Click to enlarge.

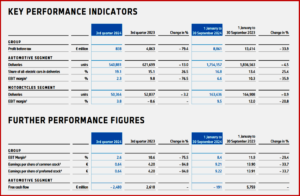

BMW AG posted results yesterday for Q3 of 2024 that saw earnings at €1696 million compared to 2023 at €4352M for a plunge of -61.0%. It was the worst quarterly performance in ~four years. Consequently, its stock took a beating.

“Group revenues remained significantly down on the previous year in the third quarter of 2024 at 32,406 million (2023: € 38,458 million; -15.7%; adjusted for currency effects -15.3%). The primary reasons for this decline were negative volume effects and product mix effects in the Automotive segment resulting from delivery stops related to the supplied ABS [There were ~1.5 million vehicles recalled for a bad braking system- Autocrat], among other factors,” BMW said in an earnings release.

“In addition, consumer confidence remained low in China despite the supportive measures initiated by the central government. In the Financial Services segment, higher interest income, increased contract values and the financing of expanded dealer inventories led to an improvement in revenue in the quarter. The amount of revenue eliminated on consolidation rose due to the upturn in new leasing business and had a considerable negative effect on Group revenues,” BMW said.

Automotive Segment – Key Points

- Group revenues remained significantly down on the previous year in the third quarter of 2024 at € 32,406 million (2023: € 38,458 million; –15.7%,adjusted for currency effects: –15.3%). The primary reasons for this decline were negative volume effects and product mix effects in the Automotive segment resulting from delivery stops related to the supplied ABS, among other factors.

- Consumer confidence remained low in China despite the supportive measures initiated by the central government. In the Financial Services segment, higher interest income, increased contract values and the financing of expanded dealer inventories led to an improvement in revenue in the quarter. The amount of revenue eliminated on consolidation rose due to the upturn in new leasing business and had a considerable negative effect on Group revenues.

- The Group’s cost of sales came to €28,160 million in the third quarter (2023: € 31,535 million; –10.7%), as manufacturing costs fell in the Automotive segment due to the lower sales volume. This fall was offset by increased warranty costs in connection with technical measures related to the supplied ABS, as well as higher research and development expenses.

- The research and development expenditure is primarily related to the cross-series digitalization and electrification of the vehicle fleet. Additional re-search and development expenditure was related to the development of NEUE KLASSE models. In the Financial Services segment, the cost of sales went up, largely due to a rise in interest rates.

- Selling and administrative expenses rose slightly to €2,666 million in the reporting period (2023: €2,615 million; +2.0%). This rise was due to an increase in personnel costs and IT costs, amongst others.

Forecast Discussion – International Auto Markets

- In October 2024, the International Monetary Fund (IMF) left its forecast for global economic growth at 3.2% despite the ongoing geopolitical risk factors.

- Growth rates are expected to vary by region over the year as a whole. in Europe, the overall market is expected to contract slightly compared to the previous year, while the latest forecasts have the US market on a par with the previous year. The same is true for China. The Chinese economy is feeling the effects of the ongoing challenges facing the real estate sector and low consumer confidence.

Outlook for BMW Group – Assumptions and Forecast

The following covers 2024 as a whole and is based on the composition of the BMW Group during that time.

- The Chinese market is currently lagging behind expectations. The Chinese government has announced a comprehensive economic stimulus package to revive the domestic economy. In addition, on 22 October 2024 the central bank decided to make a further cut to the benchmark interest rate. This shows that, while the economic situation is still considered difficult, the Chinese government is committed to tackling issues such as increasing domes-tic demand and reducing risks in the real estate sector. Although the measures are likely to have a positive impact, the BMW Group does not expect the Chinese economy to stabilize in the short term.

- The delivery stops related to the supplied Integrated Brake System (ABS) and a sustained drop in consumer confidence in China will continue to have an impact for the rest of the reporting year. The BMW Group expects to see a slight decline in deliveries as a result.

- Owing to the market situation in China and the fact that the majority of the vehicles affected by the delivery stops are in the upper price segment, the price level for the 2024 financial year is expected to reduce slightly across the entire product portfolio. Lower commodity prices, particularly for battery materials and precious metals, will provide some relief. However, costs for employees and from the supply chain are expected to rise in 2024 due to the high level of inflation in recent years.

- As in previous years, the implementation of the electrification and digitalization strategy will lead to higher R&D costs in 2024. Expenditure related to the NEUE KLASSE, such as the development of the sixth generation of bat-tery technology and manufacturing preparations in the production network, will also impact the Group’s earnings and result in increased capital expenditure

- The Middle East has become increasingly volatile. However, the conflict continues to have no significant effect on the BMW Group’s business as the Group does not operate directly in that region. The war in Ukraine and its potential implications for the BMW Group’s course of business are being closely monitored. Our outlook has factored in all of the restrictions which are currently in place. In view of the growing macroeconomic and political uncertainty, the actual economic performance of some regions may deviate from expectations. The outlook does not factor in any direct or indirect response which the Chinese government might take to the EU’s preliminary tariffs on electric car from China.

BMW Group – Brands and Segments

- Deliveries of BMW, MINI and Rolls-Royce brand vehicles by the Automotive segment are expected to be slightly lower than in the previous year due to the ongoing low level of demand in China and delivery stops (also in China).The share of all-electric cars relative to total deliveries will increase significantly compared to 2023.

- An EBIT margin ranging between 6 and 7% is forecast for the Automotive segment in 2024. The RoCE for the Automotive segment is expected to finish within a range between 11 and 13%. The RoCE for the Automotive segment is also being affected by the increasing investment in electrification and digitalization.

- We expect a slight decrease in carbon emissions from the EU new vehicle fleet due to further reductions in fuel consumption and the electric vehicles accounting for a larger share. It is therefore expected that the BMW Group will remain significantly under the legal limits.

- A slight reduction is expected in carbon emissions from BMW Group locations per vehicle produced (Scope 1 and 2). This will be The situation in the Middle East has become increasingly volatile. However, the conflict continues to have no significant effect on the BMW Group’s business as the Group does not operate directly in that region.

- The war in Ukraine and its potential implications for the BMW Group’s course of business are being closely monitored. Our outlook has factored in all of the re-strictions which are currently in place.

Caveat: In view of the growing macroeconomic and political uncertainty, the actual economic performance of some regions may deviate from expectations. The outlook does not factor in any direct or indirect response which the Chinese government might take to the EU’s preliminary tariffs on electric cars from China.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

BMW Q3 2024 Profits Drop 61%

Click to enlarge.

BMW AG posted results yesterday for Q3 of 2024 that saw earnings at €1696 million compared to 2023 at €4352M for a plunge of -61.0%. It was the worst quarterly performance in ~four years. Consequently, its stock took a beating.

“Group revenues remained significantly down on the previous year in the third quarter of 2024 at 32,406 million (2023: € 38,458 million; -15.7%; adjusted for currency effects -15.3%). The primary reasons for this decline were negative volume effects and product mix effects in the Automotive segment resulting from delivery stops related to the supplied ABS [There were ~1.5 million vehicles recalled for a bad braking system- Autocrat], among other factors,” BMW said in an earnings release.

“In addition, consumer confidence remained low in China despite the supportive measures initiated by the central government. In the Financial Services segment, higher interest income, increased contract values and the financing of expanded dealer inventories led to an improvement in revenue in the quarter. The amount of revenue eliminated on consolidation rose due to the upturn in new leasing business and had a considerable negative effect on Group revenues,” BMW said.

Automotive Segment – Key Points

Forecast Discussion – International Auto Markets

Outlook for BMW Group – Assumptions and Forecast

The following covers 2024 as a whole and is based on the composition of the BMW Group during that time.

BMW Group – Brands and Segments

Caveat: In view of the growing macroeconomic and political uncertainty, the actual economic performance of some regions may deviate from expectations. The outlook does not factor in any direct or indirect response which the Chinese government might take to the EU’s preliminary tariffs on electric cars from China.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.