Click to enlarge.

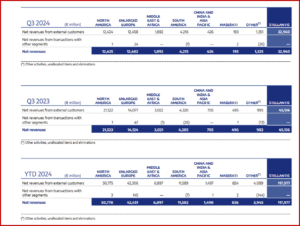

Stellantis N.V. (NYSE: STLA) said today that during Q3 2024 net revenues of €33.0 billion were down -27% compared to Q3 2023 as consolidated shipments of 1,148,000 were down 279,000 or -20% year-over-year. Stellantis also confirmed its diminished 2024 financial guidance, which was updated on September 30, 2024.*

“While Q3 2024 performance is below our potential, I’m pleased with our progress addressing operational issues, in particular U.S. inventories, which have been reduced meaningfully and are on track for year-end targets, as well as stabilization of U.S. market share. In Europe, stringent quality requirements delayed the start of certain high-volume products, but with progress resolving challenges we will soon benefit from the significantly expanded reach our generational new product wave brings to 2025 and beyond,” claimed Doug Ostermann, CFO, who replaced Natalie Knight earlier this month. Stellantis is also looking to find a successor for CEO Carlos Tavares, who will retire from his seat in 2026.

In what seems to be a “whistling past the graveyard” release appropriate for Halloween, Stellantis put forth yet again its transition plan. Stellantis’ 14 brands are to some degree or other at the heart of the Company’s planned revival/survival with ~20 new products expected this year.

The lineup of 2024 launches includes the first products built on the new, multi-energy powertrain capable STLA platforms:

- The Peugeot 3008 and 5008 available now, and Opel Grandland (coming) on STLA Medium

- The Dodge Charger Daytona and Jeep Wagoneer S to launch soon on the STLA Large platform

- The Citroën C3 Aircross and Basalt, Opel Frontera and Fiat Grande Panda based on the Smart Car platform

Stellantis said it will soon announce details of STLA Frame, the third of four all-new multi-energy platforms revealed during EV Day in 2021. Several new products are here or are available to order:

- Ram Light Duty retail U.S. sales increased 11% Q3 2024compared to Q2 2024 with the new 2025 Ram 1500 sales up 66% for the same period.

- The all-new Peugeot 3008 with ~75,000 orders at a 25% BEV mix.

- Orders for the all-new Citroën C3 with a new Hybrid version, which began shipping in September, totaled more than 50,000 with the ë-C3 version at more than 25,000 orders. The brand also introduced Basalt in India and South America.

- The all-new Junior brings Alfa Romeo back into the hotly contested B-segment in the European market and is said to be offered with the widest powertrain line-up in its category. Junior has more than 10,000 orders.

- Stellantis’ renewed Pro One van lineup from Citroën, FIAT Professional, Opel, Peugeot and Vauxhall is on the road with 12 models across all segments with second-generation electrification (battery-electric and fuel cell-electric vehicles) and full connectivity for vans and pickups.

- Leapmotor International, the controversial, politically fraught Stellantis-led joint venture with Chinese Leapmotor, distributed the first 1200 Leapmotor T03 (A-segment) and C10 (D-SUV) to dealers across Europe. The all-electric offer expands in 2025 with the introduction of the B10, its first global C-SUV, and introduction of range-extended EV technology on C10.*

Commercial Highlights

- Stellantis is No. 1 selling automaker in France, Italy, Brazil, Portugal, Turkey, Algeria and Argentina year-to-date through September. Stellantis is in the top three in Germany, Spain and United Kingdom.

- Stellantis U.S. market share grew from 7.2% in July to 8% in September; U.S. brands continue to show strong sales momentum.

- S. dealer inventory level was reduced by over 80 thousand units at October 30, 2024, from June 30, 2024, and is on track to reach our previously communicated 100 thousand unit reduction target by November 30, 2024.

- Stellantis brands continue their domination of the plug-in hybrid category in the U.S. with the Jeep Wrangler 4xe, Jeep Grand Cherokee 4xe, Chrysler Pacifica Hybrid and Dodge Hornet R/T holding four of the top five spots for best-selling plug-in hybrids, representing 45% of market share on PHEV through August 2024.

- Stellantis Pro One is the light commercial vehicle leader in Europe through the first three quarters of 2024 with a share of 29%, leading in France, Italy, Spain and Portugal, and in South America with more than 32% share. In BEVs, Pro One holds the top spot in European BEV share with 32.8%.

- Jeep sales in Europe topped 100,000 units this year through September, a 3.5% year-over-year increase. In Q3, Wagoneer sales rose 79% year-to-date. Avenger is the best-selling SUV in Italy (4.5% share) and third in France and Netherlands year-to-date August.

- The Fiat 500e is the leader in A-segment BEVs with a 45% market share; the Peugeot e-208 is the leader in B-segment BEVs.

- The Fiat Panda is the most sold car in the A-segment in Europe, with sales surpassing 100,000 units in 2024.

- The Jeep Commander has been best-selling seven-seater SUV in Brazil since 2021. Sales of Jeep Renegade, Jeep Compass and Jeep Commander models, all produced in country, have now reached 1 million.

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis Q3 2024 – Shipments and Revenues Plunge

Click to enlarge.

Stellantis N.V. (NYSE: STLA) said today that during Q3 2024 net revenues of €33.0 billion were down -27% compared to Q3 2023 as consolidated shipments of 1,148,000 were down 279,000 or -20% year-over-year. Stellantis also confirmed its diminished 2024 financial guidance, which was updated on September 30, 2024.*

“While Q3 2024 performance is below our potential, I’m pleased with our progress addressing operational issues, in particular U.S. inventories, which have been reduced meaningfully and are on track for year-end targets, as well as stabilization of U.S. market share. In Europe, stringent quality requirements delayed the start of certain high-volume products, but with progress resolving challenges we will soon benefit from the significantly expanded reach our generational new product wave brings to 2025 and beyond,” claimed Doug Ostermann, CFO, who replaced Natalie Knight earlier this month. Stellantis is also looking to find a successor for CEO Carlos Tavares, who will retire from his seat in 2026.

In what seems to be a “whistling past the graveyard” release appropriate for Halloween, Stellantis put forth yet again its transition plan. Stellantis’ 14 brands are to some degree or other at the heart of the Company’s planned revival/survival with ~20 new products expected this year.

The lineup of 2024 launches includes the first products built on the new, multi-energy powertrain capable STLA platforms:

Stellantis said it will soon announce details of STLA Frame, the third of four all-new multi-energy platforms revealed during EV Day in 2021. Several new products are here or are available to order:

Commercial Highlights

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.