.7 billion trade surplus for the European Union.

- Over 7.5% of EU GDP generated by the auto industry.

- €72.8 billion in R&D spending annually, 33% of EU total.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Tavares Out. Stellantis Back into ACEA!

Click to enlarge.

A mere five days after Carlos Tavares* was ousted from the CEO job at Stellantis over his embrace of electric vehicles as the core of the global automaker’s strategy, Stellantis said it would rejoin the European Automobile Manufacturers’ Association** (aka ACEA at AutoInformed), the lobbying group of 15 major European automakers. Under Tavares, Stellantis resigned from ACEA, which has been advocating slow-walking fines for automakers that fail to meet intermediate carbon reduction targets set for 2025. Battery electric vehicles sales in the EU have been tanking this year.

“ACEA welcomes the application from Stellantis to rejoin the association. Given Europe’s unprecedented competitiveness crisis and collective need to master the challenges of the green transformation, it is more important than ever to stand united. ACEA members may be competitors on the market, but they all share the same goal: a competitive and sustainable transition to zero-emission mobility, in a Europe that can stand its ground globally. This we will continue working on with full drive and commitment,” stated Luca de Meo, ACEA President and CEO of Renault Group.

Back in November ACEA said that “New data from S&P Global reveals a worsening outlook for the EU battery-electric vehicle (BEV) market amid shifting economic conditions. Between the first and second halves of 2024 market expectations significantly evolved, prompting a reassessment of EU trends.

“S&P Global data reveals a substantial downward revision in BEV market share forecasts for 2025, from 27% in the first half of the year to 21% today. This recalibration signals a major compliance setback for the EU’s 2025 CO2 emission targets, linked directly to the reduced BEV market penetration, stoking concern across EU capitals….

“The European Automobile Manufacturers’ Association (ACEA) has consistently urged EU policymakers to address the steep compliance costs associated with the 2025 targets, caused to a large extent by factors outside manufacturers’ control, such as a lack of widespread charging infrastructure and EV market stimulus. A robust, comprehensive and immediate review of the current approach is essential, given that the current trajectory diverges sharply from earlier projections. In light of recent economic and geopolitical challenges, ACEA calls for urgent cost relief in 2025 and an expedited review of the CO2 standards for both light- and heavy-duty vehicles to safeguard EU industry competitiveness,” said Sigrid de Vries, ACEA Director General.

The Amsterdam Hedge

In a related development today Monday 9 December, the first meeting of the Stellantis Dealers Associations was held in Amsterdam, with 110 participants from 20 European countries. The stated main objective “was to define together the 2025 priorities both for Sales and After Sales activities, in a particularly challenging market that is undergoing a revolutionary transition to electric power.” AutoInformed notes the irony and nuance of this position compared to Tavare’s aspirations.

Jean-Philippe Imparato, Stellantis Chief Operating Officer for Enlarged Europe, attended with his top Brand and Marketing & Sales executives, and firmly reiterated the centrality of the dealer network for the Stellantis project: “The Stellantis distribution network is fundamental to our business: we are all Stellantis, and only by maintaining open collaboration and a climate of mutual trust can we overcome and win the challenges that await us in this period of great change.”

Imparato asserted 2025 goals stressing the need for simplification and streamlining of processes, with a view to continuous support for the network from a commercial, financial, and ITC perspective. The sales goals are to increase both market share and the share of electric vehicles, to comply with stringent European regulations.

*AutoInformed on

**ACEA

The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group

The EU automobile industry

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.