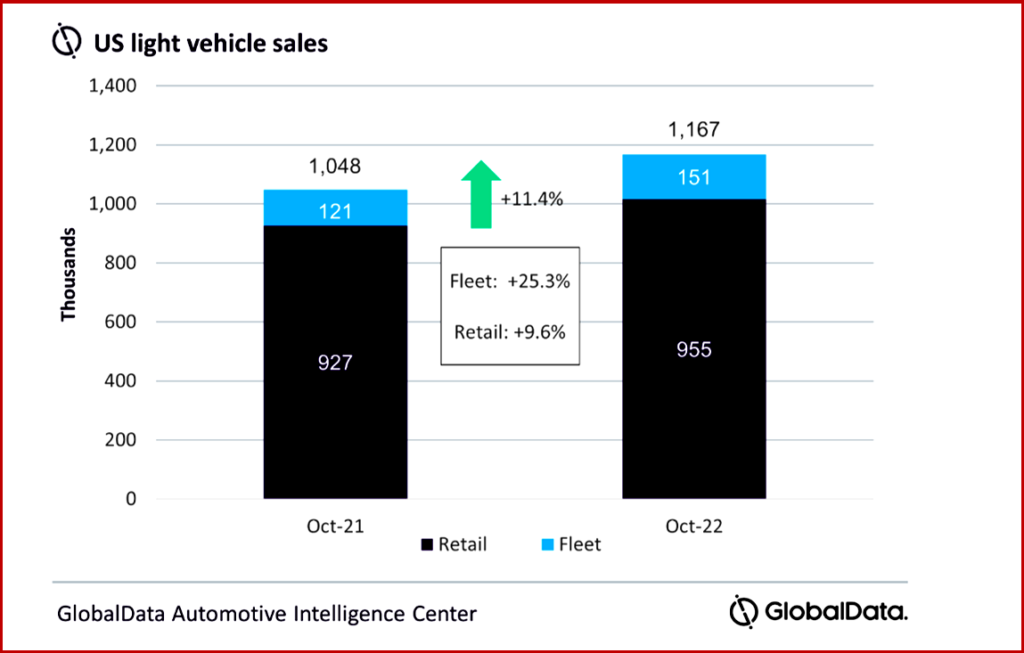

According to data just released by LMC Automotive,* US light vehicle sales grew by 11.4% Year-over-Year in October to 1.17 million units. While the YoY comparison continues to be “flattered by a low base, as the market struggled a year ago with dwindling inventory, October 2022 had one fewer selling day than October 2021, making last month’s performance somewhat more impressive,” LMC said.

The October selling rate was 15.1 million units/year from 13.4 million units/year in September. This was only the second time that the rate has exceeded 15 million units/year in 2022. The daily selling rate is estimated at around 44,900 units/selling day, up from 44,300 units/selling day in September. According to preliminary estimates, retail sales totaled around 1,016,000 units, compared to 955,000 units in September. This, if accurate, means that retail sales topped 1 million units for the first time since April. LMC converts this to an 87% total market share for retail sales.

Click for more information.

“Even though October sales were upbeat compared to recent months, we should remember that the market has fallen significantly from its typical levels over recent years. Excluding 2021, the last October that saw lower sales than last month was in 2012. Through the first 10 months of the year, sales are down by 10.9% YoY,” LMC said.

“While the industry continues to face challenges on a number of different fronts, some encouragement can perhaps be drawn from the October results. A selling rate of 15.1 million units/year might be unremarkable in normal times, but the 15 million units/year mark has only been surpassed twice since the first half of 2021, providing some cheer heading into the final two months of 2022. Inventory levels have improved notably over the last two months, relieving some of the pressure on the supply side of the market. However, we cannot necessarily assume progress in this area will be linear, as a number of logistical problems are still affecting the industry, besides semiconductor shortages. As interest rates continue to climb, financing costs are also increasing, with average transaction prices still at near-record levels, even if there has been a slight decline over recent months,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

The market viewed by automaker shows that Mercedes-Benz enjoyed the strongest YoY growth in October, with a 53.0% YoY gain. Among higher-volume manufacturers, General Motors showed the strongest growth, up by 51.2% YoY. GM also led the market, with a 17.2% share, 0.9 percentage points (pp) ahead of Toyota Group. Honda Group’s struggles continue with sales down by 16.0% YoY. Stellantis and Ford Motor also saw YoY declines, of 14.0% and 10.2%, respectively.

The Compact Non-Premium SUV was the most popular segment in October, with an 18.3% market share, up by 4.1 pp, YoY. Mid-size Non-Premium SUV was the next best-selling segment, on 16.1%, down by 2.6 pp, YoY. Large Pickups claimed a 13.5% share of the market in October, down by 2.2 pp, YoY, but an increase of 0.5 pp from September’s figure.

“With Ford’s Pickups seemingly recovering somewhat from a very weak September, Pickups outsold Cars by 15k units in October, compared to just 2k units in September. interest rates continue to climb, financing costs are also increasing, with average transaction prices still at near-record levels, even if there has been a slight decline over recent months,” LMC said.

“Vehicle inventory in September edged up, adding 160,000 units since August and crossed the 30-day supply level for the first time since April 2021. However, total disruption for 2022 in North America remains at 1.85 million units and full-year North America production volume was trimmed by 100,000 units to 14.3 million,” said Jeff Schuster, President, LMC Automotive.

“The disruption picture is expected to improve as the end of 2022 nears. Inventory constraints should ease into 2023 but will be present throughout most of the year. Given the baseline forecast is calling for a mild recession next year, pressure on the consumer and demand levels will remain. However, 2023 is still expected to see an increase in sales volume, even as the great recession takes shape, thus this is a vastly different market than the financial crisis of 2008/2009. When the dust settles and market forces are back to equilibrium, we would expect a lower top-line level than the 17-million-unit level the market averaged before the pandemic,” Schuster concluded.

*LMC Automotive

LMC Automotive, a GlobalData company, is a leading independent and exclusively automotive provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC claims to be the world’s leading economic and business consultancy for the agribusiness sector. LMC’s own specialist automotive research team presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US October Light Vehicle Sales Grow 11.4% to 1.2 Million

According to data just released by LMC Automotive,* US light vehicle sales grew by 11.4% Year-over-Year in October to 1.17 million units. While the YoY comparison continues to be “flattered by a low base, as the market struggled a year ago with dwindling inventory, October 2022 had one fewer selling day than October 2021, making last month’s performance somewhat more impressive,” LMC said.

The October selling rate was 15.1 million units/year from 13.4 million units/year in September. This was only the second time that the rate has exceeded 15 million units/year in 2022. The daily selling rate is estimated at around 44,900 units/selling day, up from 44,300 units/selling day in September. According to preliminary estimates, retail sales totaled around 1,016,000 units, compared to 955,000 units in September. This, if accurate, means that retail sales topped 1 million units for the first time since April. LMC converts this to an 87% total market share for retail sales.

Click for more information.

“Even though October sales were upbeat compared to recent months, we should remember that the market has fallen significantly from its typical levels over recent years. Excluding 2021, the last October that saw lower sales than last month was in 2012. Through the first 10 months of the year, sales are down by 10.9% YoY,” LMC said.

“While the industry continues to face challenges on a number of different fronts, some encouragement can perhaps be drawn from the October results. A selling rate of 15.1 million units/year might be unremarkable in normal times, but the 15 million units/year mark has only been surpassed twice since the first half of 2021, providing some cheer heading into the final two months of 2022. Inventory levels have improved notably over the last two months, relieving some of the pressure on the supply side of the market. However, we cannot necessarily assume progress in this area will be linear, as a number of logistical problems are still affecting the industry, besides semiconductor shortages. As interest rates continue to climb, financing costs are also increasing, with average transaction prices still at near-record levels, even if there has been a slight decline over recent months,” said David Oakley, Manager, Americas Sales Forecasts, LMC Automotive.

The market viewed by automaker shows that Mercedes-Benz enjoyed the strongest YoY growth in October, with a 53.0% YoY gain. Among higher-volume manufacturers, General Motors showed the strongest growth, up by 51.2% YoY. GM also led the market, with a 17.2% share, 0.9 percentage points (pp) ahead of Toyota Group. Honda Group’s struggles continue with sales down by 16.0% YoY. Stellantis and Ford Motor also saw YoY declines, of 14.0% and 10.2%, respectively.

The Compact Non-Premium SUV was the most popular segment in October, with an 18.3% market share, up by 4.1 pp, YoY. Mid-size Non-Premium SUV was the next best-selling segment, on 16.1%, down by 2.6 pp, YoY. Large Pickups claimed a 13.5% share of the market in October, down by 2.2 pp, YoY, but an increase of 0.5 pp from September’s figure.

“With Ford’s Pickups seemingly recovering somewhat from a very weak September, Pickups outsold Cars by 15k units in October, compared to just 2k units in September. interest rates continue to climb, financing costs are also increasing, with average transaction prices still at near-record levels, even if there has been a slight decline over recent months,” LMC said.

“Vehicle inventory in September edged up, adding 160,000 units since August and crossed the 30-day supply level for the first time since April 2021. However, total disruption for 2022 in North America remains at 1.85 million units and full-year North America production volume was trimmed by 100,000 units to 14.3 million,” said Jeff Schuster, President, LMC Automotive.

“The disruption picture is expected to improve as the end of 2022 nears. Inventory constraints should ease into 2023 but will be present throughout most of the year. Given the baseline forecast is calling for a mild recession next year, pressure on the consumer and demand levels will remain. However, 2023 is still expected to see an increase in sales volume, even as the great recession takes shape, thus this is a vastly different market than the financial crisis of 2008/2009. When the dust settles and market forces are back to equilibrium, we would expect a lower top-line level than the 17-million-unit level the market averaged before the pandemic,” Schuster concluded.

*LMC Automotive

LMC Automotive, a GlobalData company, is a leading independent and exclusively automotive provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC claims to be the world’s leading economic and business consultancy for the agribusiness sector. LMC’s own specialist automotive research team presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.