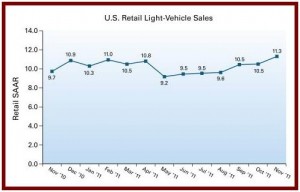

New-vehicle retail sales in November are increasing at a rate that could mean deliveries of 791,900 cars and light trucks, which represents a seasonally adjusted annualized rate (SAAR) of 11.3 million units. This would be the highest monthly selling rate in three and a half years in what remains a slow growth, “no jobs created” U.S. economy. Nevertheless it remains a drastic drop from the 15-16 million averages of the previous decade before the 2008 economic collapse and the ongoing Great Recession.

Total light-vehicle sales in November are expected to come in at 975,600 units, which is 8% higher than a depressed market in November 2010. Fleet sales are expected to decrease by 6% compared with November 2010, but will account for 19% of total sales, a large number. Unlike moribund European economies, which have seen declining auto sales for four straight years, U.S. sales are slowly recovering. (See EU Car Sales Down Again in October. Four Year Trend Ongoing)

This optimistic forecast is based on J.D. Power’s real-time transaction data gathered from more than 8,900 retail franchisees throughout the United States, and LMC Automotive’s analysis.LMC recently purchased Power.

“The improving performance of the past three months suggests that the current momentum, primarily driven by replacement demand and improvements in vehicle availability, is not an aberration,” said John Humphrey, senior vice president of global automotive operations at J.D. Power and Associates.

After a solid October and expectations for a strong November, LMC Automotive is increasing its forecast for 2011 to 12.7 million units (from 12.6 million units) for total light-vehicle sales and to 10.3 million units (from 10.2 million units) for retail light-vehicle sales.

LMC Automotive is maintaining its forecast for 2012 at 13.8 million units for total light-vehicle sales and 11.2 million units for retail light-vehicle sales.

“The upward forecast revision to 2011 represents the first increase to the forecast all year and tempers the cloud of uncertainty that has been over the automotive market for several months,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive.

“The current recovery pace appears sustainable into 2012. As long as there is not an external shock or economic setback, the selling rate could be stable above the 14-million-unit level during the second half of 2012,” Schuster said.

North American Production

Light-vehicle production volume in North America has increased by 920,000 units, or 9% through the first 10 months of 2011 compared with the same period in 2010, according to LMC Automotive. The Detroit Three are seeing nearly a 14% increase in year-to-date production through October, while European OEMs are up 38%.

Hyundai Group production is up 48% after increased production of existing models and additional localization of models in 2011. Japanese manufacturers, as a group, posted an 8% decline year-to-date in October from the same period in 2010, due to the Japan earthquake and tsunami and additional setbacks to Honda and Toyota from the flooding in Thailand. The impact of the flooding is expected to continue through the fourth quarter, causing further downtime to Toyota and Honda North American operations.

Toyota is recovering faster than initially anticipated, with lost volume estimated to be 5,000 units in the fourth quarter. The impact to Honda is expected to be more severe due to the location of its Thai plants. Honda’s fourth quarter loss in North America is now estimated at 35,000 units.

Overall vehicle inventory improved to a 58-day supply at the beginning of November from 50 days at the beginning of October. Car inventory improved to a 53-day supply, up from 43 days in October, while truck levels are stable with a 62-day supply. Several manufacturers continue to remain below the industry norm of a 60-day supply. Hyundai/Kia began November with 28 days’ supply, Honda was at 37 days’ supply, and BMW at 28 days’ supply.

The 2011 North American production outlook remains on track for 12.9 million units, an increase of nearly 9% from 2010. While overall production volume in 2011 is the highest since 2007’s 15- million-unit level, it remains well below the mid-15 million levels during 2001-2006.