Click to enlarge.

Swamy Kotagiri the Chief Executive Officer of MAGNA* spoke to the Automotive Press Association this week in Michigan about the complexities of the global automobile industry. He spoke as global volumes are relatively flat and volumes in North America and Europe are down. Now programs are being canceled after the investments are made. Volumes are being reduced after the capacity is installed.

“There is increased spending over a smaller number of units. This is sub-optimal for returns. And what does our industry look for? Scale and we need stability to be efficient through the value chain, given how the industry works to be efficient,” said Kotagiri, whose next big event is the Shanghai Motor Show at the end of the month to be held in the midst of the ongoing Trump versus the world trade wars. Last year MAGNA did ~$5.5 billion in sales in China, growing 15%.

“Technology is evolving rapidly. Whether it’s in electrification, or assisted driving or full autonomy. In addition, there this is: Adjacent areas are also changing drastically, whether it be robotics, whether it’s the applications of AI in manufacturing,” Kotagiri said. “It’s also driving consumer preferences. The expectations are increased and it is also varying from region to region.”

“The more fundamental issue is the lack of stability in the schedule and which means you cannot plan workforce properly without the entire cost and operational inefficiencies. And this is not to say there is one guilty party here, I’m talking about the industry as a whole, said Kotagiri.**

One internal research study of 12 leading OEMs shows an estimated Capital Expenditure during 2024 of ~$200 billion.

Click to enlarge.

“Our industry thrives on scale and we have to get back to that,” said Kotagiri. “And we have to look at partnerships. We have to look at alliances maybe differently and we have to manage risks and the key word is we have to manage risk together. The problems we are facing as an industry require time.

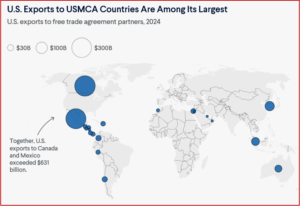

“So I’m going to close out with … Obviously, the ideal situation would probably be going back to 0% tariffs. But what would be a compromise? Is it 10%? Or is that higher? Lower? What would they compromise be in your ideal situation? I mean, compromise is not in terms of how much tariff you can have. Compromise is how do you have a policy road map that is clear and it says whatever that is. I think the industry can figure out a way to deal with it, right? So I think certainty on policy in a time frame is the most important thing.” [disclosure Ken Zino was a founding member of the Automotive Press Association, its first president and a decades long board member.]

*Magna is a global mobility technology company with ~170,000 employees and 448 manufacturing operations and ~90 product development, engineering and sales centers in 28 countries.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Trump Tariff Pandemic is Crisis for the U.S. Auto Industry

Click to enlarge.

Swamy Kotagiri the Chief Executive Officer of MAGNA* spoke to the Automotive Press Association this week in Michigan about the complexities of the global automobile industry. He spoke as global volumes are relatively flat and volumes in North America and Europe are down. Now programs are being canceled after the investments are made. Volumes are being reduced after the capacity is installed.

“There is increased spending over a smaller number of units. This is sub-optimal for returns. And what does our industry look for? Scale and we need stability to be efficient through the value chain, given how the industry works to be efficient,” said Kotagiri, whose next big event is the Shanghai Motor Show at the end of the month to be held in the midst of the ongoing Trump versus the world trade wars. Last year MAGNA did ~$5.5 billion in sales in China, growing 15%.

“Technology is evolving rapidly. Whether it’s in electrification, or assisted driving or full autonomy. In addition, there this is: Adjacent areas are also changing drastically, whether it be robotics, whether it’s the applications of AI in manufacturing,” Kotagiri said. “It’s also driving consumer preferences. The expectations are increased and it is also varying from region to region.”

“The more fundamental issue is the lack of stability in the schedule and which means you cannot plan workforce properly without the entire cost and operational inefficiencies. And this is not to say there is one guilty party here, I’m talking about the industry as a whole, said Kotagiri.**

One internal research study of 12 leading OEMs shows an estimated Capital Expenditure during 2024 of ~$200 billion.

Click to enlarge.

“Our industry thrives on scale and we have to get back to that,” said Kotagiri. “And we have to look at partnerships. We have to look at alliances maybe differently and we have to manage risks and the key word is we have to manage risk together. The problems we are facing as an industry require time.

“So I’m going to close out with … Obviously, the ideal situation would probably be going back to 0% tariffs. But what would be a compromise? Is it 10%? Or is that higher? Lower? What would they compromise be in your ideal situation? I mean, compromise is not in terms of how much tariff you can have. Compromise is how do you have a policy road map that is clear and it says whatever that is. I think the industry can figure out a way to deal with it, right? So I think certainty on policy in a time frame is the most important thing.” [disclosure Ken Zino was a founding member of the Automotive Press Association, its first president and a decades long board member.]

*Magna is a global mobility technology company with ~170,000 employees and 448 manufacturing operations and ~90 product development, engineering and sales centers in 28 countries.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.