Click for more.

Stellantis N.V. (NYSE: STLA) today released some preliminary and unaudited financial information for the First Half of 2025, in addition to its global quarterly consolidated shipment estimates and commentary on related trends in what appears to be an attempt to ameliorate financial market expectations based on its recently dismal operating results and program cancellations as it struggles to maintain what some consider too many brands and too little resources. See The Stellantis Spin below. (Read AutoInformed.com on: Stellantis Net Profit Down 70% in 2024)*

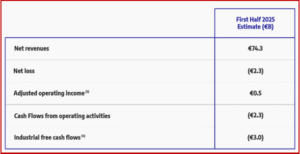

“In the absence of financial guidance, which was suspended by the Company on April 30, 2025, financial analyst consensus forecasts currently constitute the primary metric for market expectations. The disclosure of the following preliminary financial data for the First Half 2025 is intended to address the difference between these analyst consensus forecasts and the Company’s performance for the period,” Stellantis said.**

Global Consolidated Shipment Volumes – Stellantis Q2 2025

The term “shipments” describes the volume of vehicles delivered to dealers, distributors, or directly from the Company to retail and fleet customers, which drive revenue recognition. Consolidated shipments for the three months ending June 30, 2025, were an estimated 1.4 million units, representing a 6% decline y-o-y, reflecting North American tariff related production pauses early in the quarter, in addition to reduced, but adverse impacts of product transition in Enlarged Europe, where several important nameplates are either in the ramp-up phase after recent launches, or awaiting production launches scheduled for the second half of 2025.

- In North America, Q2 shipments declined approximately 109,000 units compared to the same period in 2024, representing a 25% y-o-y decline, due to factors including the reduced manufacture and shipments of imported vehicles, most impacted by tariffs, and lower fleet channel sales. Total sales declined 10% y-o-y, with U.S. retail sales relatively flat, and with the region’s two largest brands, Jeep® and Ram, collectively delivering 13% higher sales y-o-y.

- Enlarged Europe Q2 shipments declined approximately 50,000 units, representing a 6% y-o-y decline, due primarily to product transition factors. The recently launched “Smart Car” platform B-segment vehicles continue to ramp up to their full production levels, and prior year comparisons are affected by the hiatus of Fiat 500 ICE pending the arrival of its mild-hybrid successor. Shipments of the four Smart Cars (Citroën C3 and C3 Aircross, Opel/Vauxhall Frontera and Fiat Grande Panda) increased 45% sequentially in the Q2 2025 period, or 25,000, compared to the Q1 2025 period.

- Across Stellantis’ other regions, shipments grew 71,000 units in aggregate, representing a 22% increase y-o-y, mainly driven by a 30% increase in Middle East & Africa and a 20% increase in South America. In Middle East & Africa shipments were up 29,000 units, mainly driven by increased volumes in Türkiye and positive developments in Egypt, Algeria, and Morocco. Stellantis continues its leadership in South America, with a 43,000 unit y-o-y increase benefiting from higher industry volumes, especially in Argentina and Brazil.

The Stellantis Spin

“The following factors had a significant impact on results in the first half of 2025:

- The early stage of actions being taken to improve performance and profitability, with new products expected to deliver larger benefits in the Second Half of 2025.

- Approximately €3.3 billion of pre-tax net charges, primarily related to program cancellation costs and platform impairments, net impact of the recent legislation eliminating the CAFE penalty rate, and restructuring, which are excluded from Adjusted Operating Income [footnote 3] consistent with the Company’s definition of AOI.

- Adverse impacts to AOI from higher industrial costs, geographic and other mix factors, and changes in foreign exchange rates.

- The early effects of US tariffs – €0.3 billion of net tariffs incurred as well as loss of planned production related to implementation of the Company’s response plan,” Stellantis claimed.

Financial results for the First Half 2025 will be released as scheduled on July 29, 2025 and a call will be hosted on that day by CEO Antonio Filosa and CFO Doug Ostermann.

*AutoInformed on

**Inevitable Stellantis Footnotes

- Consolidated shipments only include shipments by Company’s consolidated subsidiaries, which represent new vehicles invoiced to third party (dealers/importers or final customers). Consolidated shipment volumes for Q2 2025 presented here are unaudited and may be adjusted.

- Final figures will be provided in our H1 2025 Results. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change.

- [3] Adjusted Operating Income/(Loss) excludes from Net profit/(loss) adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit). Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers. Adjusted Operating Income/(Loss) Margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

- Industrial Free Cash Flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities, (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net inter-company payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition Industrial free cash flows is one of the metrics used in the determination of the annual performance for eligible employees, including members of the Senior Management.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis Struggles – Q2 2025 Shipments Mostly Down Again

Click for more.

Stellantis N.V. (NYSE: STLA) today released some preliminary and unaudited financial information for the First Half of 2025, in addition to its global quarterly consolidated shipment estimates and commentary on related trends in what appears to be an attempt to ameliorate financial market expectations based on its recently dismal operating results and program cancellations as it struggles to maintain what some consider too many brands and too little resources. See The Stellantis Spin below. (Read AutoInformed.com on: Stellantis Net Profit Down 70% in 2024)*

“In the absence of financial guidance, which was suspended by the Company on April 30, 2025, financial analyst consensus forecasts currently constitute the primary metric for market expectations. The disclosure of the following preliminary financial data for the First Half 2025 is intended to address the difference between these analyst consensus forecasts and the Company’s performance for the period,” Stellantis said.**

Global Consolidated Shipment Volumes – Stellantis Q2 2025

The term “shipments” describes the volume of vehicles delivered to dealers, distributors, or directly from the Company to retail and fleet customers, which drive revenue recognition. Consolidated shipments for the three months ending June 30, 2025, were an estimated 1.4 million units, representing a 6% decline y-o-y, reflecting North American tariff related production pauses early in the quarter, in addition to reduced, but adverse impacts of product transition in Enlarged Europe, where several important nameplates are either in the ramp-up phase after recent launches, or awaiting production launches scheduled for the second half of 2025.

The Stellantis Spin

“The following factors had a significant impact on results in the first half of 2025:

Financial results for the First Half 2025 will be released as scheduled on July 29, 2025 and a call will be hosted on that day by CEO Antonio Filosa and CFO Doug Ostermann.

*AutoInformed on

**Inevitable Stellantis Footnotes

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.