Click for more analysis.

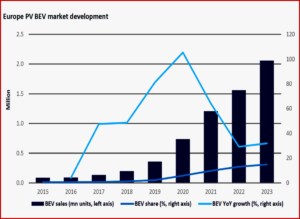

The European Passenger Vehicle (PV) Battery Electric Vehicle market EV market grew ~32% with positive growth in all months except December during 2023. This growth was better than many forecasters indicated at the start of last year (and better than in 2022), with some predicting no growth. BEV sales volume came in at just under 2.1 million units. This is 500,000 more than were sold in 2022.

“It is clear there has been some recent slowdown in the market, but it depends where you look. Some brands are doing considerably better than others, with the likes of MG and Tesla standing out as strong performers in 2023,” the respected consultancy GlobalData* said today.

AutoInformed has not been among the naysayers. Consider this from Carlos Tavares, CEO of Stellantis (full story here at AutoInformed.com: Stellantis Posts Record 2023 Results – €18.6B Net). In Tavare’s view, EV adoption is mostly driven by the “alignment of four different stars.”

- The first star is the Clean Energy Star. “We need to clean energy. Whatever you do in terms of CO2 emission reduction you need to start with clean energy.”

- Assuming that we have the clean energy, the second star is that we need to have a “visible and highly dense charging network, which means a charging network where you don’t need to look for the charging spot. It needs to be there when you go to the shopping mall; when you go to the supermarket; when you go to the restaurant; when you go to gym – in the parking lots of those services.”

- The third star is the product itself. The product needs to be enjoyable with acceleration and range and all the things that make the product simply appealing. “I think we are there…I can tell with 42 years of automotive experience, the BEV products are better products, if we solve the inconvenience of range or the inconvenience of not finding always the charging that we’d like to find. So that’s the third star.”

- The 4th star is affordability. “I would say that on the first three stars, some progress is being made on clean energy. Some progress, probably not enough, is being made on the density of the charging network. The products are here, and the products are coming. We need to bring affordability… We’ll keep on working on reducing the costs of the EV technology.

“So when those four stars are going to align? Things are going to move and they will move faster and they will move eventually very, very fast. We have a big stimulation coming. It’s the Chinese offensive. It’s a big stimulation for us to go faster in aligning those four stars.

“When I was (Tavares) asked the question this morning, if we are going to take any decision like some of our US competitors in terms of slowing down, what we are doing in electrification and my answer is crystal clear. No, we keep it flat out because we believe that the education of the citizens and the education of the consumer about the urgency of contributing to fixing the global warming issue is going to grow. The fact that we are already seeing that we are above 1.5° of global warming much sooner than what we had predicted. So the public opinion is going to push in that direction. Whatever happens, you may have some bumps on the road, some slowdowns on the road, but anyway it’s going to move – so we keep it flat out in the execution of the move forward plan,” Tavares said.

GlobalData Observations and Opinions

- The charging infrastructure and BEV versus Internal Combustion Engine (ICE)/hybrid prices are still headwinds.

- It was to be expected that the levels of growth seen from 2019 to 2021 would ease, not least because the buyers to whom BEVs are most attractive (wealthy, multiple-car households with off-road charging facilities) have been somewhat satisfied.

- In addition, adoption rates for new technologies will tend to rise and fall over time as the use case for them doesn’t grow uniformly but develops in a series of steps leading ultimately to near-100% penetration.

- The market over the last few years has been demand-driven whereas prior to that point, fleet CO2 targets were a big factor in the high BEV growth rates see the chart.

- For some OEMs at least, the medium-term plan for BEV build set in late 2022 or early 2023 was over-ambitious, especially given the economic headwinds faced by many consumers which are only reaching the peak of their influence now due to the lagged impact of rising interest rates, and the car replacement cycle.

GlobalData Forecast

“Well, we don’t expect people in Europe, on the whole, to be feeling much richer than they did in 2023 although inflation continues to decline for most and it seems interest rates have peaked. Car demand overall is predicted to increase only modestly (+3%) but BEV growth has consistently outperformed car market growth for several years and we expect the same in 2024,” said Al Bedwell, Director, Global Powertrain at GlobalData.

- Helping this to happen will be downward pressure on average BEV prices.

- The ingredients are in place for some kind of price war. This won’t be on the brutal scale seen in China where plug-in car prices have, in some cases, been reduced to parity with ICE, but it will help shift BEVs.

- OEMs have scope to implement targeted downward pricing actions using some of the healthy profits made during the chip crisis.

- Battery prices are on a downward trend with battery grade lithium and other critical material prices now being seen as on a better trajectory as fears of lithium shortages have receded.

- We see OEM flexibility in this area offsetting incentive reduction. Many brands have stated that they will compensate for Germany’s BEV grant deletion, for example.

“On top of this, 2024 will see the European introduction of several affordable BEV models in the €20k to €25k bracket, bringing in buyers with lower budgets than the traditional average BEV transaction price of €40,000 upwards. Hyundai’s Casper model is a good example of this. These more affordable cars will be joined by many other BEV models, increasing choice for buyers. So, we remain cautiously optimistic for 2024, though we do expect lower BEV sales growth than seen in 2023,” said GlobalData in an Analyst Briefing this morning in Europe.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Do Media Have the Electric Vehicle Market Collapse Wrong?

Click for more analysis.

The European Passenger Vehicle (PV) Battery Electric Vehicle market EV market grew ~32% with positive growth in all months except December during 2023. This growth was better than many forecasters indicated at the start of last year (and better than in 2022), with some predicting no growth. BEV sales volume came in at just under 2.1 million units. This is 500,000 more than were sold in 2022.

“It is clear there has been some recent slowdown in the market, but it depends where you look. Some brands are doing considerably better than others, with the likes of MG and Tesla standing out as strong performers in 2023,” the respected consultancy GlobalData* said today.

AutoInformed has not been among the naysayers. Consider this from Carlos Tavares, CEO of Stellantis (full story here at AutoInformed.com: Stellantis Posts Record 2023 Results – €18.6B Net). In Tavare’s view, EV adoption is mostly driven by the “alignment of four different stars.”

“So when those four stars are going to align? Things are going to move and they will move faster and they will move eventually very, very fast. We have a big stimulation coming. It’s the Chinese offensive. It’s a big stimulation for us to go faster in aligning those four stars.

“When I was (Tavares) asked the question this morning, if we are going to take any decision like some of our US competitors in terms of slowing down, what we are doing in electrification and my answer is crystal clear. No, we keep it flat out because we believe that the education of the citizens and the education of the consumer about the urgency of contributing to fixing the global warming issue is going to grow. The fact that we are already seeing that we are above 1.5° of global warming much sooner than what we had predicted. So the public opinion is going to push in that direction. Whatever happens, you may have some bumps on the road, some slowdowns on the road, but anyway it’s going to move – so we keep it flat out in the execution of the move forward plan,” Tavares said.

GlobalData Observations and Opinions

GlobalData Forecast

“Well, we don’t expect people in Europe, on the whole, to be feeling much richer than they did in 2023 although inflation continues to decline for most and it seems interest rates have peaked. Car demand overall is predicted to increase only modestly (+3%) but BEV growth has consistently outperformed car market growth for several years and we expect the same in 2024,” said Al Bedwell, Director, Global Powertrain at GlobalData.

“On top of this, 2024 will see the European introduction of several affordable BEV models in the €20k to €25k bracket, bringing in buyers with lower budgets than the traditional average BEV transaction price of €40,000 upwards. Hyundai’s Casper model is a good example of this. These more affordable cars will be joined by many other BEV models, increasing choice for buyers. So, we remain cautiously optimistic for 2024, though we do expect lower BEV sales growth than seen in 2023,” said GlobalData in an Analyst Briefing this morning in Europe.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.