Mark Stewart, Stellantis North America COO, told employees today that the company’s “First Economic Proposal to the UAW” (aka the 2023 contract) includes “significant wage increases in each year of the contract and, in percentage terms, this opening offer is larger than where we ultimately landed in 2019.” The contract, which represents ~43,000 employees expires at 11:59 p.m. on 14 September. The offer came as Stellantis was celebrating the opening of a battery center in Italy saying it was committed to Italian workers. Stellantis resulted from the merger in January 2021 of Fiat Chrysler, aka FCA, and Peugeot or PSA. (AutoInformed: Stellantis Opens Its First Battery Technology Center in Italy)

“This is a responsible and strong offer that positions us to continue providing good jobs for our employees today and in the next generation here in the U.S. It also protects the company’s future ability to continue to compete globally in an industry that is rapidly transitioning to electric vehicles. Because we know this is important to you and your families, we remain committed to bargaining in good faith and reaching a fair agreement,” said Mike Resha, Head of North America Manufacturing.

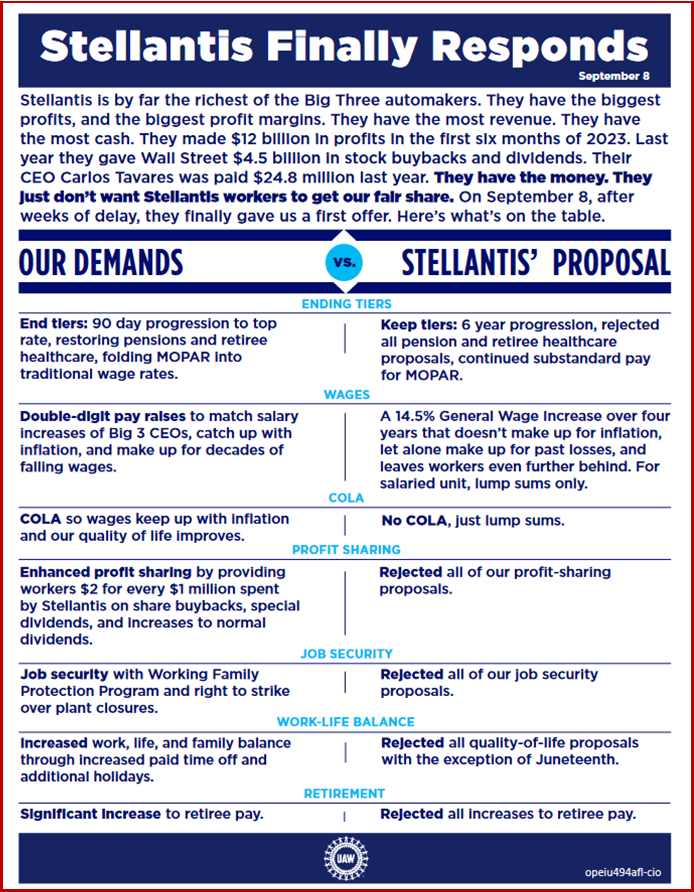

The UAW told its members that “after weeks of delay, Stellantis finally came back with a counterproposal to our core economic demands. It’s a deeply unfair offer. The wage proposal doesn’t make up for inflation, let alone make up for past losses.” This – so far – is a toning down of the fierce rhetoric employed during Big Three UAW negotiations this year. It is a helpful and positive trend we hope continues.

Stellantis offer

For Most Represented Employees:

- Wage increases in each year of the contract totaling 14.5% (no lump sums)

- Inflation protection:

- $6,000 one-time inflation protection payment in first year of the contract.

- $4,500 in inflation protection payments over the final three years of the contract.

For All Represented Employees:

- Juneteenth as a paid holiday.

For Supplemental and In-Progression Employees:

Supplemental employees:

- Wage increase from starting rate of $15.78/hour to $20/hour (a $4.22/hour increase).

In-progression employees:

- Accelerate progression timeline from eight years to six years, potentially reducing the time that employees can reach the max wage rate by 25%.

This is unbelievably bad timing given that stock buybacks that enrich management and shareholders is one of the contentious issues between the Big Three and the UAW where the contract expires at 11:59 pm this Thursday night. Is anybody at Stellantis taking the UAW seriously???? – Ken Zino, aka AutoCrat.

AMSTERDAM – Stellantis N.V. (“Stellantis” or the “Company”) announced today that pursuant to its Share Buyback Program (the “Program”) announced on February 22, 2023, covering up to €1.5 billion (total purchase price excluding ancillary costs) to be executed in the open market with the intent to cancel the common shares acquired through the Program and following the completion of the first and second tranches of the Program as previously announced, Stellantis has signed a share buyback agreement for the third tranche of its Program with an independent investment firm that makes its trading decisions concerning the timing of purchases independently of Stellantis.

This agreement will cover a maximum amount of up to €500 million. The third tranche of the Program shall start on September 11, 2023 and end no later than December 11, 2023. Common shares purchased under the Program will be cancelled in due course.

Any buyback of common shares in relation to this announcement will be carried out under the authority granted by the general meeting of shareholders held on April 13, 2023, up to a maximum of 10% of the Company’s capital, or any renewed or extended authorization to be granted at a future general meeting of the Company. The purchase price per common share will be no higher than an amount equal to 110% of the market price of the shares on the NYSE, Euronext Milan or Euronext Paris (as the case may be). The market price will be calculated as the average of the highest price on each of the five days of trading prior to the date on which the acquisition is made, as shown in the official price list of the NYSE, Euronext Milan or Euronext Paris. The share buybacks will be carried out subject to market conditions and in compliance with applicable rules and regulations, including the Market Abuse Regulation 596/2014 and the Commission Delegated Regulation (EU) 2016/1052.

As of today, following the relevant portions of the first and second tranches, the remaining authorization stands at approximately 260 million shares, which is expected to be adequate to cover this Program, as well as any repurchase(s) of the 99.2 million shares currently owned by Chinese JV partner Dongfeng Corporation under the terms announced on July 15, 2022.