Click for more information.

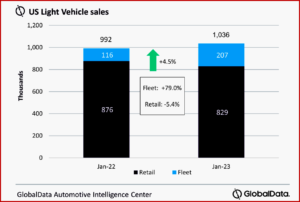

US Light Vehicle sales totaled 1.04 million units in January, according to data just released by LMC Automotive.* This is a Year-over-Year gain of 4.5%, with the same number of selling days as in January 2022. Nevertheless, January 2022 was the first January to fail to reach 1 million units since 2012. LMC put it succinctly: “if we excluded last year, January 2023 would be the worst opening month of the year since 2014.”

The usual problems remain – record high transaction prices, economic uncertainty, the Federal Reserve’s determination to send the economy into a recession via its ongoing interest rate increases, skimpy inventory caused by supply chain disruptions for some major automakers, notably Ford and Toyota – all make for a rerun of the flop show Pandemic Blues. So good luck reopening that show in 2023 with the same cast and plot.

General Motors is running on all cylinders.

“Interest rates for vehicle financing increased significantly throughout 2022 and are expected to increase further in first-half 2023. The average rate on a new-vehicle finance contract in January 2023 should reach 6.8%, an increase of 264 basis points year over year, says J.D. Power. The Fed increased the targeted range of the Fed Funds Rate by 25 basis points at its first meeting of 2023. This increase will push vehicle-financing rates higher in coming months, and we believe that the Fed will increase rates a couple more times before pausing later this year,” said Patrick Manzi, the Chief Economist of the National Automobile Dealers Association.

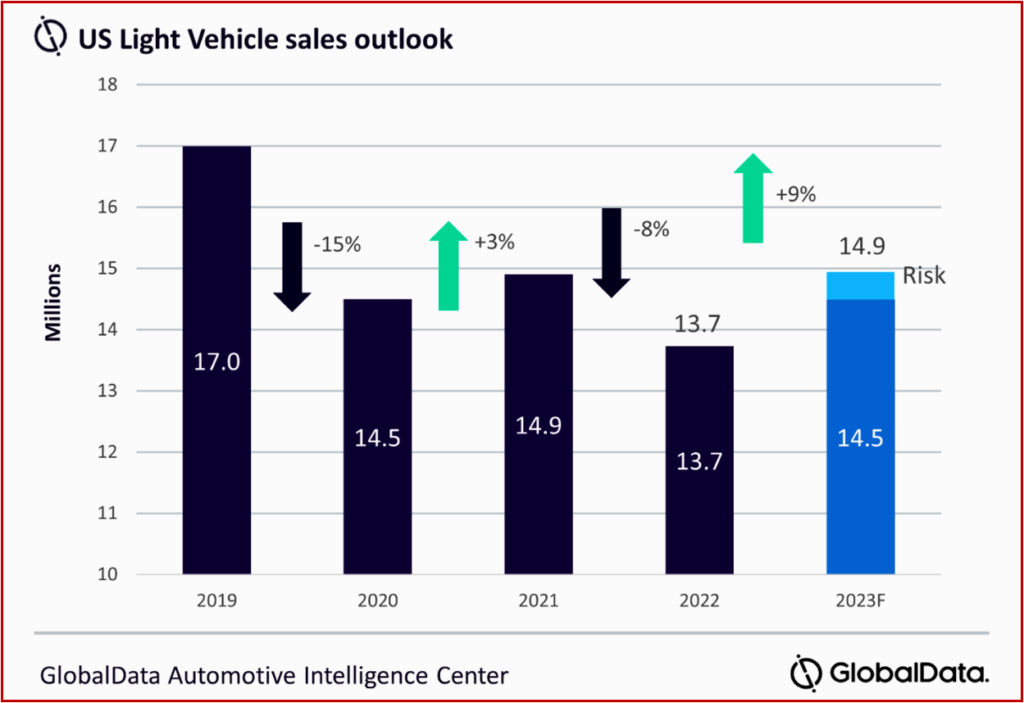

The January selling rate, aka SAAR, was 15.8 million units/year, up from 13.5 million units/year in December. “While on paper this appears to represent a rapid acceleration in the market, in reality we need to be cautious before jumping to that conclusion. While in December the rate was kept in check by the fact that December has historically been a strong month for sales, January’s traditional weakness seems to have inflated the selling rate last month,” LMC said.

The executive summary: market fundamentals have not changed significantly from December to January. Supply disruptions are distorting normal seasonality. The daily selling rate is estimated at 43,200 units/selling day in January, compared to 47,500 units/selling day in December.

“The market performed largely as expected in January. In year-on-year terms, volumes were up, but sales are still subdued compared to their pre-pandemic levels. Retail sales appeared to fall YoY, with the highest share for fleet sales since the onset of the pandemic helping to keep the total market afloat. Fleet traditionally sees a bump in share in January, and we expect this side of the market to play an increasingly important role in 2023 as the retail environment becomes more challenging. Overall, these results suggest that the market can grow this year, despite the challenges, barring any further major shocks,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

According to preliminary estimates, retail sales totaled around 829,000 units, while fleet accounted for approximately 207,000 units, representing 20.0% of the total market, the highest share since March 2020.

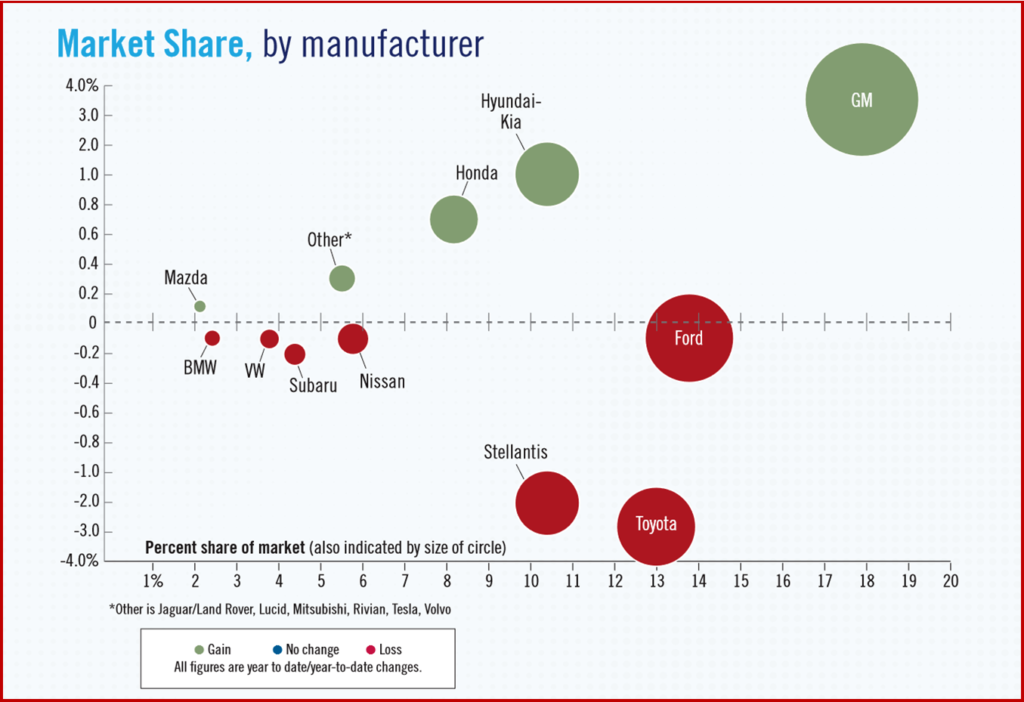

General Motors once again was the leading automaker, with its lead over Toyota Group (the number one global seller in 2022) to more than 50,000 units, compared to 41,000 in December. Toyota Group continues with inventory shortages, and slipped behind Ford Group into third place.

LMC notes and we concur that GM is now be operating at close to normal, having been one of the first manufacturers to suffer from supply chain disruption. Underlining this trend was the fact that not only did the Toyota brand fail to be the bestselling brand last month – as had been the case frequently in 2022 – it also fell behind Chevrolet into third place.

Ford claimed the number one spot in the rankings, as it did in December. The Ford F-150 retained its title as the bestselling Light Vehicle in January, ahead of the Chevrolet Silverado by 8k units. The usual AutoInformed caveat applies here strong GMC and Hummer truck numbers aren’t in this statistical mix.

- Compact Non-Premium SUV was again the number one segment in January, with an

- 1% market share, up by 1.4 percentage points , YoY.

- Mid-size Non-Premium SUV was ranked second on 16.7%, a YoY decline of 1.7 percentage points .

- Large Pickups saw a share of 14.6%, up by 0.3 percentage points YoY, down by 1.3 percentage points compared with December, as is normal at this point in the calendar.

- Pickups outsold Cars in January, by ~20,000 units.

Global Outlook?

December ended 2022 with global Light- Vehicle sales posting an increase of 1% to 7.5 million units, slightly better than expected. The selling rate was 83.4 million units which was consistent with November and 1.2 million units stronger than a year ago. Sales in 2022 were 81.1 million units, a decline of 0.5% as the industry struggled with supply disruption and the ongoing issue with affordability. Despite the risk, 2023 is expected to restart the recovery, with global Light Vehicle sales increasing 6% from 2022 to 85.8 million units. There remains a robust level of unfulfilled demand that should be supportive of recovery over the next few years.

Click for more information.

Jeff Schuster, Automotive Group Head and Executive Vice President, GlobalData, said: “The outlook for autos is at a crossroads, as the rebalancing of supply and demand continues to play out. 2023 will be a pivotal year in shaping the recovery going forward and setting the tone where the natural level of demand will settle. There is reason to be cautiously optimistic as we move through 2023.”

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Light Vehicles Sales in January 2023 Weak at 1 Million

Click for more information.

US Light Vehicle sales totaled 1.04 million units in January, according to data just released by LMC Automotive.* This is a Year-over-Year gain of 4.5%, with the same number of selling days as in January 2022. Nevertheless, January 2022 was the first January to fail to reach 1 million units since 2012. LMC put it succinctly: “if we excluded last year, January 2023 would be the worst opening month of the year since 2014.”

The usual problems remain – record high transaction prices, economic uncertainty, the Federal Reserve’s determination to send the economy into a recession via its ongoing interest rate increases, skimpy inventory caused by supply chain disruptions for some major automakers, notably Ford and Toyota – all make for a rerun of the flop show Pandemic Blues. So good luck reopening that show in 2023 with the same cast and plot.

General Motors is running on all cylinders.

“Interest rates for vehicle financing increased significantly throughout 2022 and are expected to increase further in first-half 2023. The average rate on a new-vehicle finance contract in January 2023 should reach 6.8%, an increase of 264 basis points year over year, says J.D. Power. The Fed increased the targeted range of the Fed Funds Rate by 25 basis points at its first meeting of 2023. This increase will push vehicle-financing rates higher in coming months, and we believe that the Fed will increase rates a couple more times before pausing later this year,” said Patrick Manzi, the Chief Economist of the National Automobile Dealers Association.

The January selling rate, aka SAAR, was 15.8 million units/year, up from 13.5 million units/year in December. “While on paper this appears to represent a rapid acceleration in the market, in reality we need to be cautious before jumping to that conclusion. While in December the rate was kept in check by the fact that December has historically been a strong month for sales, January’s traditional weakness seems to have inflated the selling rate last month,” LMC said.

The executive summary: market fundamentals have not changed significantly from December to January. Supply disruptions are distorting normal seasonality. The daily selling rate is estimated at 43,200 units/selling day in January, compared to 47,500 units/selling day in December.

“The market performed largely as expected in January. In year-on-year terms, volumes were up, but sales are still subdued compared to their pre-pandemic levels. Retail sales appeared to fall YoY, with the highest share for fleet sales since the onset of the pandemic helping to keep the total market afloat. Fleet traditionally sees a bump in share in January, and we expect this side of the market to play an increasingly important role in 2023 as the retail environment becomes more challenging. Overall, these results suggest that the market can grow this year, despite the challenges, barring any further major shocks,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

According to preliminary estimates, retail sales totaled around 829,000 units, while fleet accounted for approximately 207,000 units, representing 20.0% of the total market, the highest share since March 2020.

General Motors once again was the leading automaker, with its lead over Toyota Group (the number one global seller in 2022) to more than 50,000 units, compared to 41,000 in December. Toyota Group continues with inventory shortages, and slipped behind Ford Group into third place.

LMC notes and we concur that GM is now be operating at close to normal, having been one of the first manufacturers to suffer from supply chain disruption. Underlining this trend was the fact that not only did the Toyota brand fail to be the bestselling brand last month – as had been the case frequently in 2022 – it also fell behind Chevrolet into third place.

Ford claimed the number one spot in the rankings, as it did in December. The Ford F-150 retained its title as the bestselling Light Vehicle in January, ahead of the Chevrolet Silverado by 8k units. The usual AutoInformed caveat applies here strong GMC and Hummer truck numbers aren’t in this statistical mix.

Global Outlook?

December ended 2022 with global Light- Vehicle sales posting an increase of 1% to 7.5 million units, slightly better than expected. The selling rate was 83.4 million units which was consistent with November and 1.2 million units stronger than a year ago. Sales in 2022 were 81.1 million units, a decline of 0.5% as the industry struggled with supply disruption and the ongoing issue with affordability. Despite the risk, 2023 is expected to restart the recovery, with global Light Vehicle sales increasing 6% from 2022 to 85.8 million units. There remains a robust level of unfulfilled demand that should be supportive of recovery over the next few years.

Click for more information.

Jeff Schuster, Automotive Group Head and Executive Vice President, GlobalData, said: “The outlook for autos is at a crossroads, as the rebalancing of supply and demand continues to play out. 2023 will be a pivotal year in shaping the recovery going forward and setting the tone where the natural level of demand will settle. There is reason to be cautiously optimistic as we move through 2023.”

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.