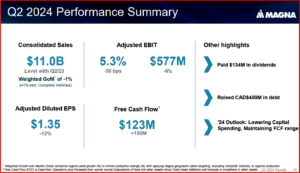

Magna International Inc. (TSX: MG; NYSE: MGA) today reported financial results for Q2 2024 with sales of $11B, essentially unchanged from the second quarter of 2023, which compares to a 2% increase in global light vehicle production, including 6% and 1% higher production in China and North America, respectively. This was partially offset by 5% lower production in Europe. AutoInformed* notes that Magna’s challenge as a global diversified supplier to automakers going forward is adopting to and making money from the delay, elimination or reduced volumes in larger automaker EV programs while retaining or increasing sales from the now extended life of vehicles with internal combustion engines and their potential freshening and updates with increased content that this likely entails.

“Overall, our second quarter operating performance largely met our expectations, despite lower than anticipated volumes on certain key vehicle programs in North America. Our focus remains on factors we can control, including operational excellence, cost reductions, and flawless launches. These efforts, together with ongoing customer commercial discussions are enabling us to substantially maintain our 2024 Adjusted EBIT margin range,” said Swamy Kotagiri, Magna’s Chief Executive Officer.

Magna sales were negatively impacted by the end of production of certain programs, lower Complete Vehicle assembly volumes, as a result of the end of production of the BMW 5-Series, and the weakening of foreign currencies against the U.S. dollar. These were offset by higher global light vehicle production, the launch of new programs, and acquisitions, net of divestitures, during or subsequent to Q2 of 2023.

Adjusted EBIT was $577 million in the second quarter of 2024 compared to $616 million in the second quarter of 2023. The decrease in Adjusted EBIT reflects reduced earnings on lower assembly volumes in Complete Vehicles such as the BMW above, higher net warranty costs, the unfavorable impact of foreign exchange losses in the second quarter of 2024 compared to foreign exchange gains in the second quarter of 2023 related to their measurement of net deferred tax assets that are maintained in a currency other than their functional currency, lower equity income, and higher restructuring costs. These were partially offset by commercial items in the second quarters of 2024 and 2023, which had a net favorable impact on a year-over-year basis, productivity and efficiency improvements, including lower costs at certain underperforming facilities and lower net engineering costs, including spending related to Magna’s electrification and active safety businesses.

Income from operations before income taxes was $427 million for the second quarter of 2024 compared to$483 million in the second quarter of 2023, which includes Other expense, net (2)**a nd Amortization of acquired intangibles of $96 million and $99 million in the second quarters of 2024 and 2023, respectively. Excluding Other expense, net and Amortization of acquired intangibles from both periods, income from operations before income taxes decreased $59 million in the second quarter of 2024 compared to the second quarter of 2023.

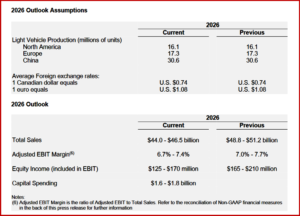

“Our updated 2026 Outlook reflects customer program updates and a tempered view on mid-term electric vehicle penetration rates, particularly in North America. While we have reduced our sales forecast, we are taking a number of concrete actions to mitigate the sales impacts and continue to expect margin expansion and strong free cash flow growth,” said Kotagiri.

AutoInformed on

- Magna Joins Northstar for 5G Autonomous Driving Development

- Magna Buys Veoneer Active Safety Business

- Magna Wins Additional EV Component Business in China

- New St. Clair Magna Plant to Supply GMC’s Hummer EV

- New LG and Magna Joint Venture in Powertrain Electrification

**(2) Other expense (income), net is comprised of restructuring and impairment costs relating to Fisker Inc. [“Fisker”], net losses on the revaluation of certain public company warrants and equity investments, gain on business combination, restructuring activities and transaction costs relating to the acquisition of Veoneer Active Safety Business [“Veoneer AS”] during the three and six months ended June 30, 2023 & 2024.

Pingback: Oh Canada – Magna Q3 Sales Off but Net Earnings Up | AutoInformed