Click to enlarge.

Wholesale used-vehicle prices on a mix-, mileage- and seasonally-adjusted basis, decreased from July in the first 15 days of August. The mid-month Manheim Used Vehicle Value Index fell to 206.5, showing a rise of only 1.2% from the full month of August 2024. The seasonal adjustment was responsible for the decline in the index in the month, as it was higher than normally seen. The non-adjusted price change in the first half of August rose 0.6% compared to July, and the un-adjusted price is higher by 1.3% year over year,” according to the latest data released today by Cox Automotive.* (Read AutoInformed.com on: ACSI – Customer Satisfaction with Autos Dropping)

“We started to see stronger sales trends in late July and early August for retail and wholesale markets, and that’s causing some additional volatility in wholesale pricing trends in recent weeks, against a stronger comparison from last year,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive.

“In the first two weeks of August, non-seasonally adjusted prices are appreciating more than usual, though the seasonal adjustment was a bit stronger, causing the index to decline at the mid-month point. Used retail supply has further tightened in recent weeks to the tightest level since early April, and that is keeping buyers active at Manheim to replenish inventory. While the tariffs induced much volatility in the automotive market earlier this year, we still see solid demand for both retail and wholesale vehicles,” said Robb.

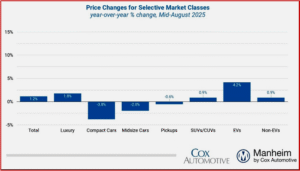

Segment Results for Seasonally Adjusted Prices Year-Over-Year Mixed In First Half of August

- Compared to the industry’s year-over-year increase of 1.2%, the luxury segment performed best, rising by 1.8%.

- Rising less than the industry, SUVs were higher by 0.9%.

- Trucks declined 0.6%.

- Mid-size cars fell by 2.0%,

- Compact car segment declined the most again, -3.8% against last year.

Against the full month of July, results by segment varied. The overall industry fell by 0.4% against the preceding month, though compact and mid-size cars were higher over the period, rising by 0.9% and 0.7%, respectively. The SUV segment was down 0.3% against July, with trucks falling by 0.7%, and luxury falling the most, down 1.4% since the end of last month.

- Electric vehicles (EVs) are showing the strongest year-over-year gains currently, as demand rises for these units with the impending end of tax credits next month. EVs showed an increase of 4.2% in early August, while the non-EV segment increased by just 0.9% over the period. Against July values, EVs showed larger gains than the industry, rising by 0.5% in the first half of August, while non-EVs were higher by 0.3% against July in the first half of the month.

Consumer Sentiment Lower in First Half of August

- The initial reading in August of the sentiment index from the University of Michigan showed a decline of 5.0% from July and was lower than analysts’ expectations. With the decline, the index was down 13.7% year over year.

- Views of both current conditions and expectations declined, but current conditions declined the most.

- Expectations for inflation in one year increased to 4.9% from 4.5%, and expectations for inflation in five years increased to 3.9% from 3.4%.

- Consumers’ views of buying conditions for vehicles decreased to the lowest level since May and were worse than one year ago, as both views of interest rates and views of car prices deteriorated.

- The daily index of consumer sentiment from Morning Consult shows a downward trend with data through Aug. 15. After increasing 1.3% throughout July, the index has reversed course and is down 1.3% so far in August.

- Views of both current conditions and future expectations declined in the first half of August, but views of future expectations declined the most.

- According to AAA, the average price of unleaded gasoline has decreased 0.3% for the month as of Aug. 15 to $3.14 per gallon, which was down 8% year over year but up 2.6% year to date.

**Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Used Vehicle Prices Down as Consumer Sentiment Drops

Click to enlarge.

Wholesale used-vehicle prices on a mix-, mileage- and seasonally-adjusted basis, decreased from July in the first 15 days of August. The mid-month Manheim Used Vehicle Value Index fell to 206.5, showing a rise of only 1.2% from the full month of August 2024. The seasonal adjustment was responsible for the decline in the index in the month, as it was higher than normally seen. The non-adjusted price change in the first half of August rose 0.6% compared to July, and the un-adjusted price is higher by 1.3% year over year,” according to the latest data released today by Cox Automotive.* (Read AutoInformed.com on: ACSI – Customer Satisfaction with Autos Dropping)

“We started to see stronger sales trends in late July and early August for retail and wholesale markets, and that’s causing some additional volatility in wholesale pricing trends in recent weeks, against a stronger comparison from last year,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive.

“In the first two weeks of August, non-seasonally adjusted prices are appreciating more than usual, though the seasonal adjustment was a bit stronger, causing the index to decline at the mid-month point. Used retail supply has further tightened in recent weeks to the tightest level since early April, and that is keeping buyers active at Manheim to replenish inventory. While the tariffs induced much volatility in the automotive market earlier this year, we still see solid demand for both retail and wholesale vehicles,” said Robb.

Segment Results for Seasonally Adjusted Prices Year-Over-Year Mixed In First Half of August

Against the full month of July, results by segment varied. The overall industry fell by 0.4% against the preceding month, though compact and mid-size cars were higher over the period, rising by 0.9% and 0.7%, respectively. The SUV segment was down 0.3% against July, with trucks falling by 0.7%, and luxury falling the most, down 1.4% since the end of last month.

Consumer Sentiment Lower in First Half of August

**Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.